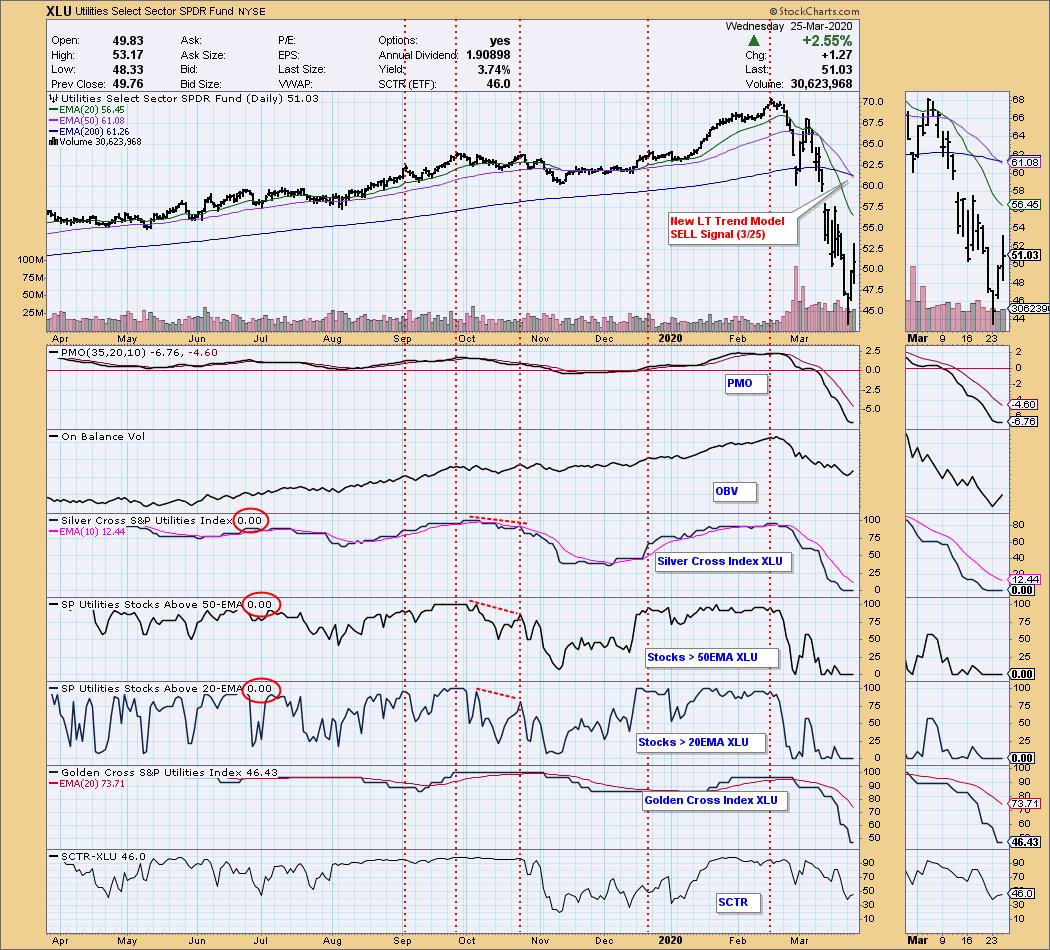

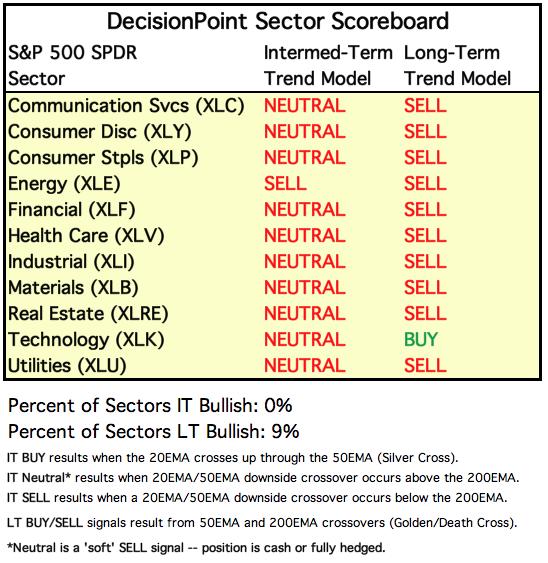

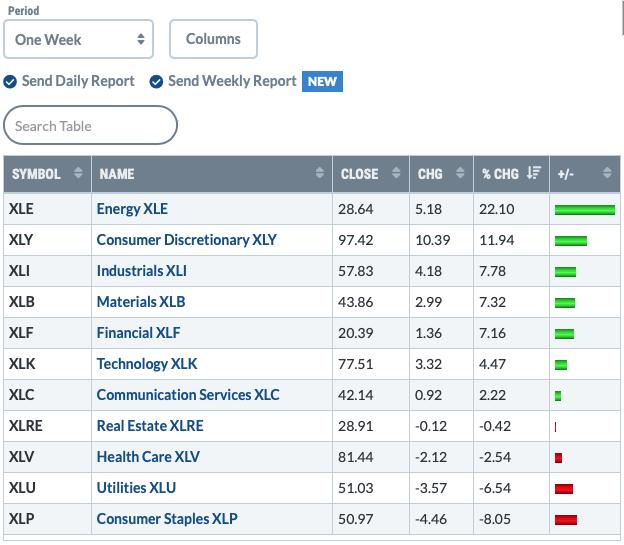

The Utilities Sector (XLU) was up over 2.5% today. It was unable to prevent the death cross of the 50/200-EMAs. The sector is heavily oversold given the zeros on the indicators below. Think about that a second... ZERO stocks above their 20/50-EMAs in the Utilities sector. The good news (?) is that in the past week, the only four sectors at a loss are Health Care (XLV), Consumer Staples (XLP), Utilities (XLU) with Real Estate (XLRE). Defensive sectors typically lead bear market rallies. If aggressive sectors begin to top the list that could possibly give us a bullish bias.

