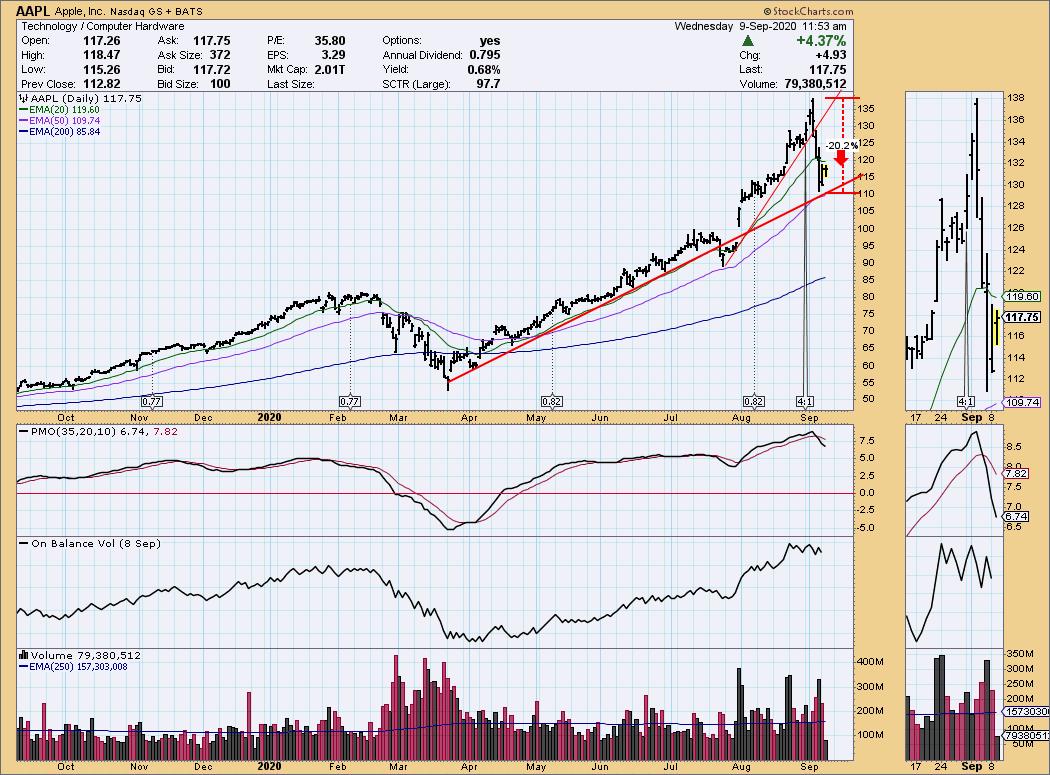

On August 31, AAPL stock split 4 for 1 and TSLA split 5 for 1. On several occasions prior to that date I tried to make DecisionPoint ALERT readers and DecisionPoint Show viewers aware that stock splits often occur in the vicinity of price tops. It doesn't happen frequently enough to make it a rule, but it happens enough to make it a caution. For the record, let's look at AAPL and TSLA.

Two days after the split AAPL topped, and has since declined 20% from the intraday high.

As investors we want to accomplish two basic things: (1) Determine the trend and condition of the market, and (2) select stocks that will ride that tide. The DecisionPoint Alert helps with the first step, and DecisionPoint Diamonds helps with the second. Go to DecisionPoint.com and SUBSCRIBE TODAY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/14)!

Did you miss the 8/31 trading room? Here is a link to the recording (password: V#^P89Yv).

TSLA also topped two days after the split, and has since declined 35% from the all-time high. Pretty awesome.

Why was I expecting this? Well, back when I was running the original DecisionPoint, I used to maintain two years of historical data for 564 stocks on Excel spreadsheets, and that data needed to be adjusted whenever one of those stocks split. Splits were a regular thing in a group of stocks that large, and observing the aftermath of a split part of the job. But to tell the truth, back then it was widely known that splits and price tops often occurred together. I was surprised that this phenomenon was not widely discussed this time around. It's probably because the financial media tends to emphasize only the bullish side of things.

Why do splits and tops frequently coincide? Some believe that splits are done to make the shares more accessible to the little guy, and by doing so making the shares easier to move from strong hands to weak hands. In other words, facilitating the distribution of shares near price tops. In the case of AAPL and TSLA, these stocks were both very overbought and very overvalued, and the split was probably a convenient trigger.

As the title implies, the purpose of this article is to encourage you to remember that stock splits can have a down side. In the case of these two examples, maybe it won't last very long, but it was something that should have been anticipated.

Happy Charting! - Carl

Technical Analysis is a windsock, not a crystal ball.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)