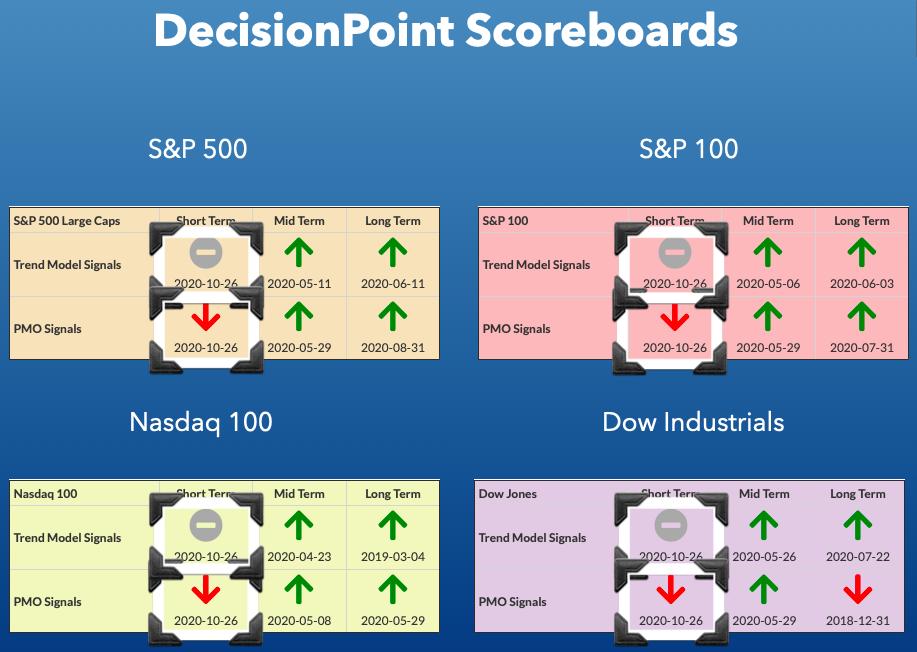

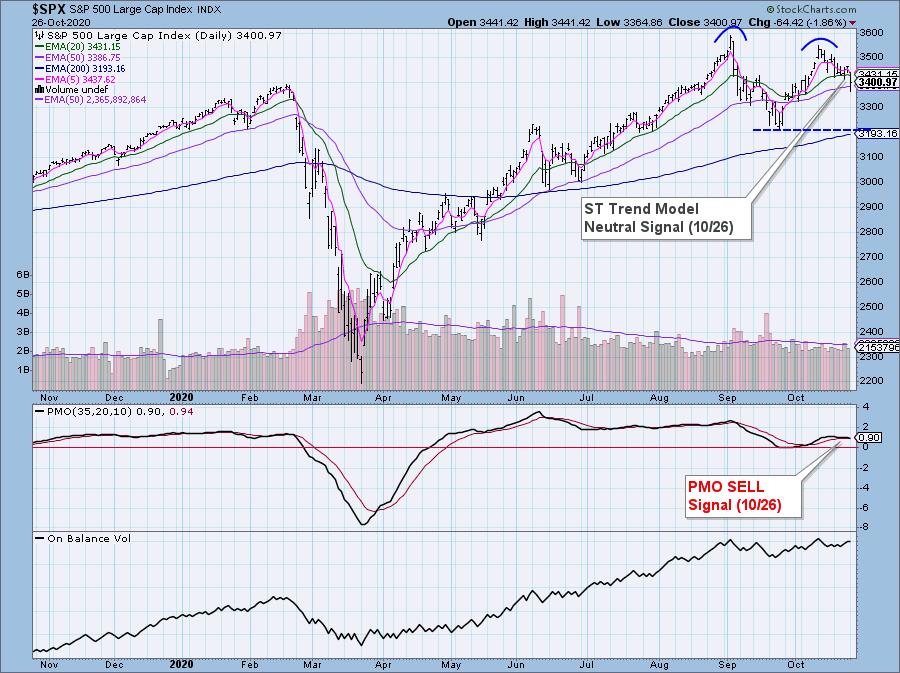

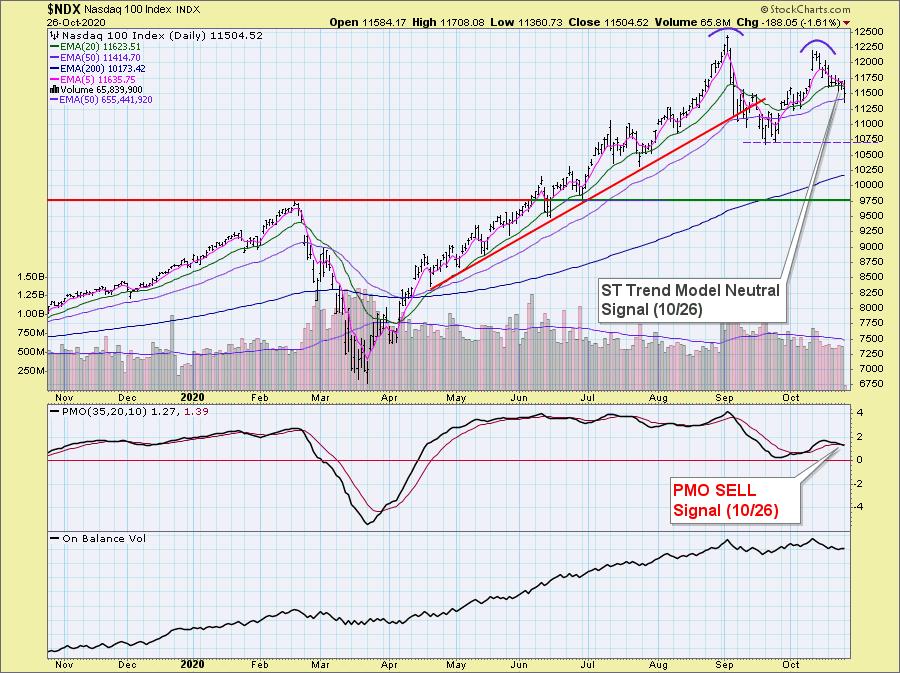

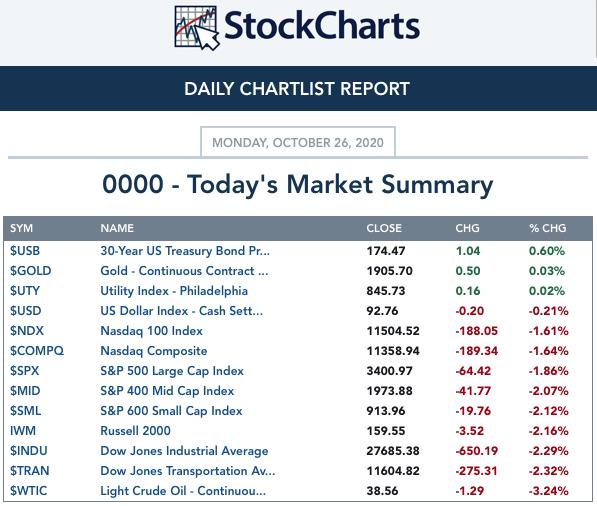

I reported today on the DecisionPoint Show that all four of our DP Scoreboard Indexes had triggered Price Momentum Oscillator (PMO) SELL signals. What I missed reviewing were four ST Trend Model Neutral signals. Not only has momentum slowed enough to generate these PMO SELL signals, the ST declining trend has now affected the ST Trend Model as the 5-EMAs crossed below the 20-EMAs. Below the Scoreboards are each of the four daily index charts with the signal changes annotated. One thing to pay attention to on all of the index charts below, are the ominous intermediate-term double-tops forming. Seeing this ahead of the election and while stimulus talks haven't passed yet, tells me the market is terribly vulnerable and internally weak.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

