Energy was the big winner this week as it gapped up on the open Monday. Since then price has consolidated somewhat and could be forming a reverse island formation. Looking under the hood at our indicators for XLE, we have quite a few that are very overbought. The 20-EMA is on its way to a positive crossover the 50-EMA for a "silver cross" which would generate a new IT Trend Model BUY signal. This is a powerful breakout from a bullish descending wedge and the first time we've seen price remain consistently above the 50-EMA. The PMO is positive again and rising on a BUY signal. The RSI is positive and not yet overbought. The Energy sector still has potential to continue higher despite some of those indicators being very overbought.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

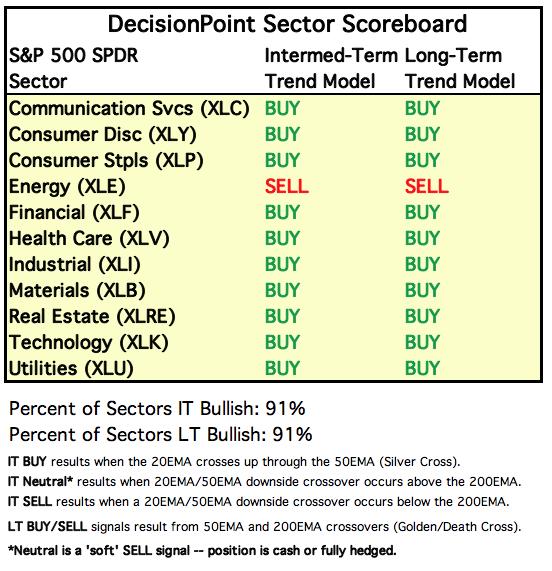

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

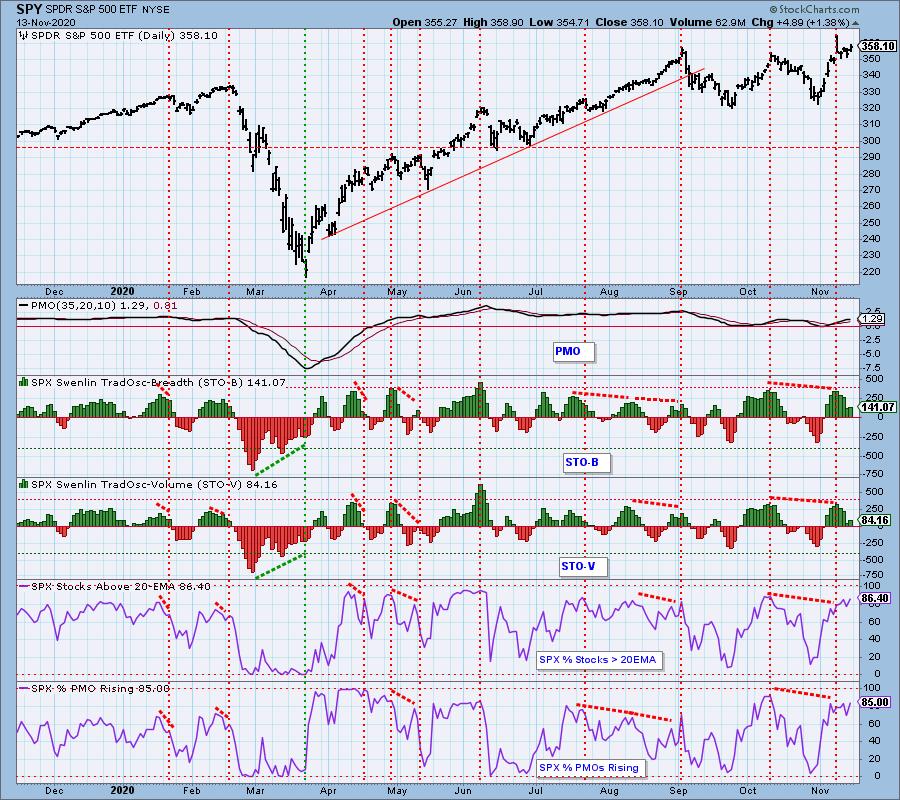

SPY Daily Chart: This week started with a bang and a big black candlestick that marked a climactic exhaustion. Since then price taken a pause rather than pullback or correct. The VIX remains steady above its moving average on the inverted scale as market participants are less concerned about a large pullback or correction. The RSI is positive and not overbought and the PMO is bullish and healthy.

On the daily bar chart, we can see the struggle price is having with overhead resistance. Total volume was below average despite a 1.38% gain on the SPY.

SPY Weekly Chart: The push on Monday to new all-time highs is pushing price through the top of the broadening top. The weekly PMO has bottomed above the signal line which is very bullish; however, it is definitely overbought right now.

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The BPI and SCI stalled this week despite a 2.27% gain on the week. The good news is that the GCI accelerated higher which suggests a bullish bias in the long term.

All of these indicators are overbought, but there is certainly room for them to move higher should price breakout to new all-time highs next week.

Climactic Market Indicators: With sideways movement this week, it is hard to get context, but it appears that we got a downside exhaustion climax on Thursday and an upside initiation climax today.

NYSE Up/Down and Down/Up volume ratios can be also be used as climax detectors. We use the 9:1 ratio suggested by the late Dr. Martin Zweig in his book, Winning on Wall Street. These climaxes happen less frequently than those on the chart above, and they can be used to clarify a particular event. We have an NYSE and S&P 500 version of the ratios, and normally they will only be published when there is a climax ratio.

