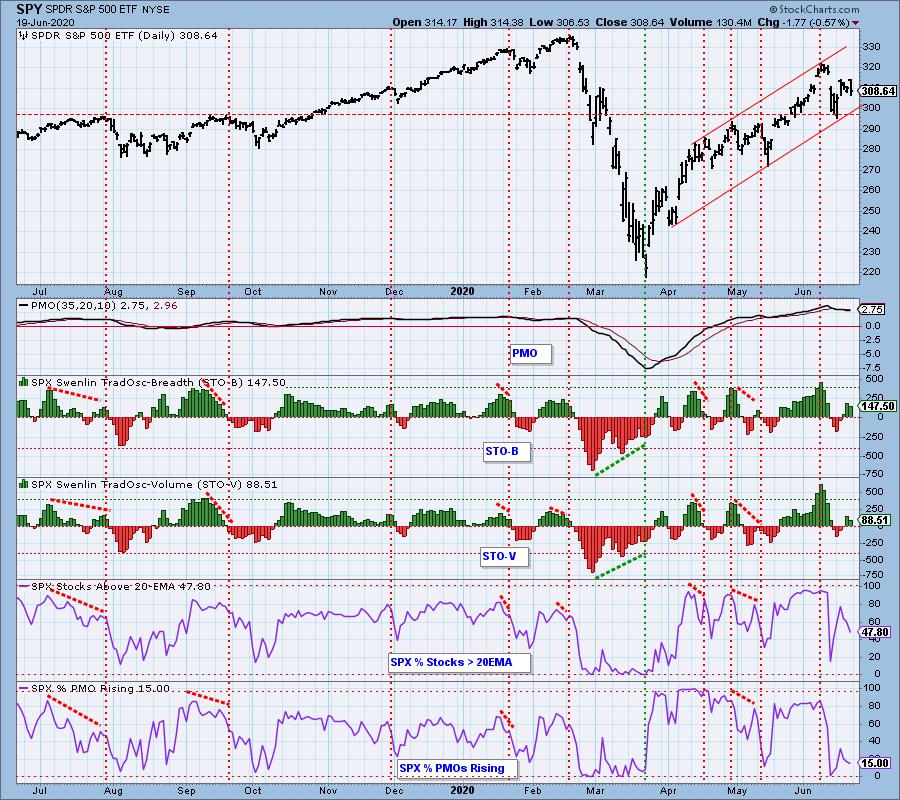

Years ago it occurred to me that we should consider market "bias" when interpreting the condition (overbought/oversold) of market indicators. Here is how bias works:

BIAS = NEUTRAL: Overbought conditions result in a price pullback until conditions are oversold. At that point price rallies until conditions are once again overbought.

BIAS = BULLISH: Overbought conditions may not impede upward price progress. Conditions become oversold well above the bottom of the normal range.

BIAS = BEARISH: Oversold conditions may not result in rally-inducing compression, just more weakness. Conditions become overbought well below the top of the normal range.