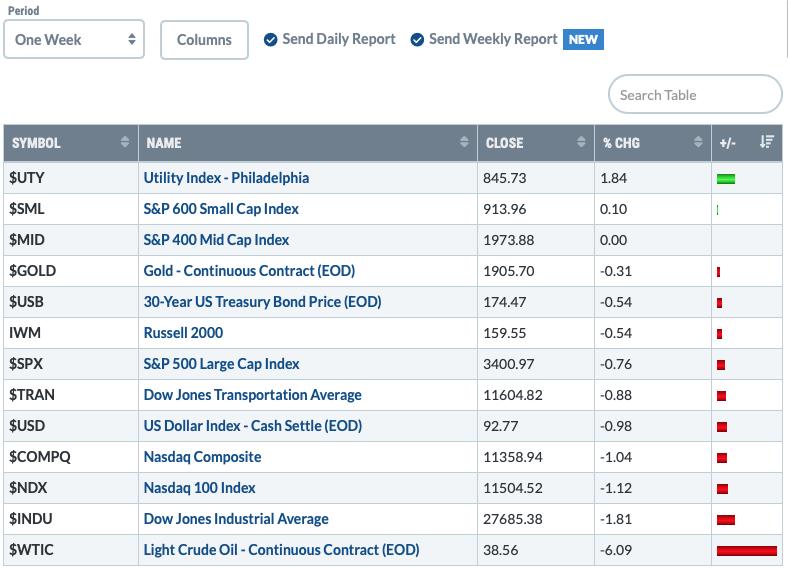

MAJOR MARKET INDEXES

One Week Results:

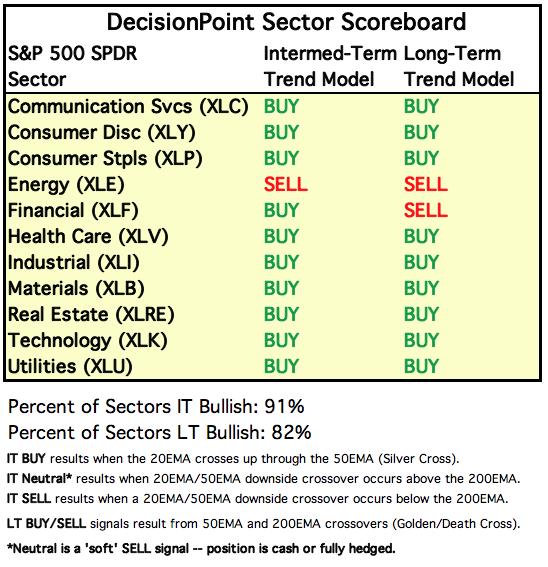

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

One Week Results:

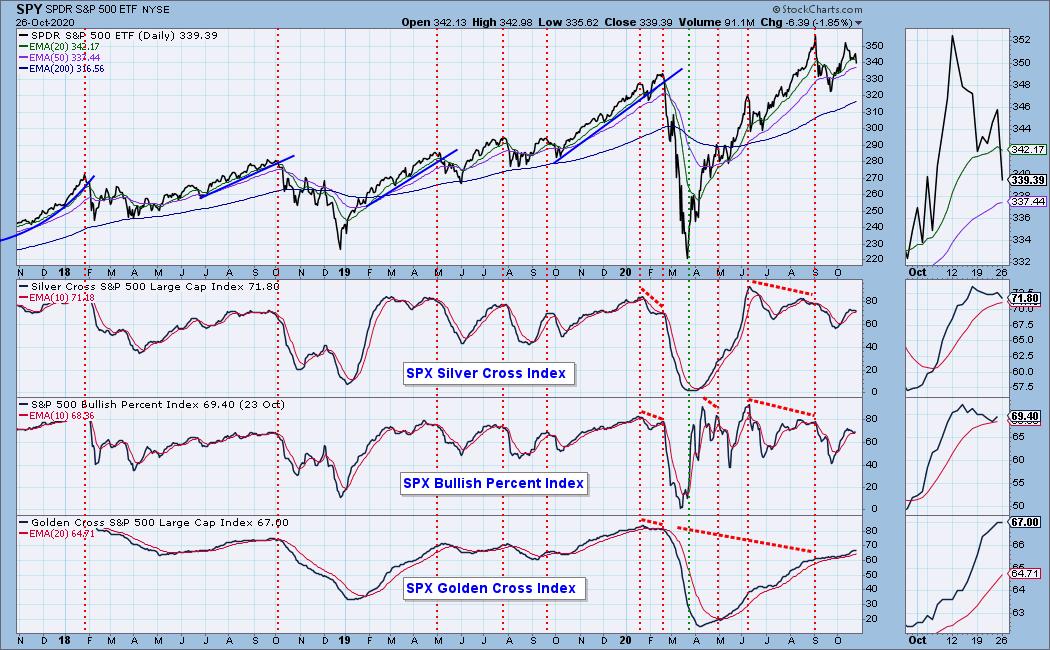

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: The declining trend channel was breached slightly today on the long "tail" of today's candlestick. The February top is holding for now. Note that we are now trading and have closed below the 20-EMA. The RSI has hit negative territory for the first time since the September correction. I have had a few subscribers and trading room participants suggest this is a bullish cup and handle. I think you could read it that way, but typically the right top is not competing with the left top, the right top is usually much lower.

The possible double-top is very concerning when viewed on the 1-year daily chart.

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 10/19 trading room? Here is a link to the recording (access code: Au6B.X*1). For best results, copy and paste the access code to avoid typos.

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Interestingly, the BPI bounced off its signal line. Seeing this on a strong down today is somewhat bullish. The GCI is now decelerating and could top this week. The SCI is going in for a negative crossover.

We saw hefty pullbacks on these indicators. They aren't yet oversold which suggests more downside.

Climactic Market Indicators: I wasn't surprised to highly climactic readings come through on these indicators. We saw very high negative readings on Net A-D indicators as well as a dramatic pullback on New Highs. We actually saw a New Low. Total volume did increase on this decline. The VIX dropped well below its bottom Bollinger Band on the inverse scale. This climactic activity could tell us this was a quick buying exhaustion and we could see a rally pop tomorrow or Wednesday. At the same time, it is coming off two positive trading days and that would suggest a selling initiation.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is NEUTRAL. The STOs give us a hint at whether this is a selling exhaustion or initiation. Note that despite a difficult drop, STOs are still rising and have reached positive territory.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT. The market bias is BULLISH. These indicators are pulling back which does possibly confirm the double-top that is forming.

CONCLUSION: The market is vulnerable given the new ST Trend Model Neutral signal and the PMO SELL signal. However, the negative impulse on climactic indicators, the VIX's puncture of the lower Bollinger Band on the inverted scale and the rising STOs which have just reached positive territory, I actually would expect a rally the next day or two. Unfortunately with the loss of short-term BUY signals on the major indexes, I expect an overall decline in the intermediate to long term. I am selling my portfolio positions into strength (as I can) and continue to tend to my stops.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