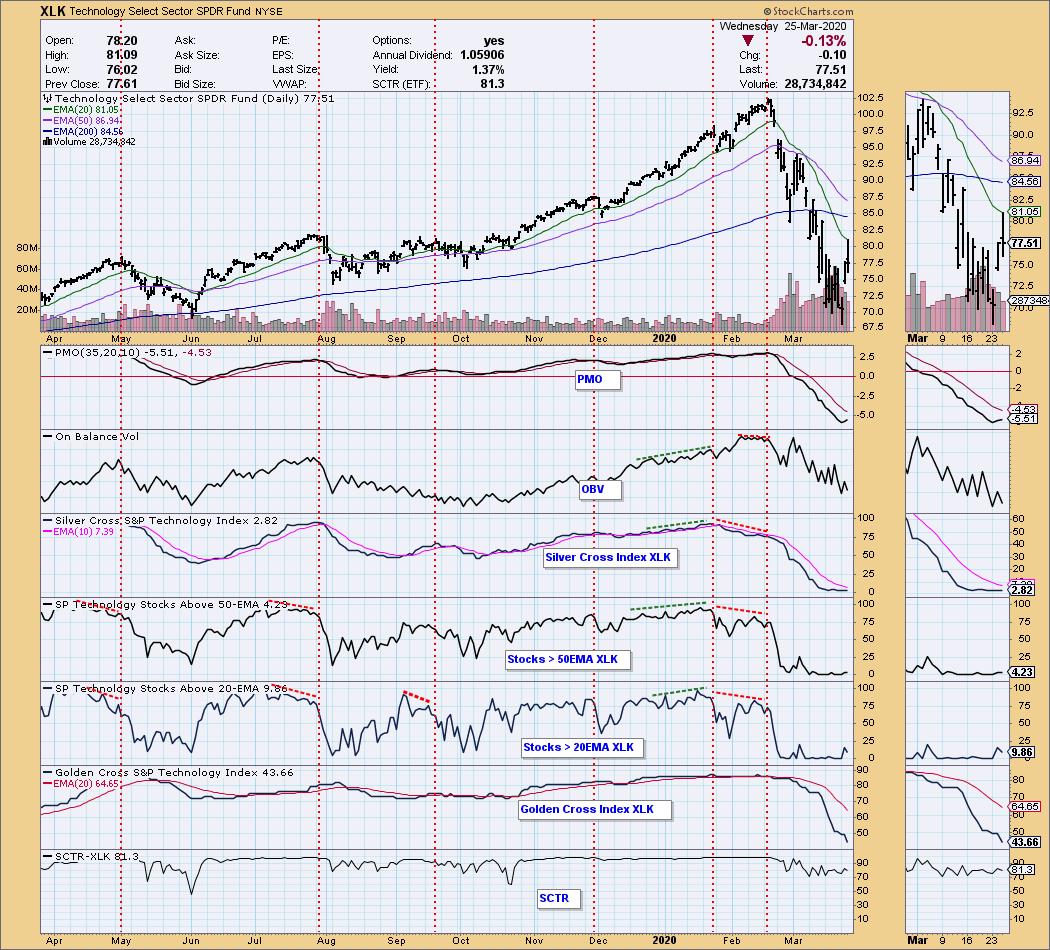

The Technology sector (XLK) could see a LT Trend Model SELL signal soon. These death crosses can only be avoided if price is above the 200-EMA which is not impossible for XLK.

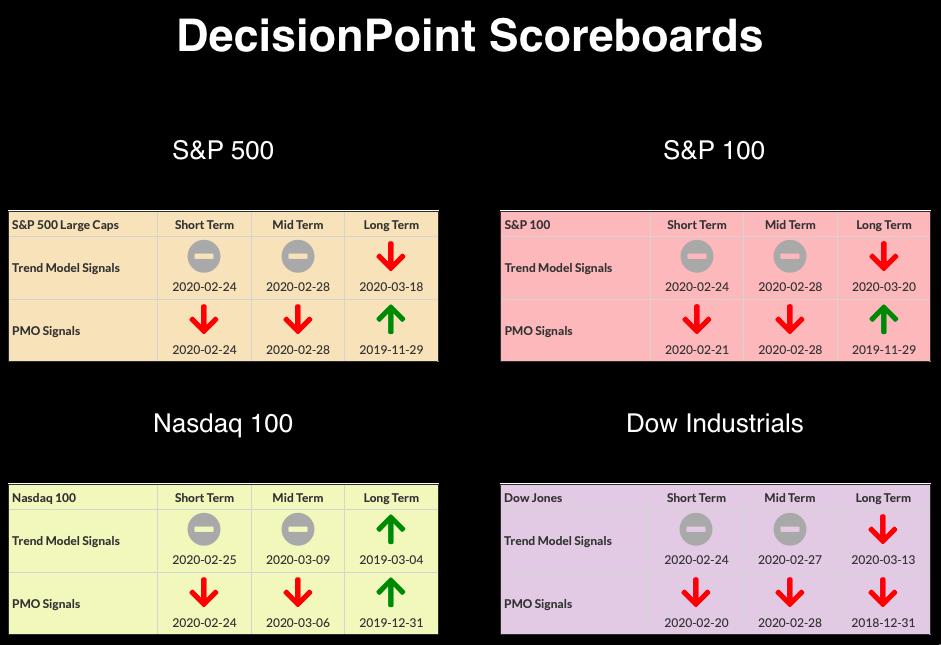

CURRENT BROAD MARKET DP Signals:

TODAY'S Broad Market Action:

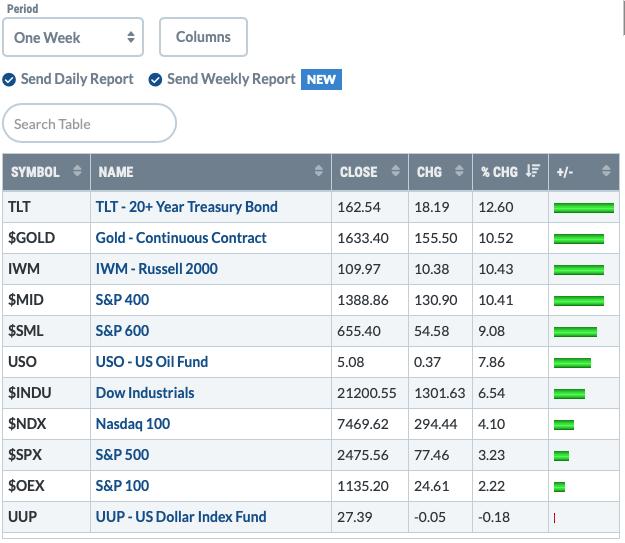

Past WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

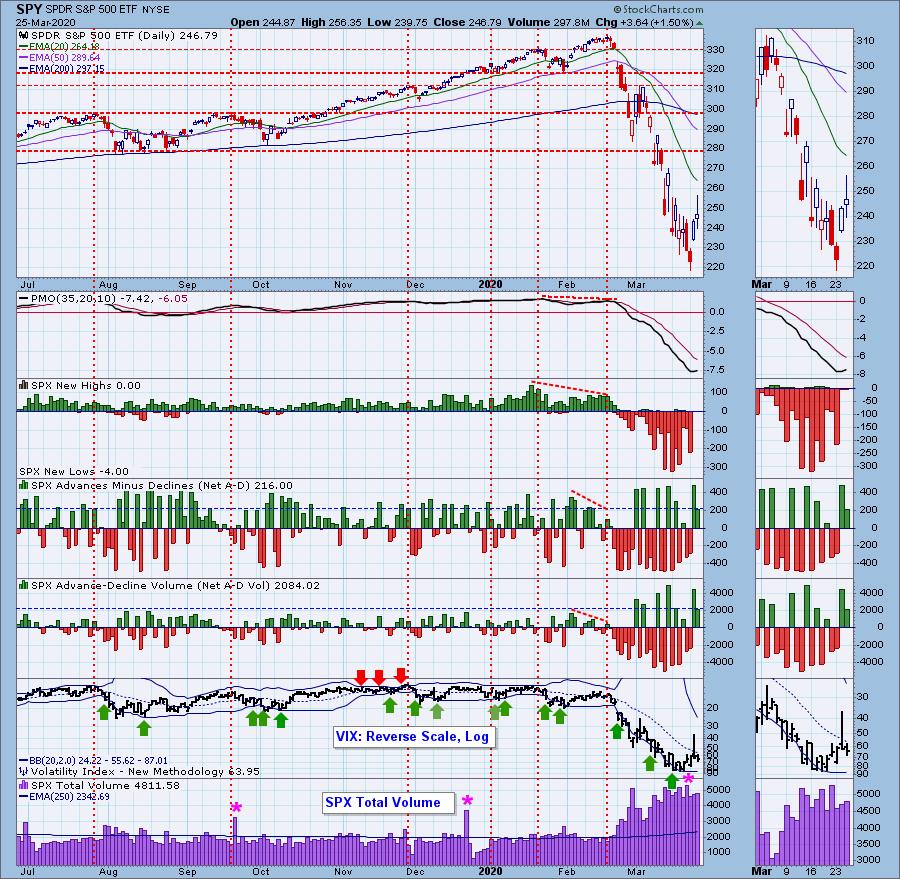

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: SELL as of 3/19/2020

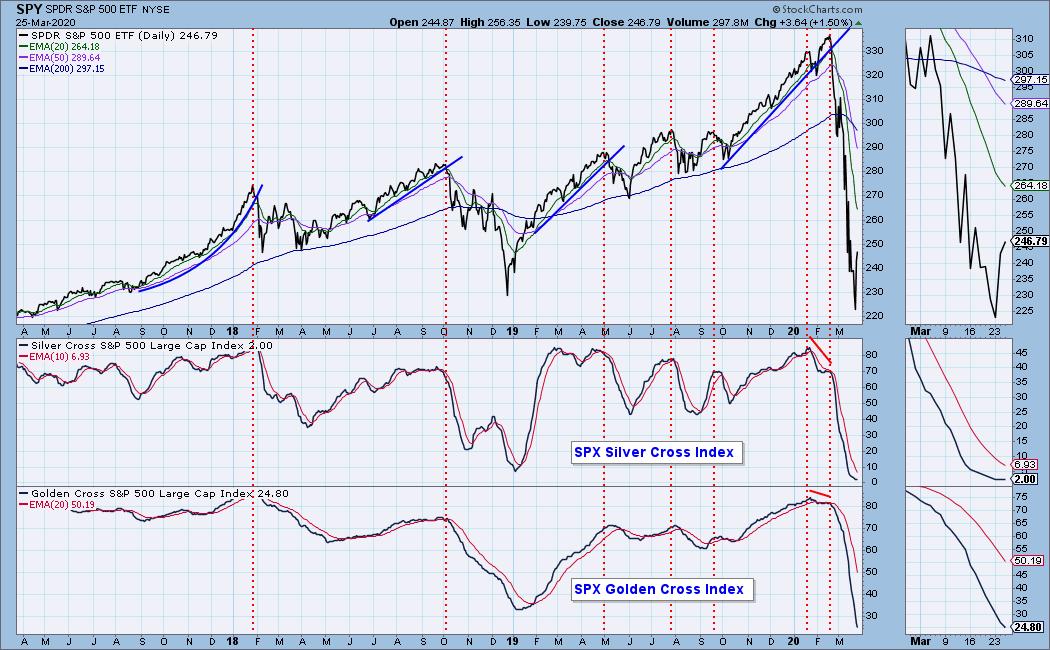

SPY Daily Chart: I find it disconcerting to see the VIX rise on an up day. Yesterday it closed on its high despite the largest point rally in history. The OBV is not yet showing a positive divergence. We are seeing the PMO rising for the first time since February which is encouraging.

Climactic Market Indicators: The VIX turned down below its 20-EMA on today's gain of 1.5%. Not good. I also note that positive breadth is lower than yesterday.

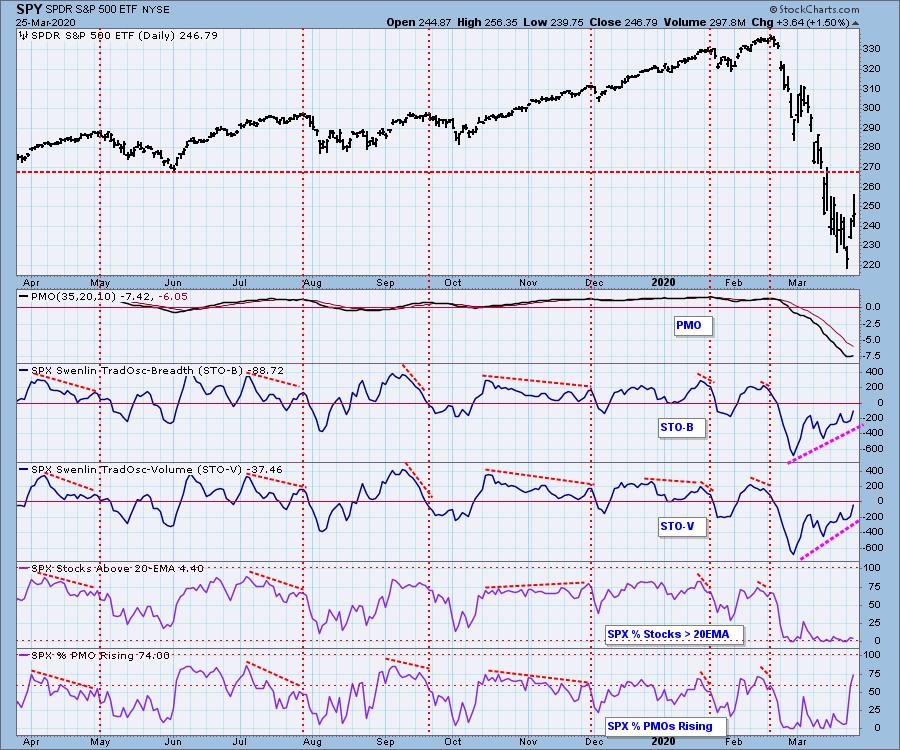

Short-Term Market Indicators: The ST trend is DOWN and the market condition is NEUTRAL based upon the Swenlin Trading Oscillator (STO) readings. Yesterday's comments apply today: "The STOs are showing positive divergences that are intriguing. This could be positive for the short term. The big bump on the %PMOs rising is also positive. We do need to see more stocks closing above their 20-EMAs in order to support even a short-term rally." One issue with seeing the %PMO Rising hit 74%, it is now reaching overbought territory quickly. Overbought conditions in a bear market are bad as they generally lead to lower prices.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are declining. Only 2% of SPX stocks have a 20-EMA > 50-EMAs. Now we are seeing very oversold readings on the GCI. We will want to see that begin to curve up to support a market bottom.