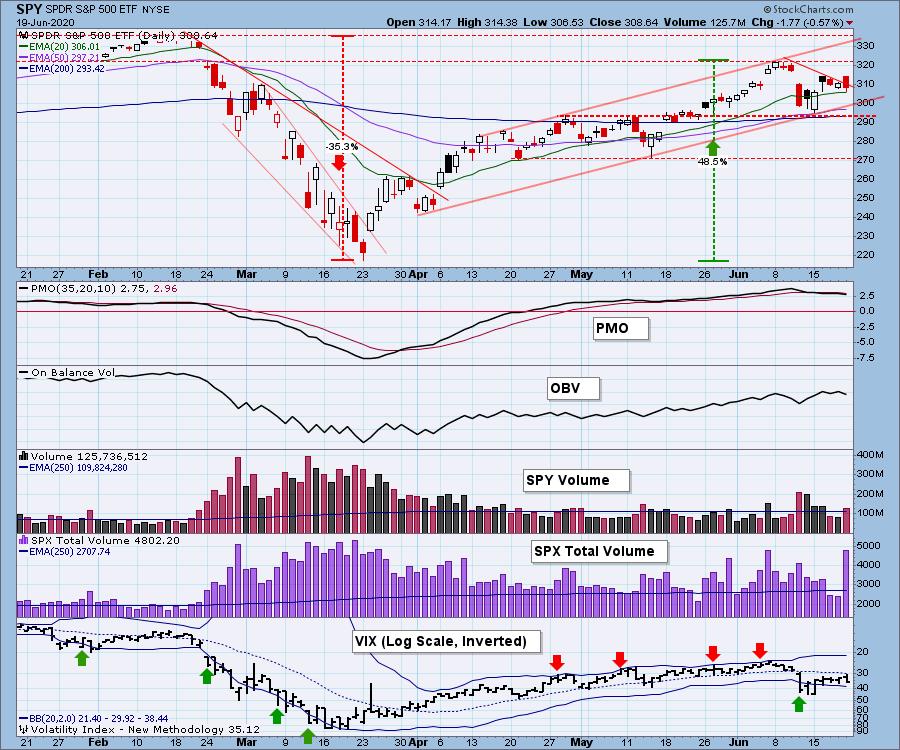

I discussed market bias with Erin on our latest StockCharts TV show, and it got me thinking about how best display it on a chart. This morning it occurred to me that changing our primary short-term and intermediate-term indicators from line to histogram might do the trick. Here they are together on the same chart, so we can see how bias differs in each time frame.

Obviously, bias fluctuation is much more active in the short-term, and there is no mistaking where the latest period of bearish bias begins and ends. More striking is the period from August 2019 to the February 2020 top, compared to the period since the March bottom. Bias most recently has been bullish, but not nearly as stable and strong as prior to the February top. Note how the recent range of the STOs (-200 to +400) is skewed toward the top of the normal range (-400 to +400).

I wasn't sure if I would like this new version, but I have already adapted to them. Beginning today I am changing the format of the STOs, ITBM, and ITVM from a line to histogram, and we will continue this discussion below.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