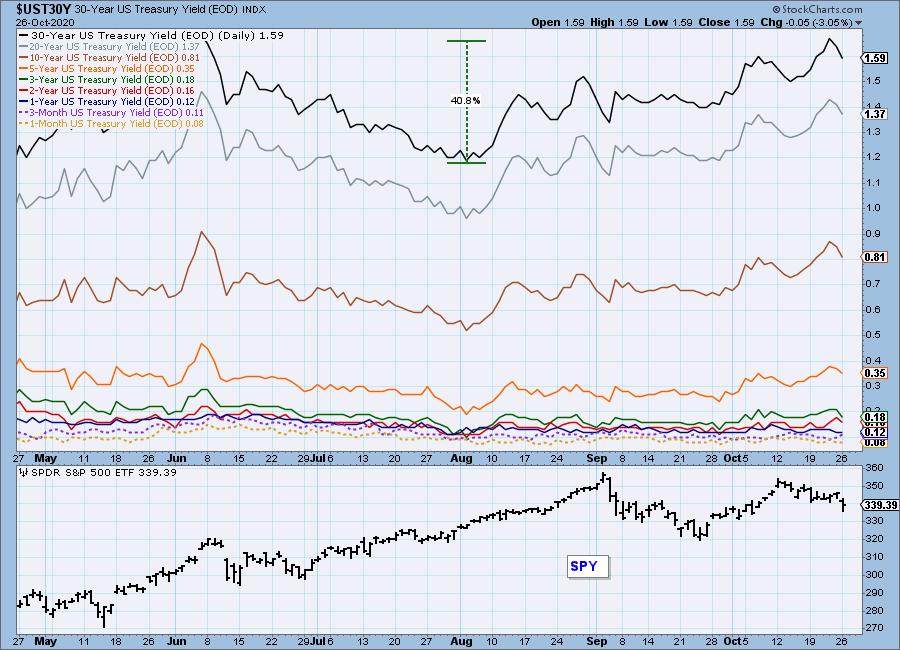

INTEREST RATES

Friday's comments still apply:

"It is clear that rates are trending higher. The 30-year bond yield has risen less than a half of a percentage point, but it's a 40% increase from the August low! We were surprised to hear a pundit on a business show say that we are in a rising rate environment. Easy to miss with rates so low, but the chart confirms it." Although we can see that they are beginning to fall again.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: There is a defined declining trend channel. Currently price is making its way back toward the top of the channel where it will find resistance in the form of the 20/50-EMAs. The PMO is on a SELL signal and the RSI remains in negative territory. I am looking for a test of $24.75 once it is turned away at resistance.

GOLD

IT Trend Model: NEUTRAL as of 10/14/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Before I get into the price action on Gold, I want to point out the correlation between Gold and the Dollar. It is typical to see a -1.00 or reverse correlation between Gold and the Dollar. That correlation is moving toward zero. If it gets close to zero, that implies no correlation, meaning they can travel together despite Gold being denominated in the Dollar. I expect the Dollar to decline and therefore, I should expect Gold to rise. When the correlation nears zero, that thinking doesn't work. Consequently, I am reviewing this chart not in the context of a declining Dollar, but simply based on its price action and sentiment.

The bullish falling wedge continues to be the dominant feature on the Gold chart. It looked like it might trigger last week as price briefly popped above the declining trendline that forms the top of the wedge. The PMO is clinging to a BUY signal and the RSI is negative to neutral. Dropping discounts suggests more interest in Gold so I'm expecting a breakout. This won't be easy given the convergence of the wedge's declining tops trendline, the 2011 top and 20/50-EMAs as all are acting as resistance.

Full disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: After breaking dow from the rising trend channel, I would expect to see GDX test the support level at the May top of $37.50. The indicators are dropping, but they are in oversold territory now. The GCI is still at 100% so despite the decline, all of the Miners in GDX have 50-EMAs above their 200-EMAs. This is the type of strength that will be needed to support a reversal.

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Oil is about ready to test support at the bottom of the current trading range. It has the appearance of a reverse island, but remember the bias is very bearish given the negative RSI and PMO that is on a SELL signal.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: I wrote last week that TLT had reached do or die support at the 200-EMA. However, after dipping below, it has rebounded strongly. Yields are now trending lower, so I would expect to see the rally in Bonds to continue. However, I wouldn't rule out the possibility of a reverse island formation. The PMO is flat and the RSI is negative.

Full Disclosure: I own TLT.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)