I have had many people (my children included) ask me about the GameStop phenomena. Carl called them "gamestoppers", but decided that "Short Stoppers" was a more apt name given they have moved on to other targets.

There is something alluring about putting the "big guys" on notice. It surprises me that it has taken this long to occur. With a new surge in younger traders given the many app platforms available and the ever-present plethora of disgruntled traders, this seems to have been inevitable. The question is how much weight do they have and how will this affect trading going forward? I don't have the answers, but clearly they have had enough weight to sway GameStop (GME).

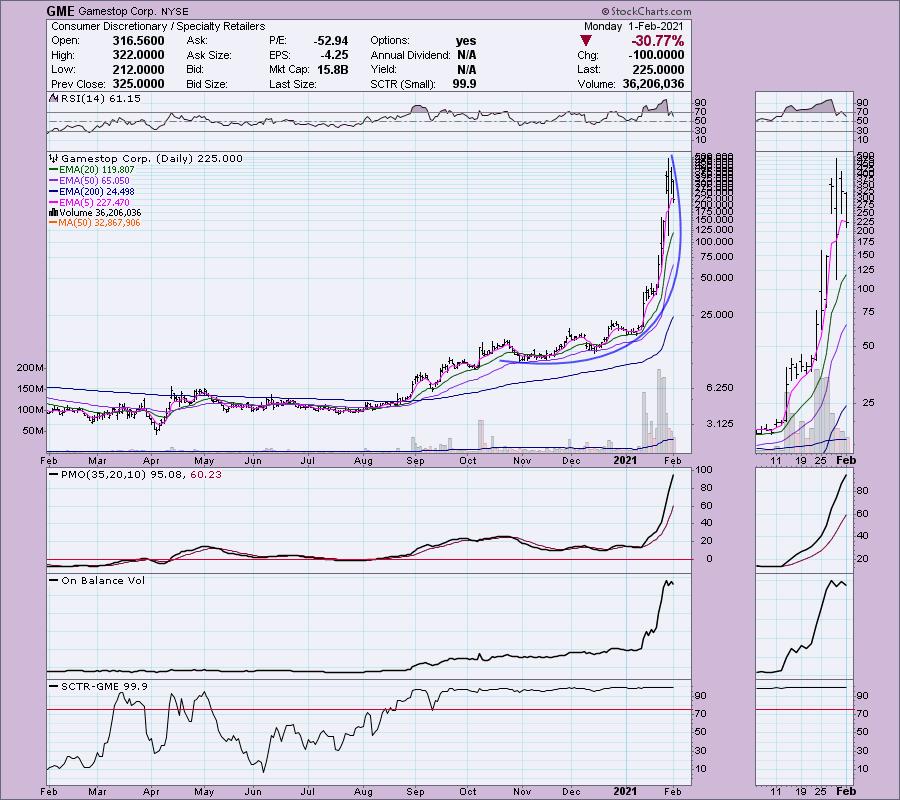

The beyond parabolic move in GameStop (GME) happened when Reddit boards decided to squeeze the short positions held by big money managers on GME. Many began piling in (including my stepson who I suspect haunts Reddit now and then) shooting the price straight up. Well, interest is waning and so is price...although it is still trading in the atmosphere at $225. Bubbles burst and with a P/E of -52.94...this one should soon enough.

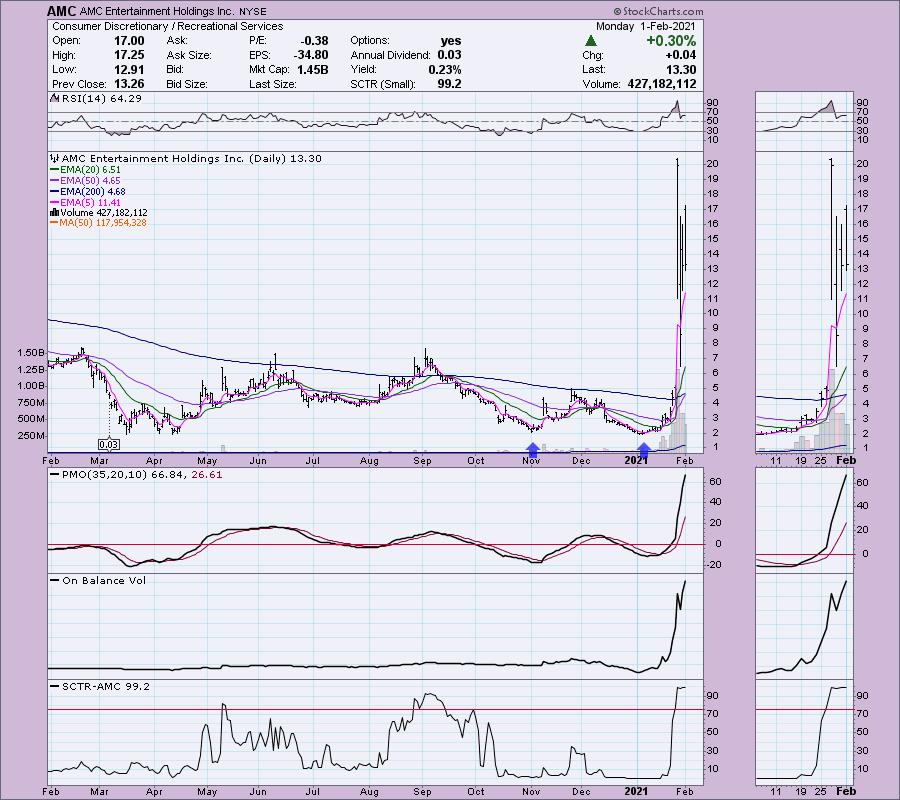

The next target was AMC Entertainment (AMC). My daughter is in this one (though she did not enter before the first gap up). Price has certainly been affected. At least with AMC we do see that the chart was shaping up nicely with a double-bottom pattern and a rising PMO.

Last word was that Silver was being targeted. Certainly the Silver ETF (SLV) shot up today, but you'll note on the stocks above it was nearly instant 100%+ gains. Carl and I discussed the SLV chart and it isn't out of the question that short stoppers pushed price, but we see large percentage fluctuations on silver without any tampering. At this point, it is hard to say if it will continue higher, but the chart was already beginning to look interesting.

Intraday price did exceed overhead resistance, but it closed back within.

Conclusion: Overall, the short stoppers have moved a few stocks exponentially, but it doesn't look like silver will follow suit. The SLV chart still looks bullish right now, but it is getting overbought.

At this point, there isn't anything illegal about this as far as I know, but it is certainly showing that individual investors can unite to manipulate price on big names, not just penny stocks. I wouldn't be surprised if the SEC figures out a fix for this, but in the meantime maybe we should be watching Reddit.

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available!

Happy Charting! - Erin

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.