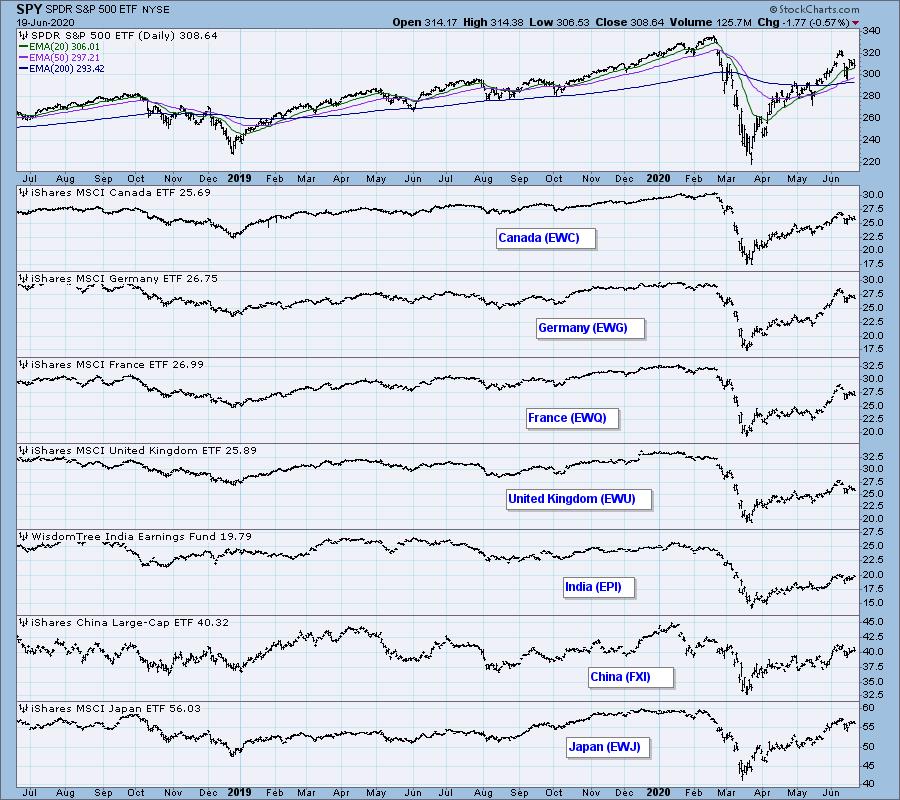

GLOBAL MARKETS

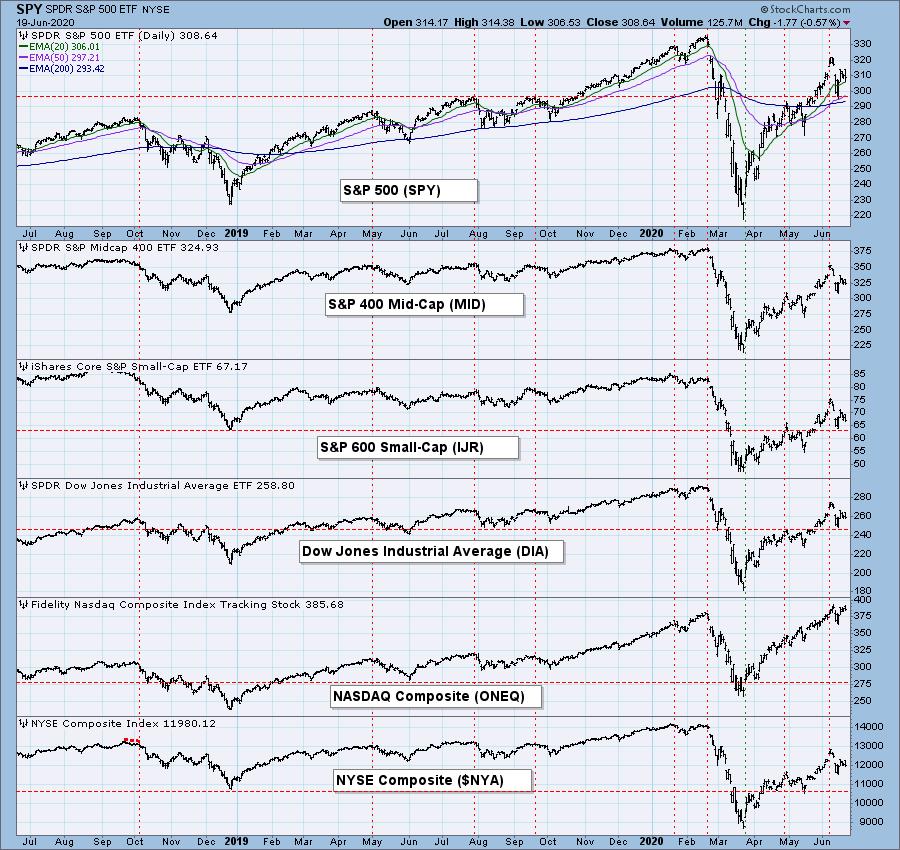

BROAD MARKET INDEXES

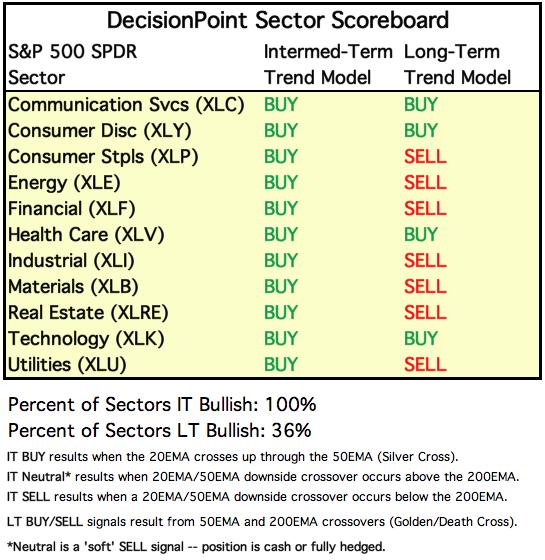

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

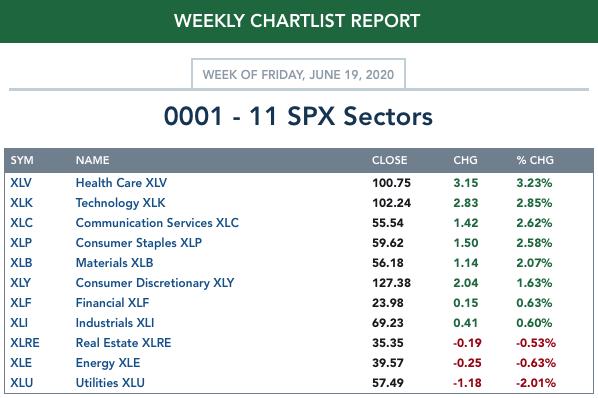

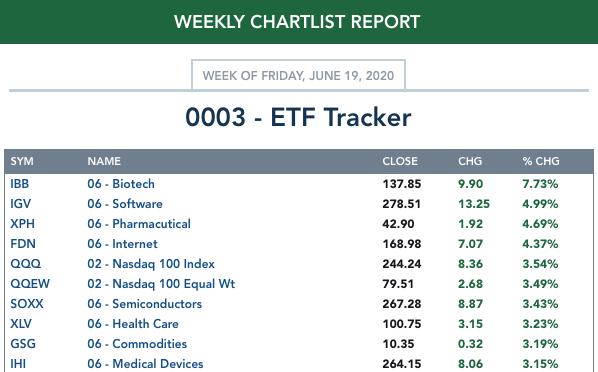

ETF TRACKER: This is a list of about 100 ETFs intended to track a wide range of U.S. market indexes, sectors, global indexes, interest rates, currencies, and commodities. StockCharts.com subscribers can acquire it in the DecisionPoint Trend and Condition ChartPack.

Top 10 . . .

. . . and bottom 10:

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

STOCKS

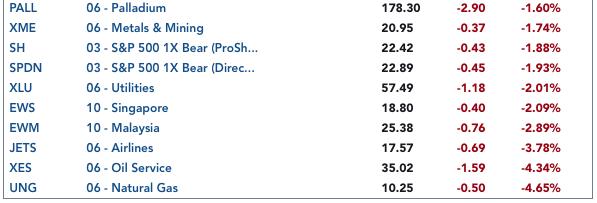

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: This week we had quadruple witching options expiration. We were looking for very high SPX Total Volume on Friday, with low volatility toward the end of the week, both of which we got.

The OBV reverse divergence I have noted is for SPY volume. There is no reverse divergence on the $SPX chart. For some time I have pondered what that means exactly, but so far I haven't worked it out. The daily PMO is very overbought and has crossed down through the signal line.

SPY Weekly Chart: SPY dropped below the rising trend line this week, but managed to close above the line.

Climactic Market Indicators: The high SPX Total Volume on Friday does not count as climactic volume because it is related to options expiration. It would be the same story for Net A-D Volume. The last climactic volume event was the upside exhaustion climax on Tuesday.

Short-Term Market Indicators: The short-term market trend is NEUTRAL and the condition is NEUTRAL. Based upon the STO ranges since the March price low, market bias is BULLISH, though not as bullish as between mid-October through mid-February.

Intermediate-Term Market Indicators: The Silver Cross Index at 88 is very overbought and has topped. The Golden Cross Index at only 41 shows that there is still a lot of longer-term damage left to repair.

The intermediate-term market trend is UP and the condition is OVERBOUGHT. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH. The daily PMO, ITBM and ITVM are still overbought, but the Percent of PMO Crossover BUY Signals shows significant internal deterioration, along with one of the few current negative divergences.