The NYA Up/Down Volume Ratios aren't confirming the climaxes this week.

The S&P 500 version can get different results than the NYSE version because: (a) there are only 500 stocks versus a few thousand; and (b) those 500 stocks are all large-cap stocks that tend to move with more uniformity.

On the S&P 500 Volume Ratio chart we can see a downside exhaustion climax on Thursday and an upside initiation climax today.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL. Yesterday the STOs dropped quite a bit, but today they are rising again before hitting negative territory which is bullish. The %Stocks indicators are overbought, but could accommodate higher prices.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT. The market bias is BULLISH. We saw these indicators tip over yesterday, but they are rising again after setting up a negative divergence with price tops.

CONCLUSION: Price popped on Monday and has spent the rest of the week consolidating that rally. STOs contracted and moved out of overbought territory and have now begun to rise. We still have negative divergences in play and overbought indicators in all timeframes. There is a strong bullish bias that prevented a serious breakdown despite an exhaustion climax on Monday. Now STOs are rising again alongside an initiation climax. We should see new all-times highs next week.

Note: Next week is options expiration week. Expect low volatility toward the end of the week.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The Dollar remains in a holding pattern as it traverses within a trading channel between $24.75 and $25.50. Given the RSI is negative and has turned down, the PMO is negative and on a SELL signal and price has been stymied at the 20-EMA; I would look for a test of the bottom of the range.

UUP Weekly Chart: The weekly PMO remains negative and is falling. Price is holding support. While it is early to make a call, we could be seeing a double-bottom in the making.

GOLD

IT Trend Model: NEUTRAL as of 10/14/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold had a difficult week, but it continues to hold support. Discounts are steady and high which bodes well for Gold as it implies bearish sentiment.

GOLD Weekly Chart: The weekly PMO is bearish as it falls from overbought territory. Technically on the weekly chart, the breakout from the wedge is still happening, price just happened to close back within it. If Gold loses support, 1800 is the next support level.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners also had a failed breakout, but they continue to hold support just like Gold. The did put in a PMO crossover SELL signal this week, but support is holding on the 200-EMA. My expectation is another breakout. Indicators are oversold and primed.

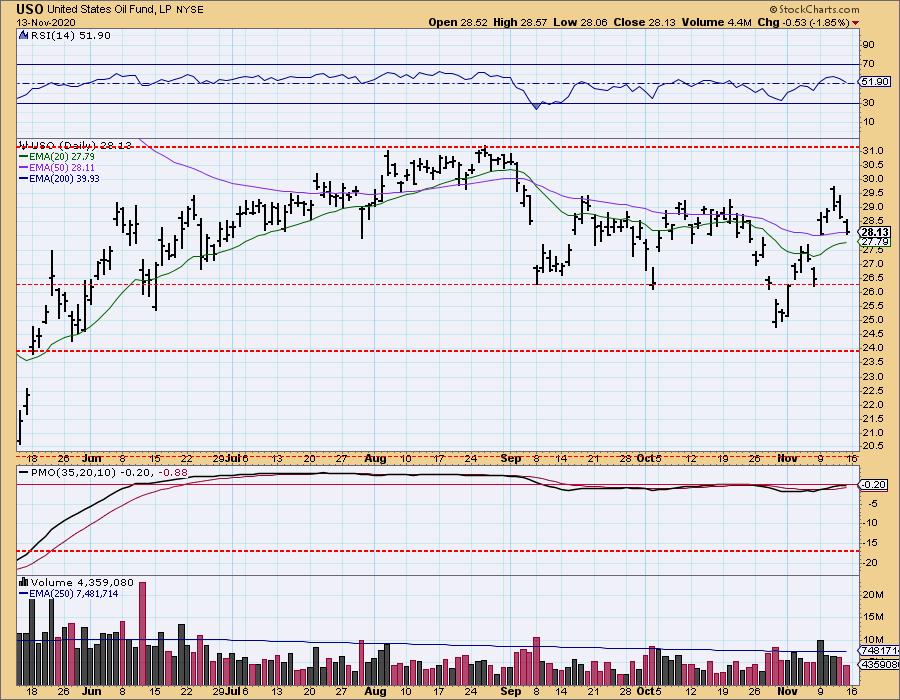

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: On Monday we saw a huge jump in Oil prices that carried through until yesterday. The 50-EMA is holding as support and the RSI is positive. The PMO is on a BUY signal but hasn't quite reached positive territory. Price movement is very bullish even on this pullback. If the 20/50-EMAs can hold Monday, we believe Oil might finally challenge the August highs.

USO/$WTIC Weekly Chart: The weekly chart is very bullish with a strongly rising PMO on a BUY signal. $WTIC is already challenging the August highs which leads us to believe that USO will do the same.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The bearish bias remains on TLT. The RSI is negative, the PMO is negative and on a SELL signal and price continues to fight against overhead resistance at the 200- and 20-EMAs.

TLT Weekly Chart: The weekly chart is similarly bearish with a falling PMO that looks uninterested in slowing its descent. Support is nearing at the June low. Given the negativity of this chart, it will have a difficult time holding that level.

Technical Analysis is a windsock, not a crystal ball.

-- Carl Swenlin

___________

Our job is not to see the future, it is to see the present very clearly.

-- Jawad Mian, stray-reflections.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)