MARKET FUNDAMENTALS: Fundamentals are a train wreck, but I don't know when the market will hit that wall. It's coming.

CONCLUSION: A wind sock tells you the present wind direction, but it can't tell you which way the wind will be blowing when you're trying put your wheels on the runway. Technical indicators are pretty much the same; although, they can sometimes help us extrapolate where the market may be headed. The market has topped and is pulling back short-term. Because the market is intermediate-term overbought and has topped, I think we should expect more downside price movement. Market bias is bullish and implies that any pullback won't devastating. We shall see.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: I have tentatively drawn the top of a trading range across the October top and the April lows.

UUP Weekly Chart: The weekly PMO has dropped below the previous lows set earlier this year.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold continues to consolidate within a flag formation, while the daily PMO has moved from overbought to neutral.

GOLD Weekly Chart: There have been random spikes of positive sentiment in the last year, but gold has rallied +70% from the 2015 lows with sentiment being mostly negative. The weekly PMO is overbought, but it has been so for a year.

GOLD MINERS Golden and Silver Cross Indexes: GDX is looking bullish, as it broke out of a flag formation on Friday.

CRUDE OIL ($WTIC)

Until further notice we will use $WTIC to track the oil market. Since this is a continuous contract dataset, it doesn't "play well" with our Trend Models, and we will not report Trend Model signals for oil.

$WTIC Daily Chart: Oil seems to be stabilizing within a trading range from 35 to 40.

$WTIC Weekly Chart: Should the current trading range fail, there is a pretty solid looking range (27-35) just below.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 6/5/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds broke down as stocks rallied at the beginning of June. Now, with stocks backing off a bit, bonds rallied. The 20EMA and 50EMA have leveled-off, and the NEUTRAL signal still holds.

TLT Weekly Chart: If there is pressure to move interest rates lower, bonds could potemntially rally above this year's high. If rates remain stable at current levels, I see resistance at about 171.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Carl

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)