The IT trend is DOWN and the market condition is EXTREMELY OVERSOLD based upon all of the readings on the indicators below. They are all beginning to rise and we see the ITVM has already had a positive crossover. I will reserve judgement on these new developments. We want to see a steep and quick recovery as we began to in 2019. I've also seen these indicators twitch. This is still encouraging to see.

CONCLUSION: The ST and IT trends are DOWN. Market condition based on ST and IT indicators is VERY OVERSOLD. I like that we are now seeing IT indicators turning up in very oversold territory. I will get bullish if I see the Silver Cross and Golden Cross Indexes begin to rise. The short-term indicators are bullish, although the climactic readings and the rising VIX suggest to me that any rally we see this week will be very short-term in nature. The economic recovery bill, should it ever pass congress, will likely goose the market to continue the rally we have seen over the past two days. On the bearish side, tomorrow unemployment numbers are going to be reported and they could be astronomically higher. That could put a damper on a possible passage of the recovery bill.

On a personal note: I want to very sincerely thank our subscribers. Your support is making a difference in the lives of our immediate family who have lost jobs and need help as we go through this difficult time. A heartfelt thank you to you all.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 3/13/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Yesterday's comments are exactly what I would say today: "I still see a flag, but following bear market rules I am not confident in a bullish conclusion. The PMO is still rising strongly but is very overbought. A drop to support at $27 would clear oversold conditions somewhat. Given the very high volume on the last four days of decline, I am looking for a pullback."

GOLD

IT Trend Model: BUY as of 3/25/2020

LT Trend Model: BUY as of 1/8/2019

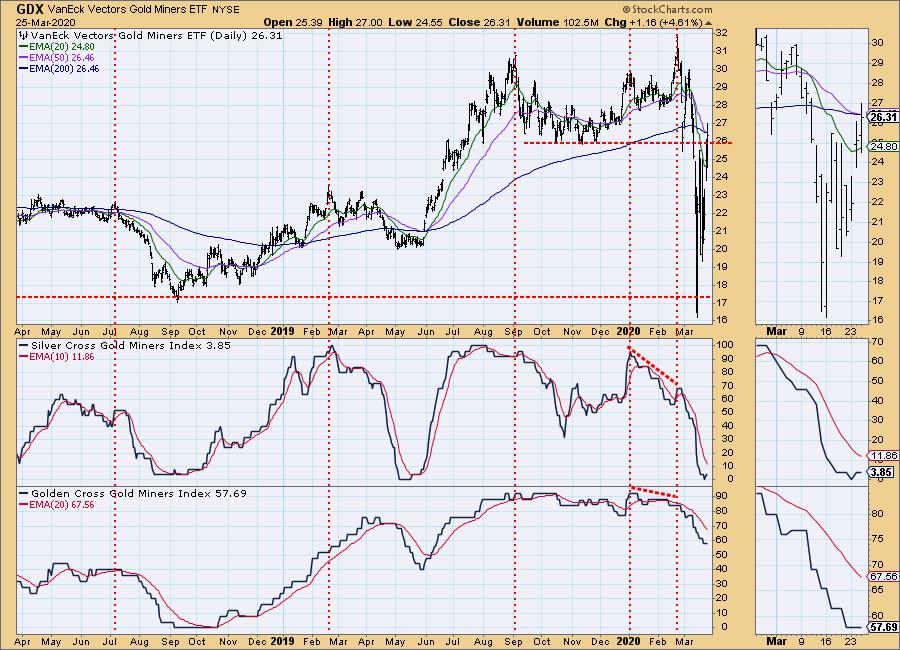

GOLD Daily Chart: After overhead resistance was met yesterday (and today), price pulled back. I told my Diamonds subscribers today that this could mean an opportunity to get in on Gold. I like to use GLD as my proxy ETF. I would avoid Gold Miners simply because they are more susceptible to the market swings. Just look at the GDX chart under the Gold chart. The PMO is rising and we are now seeing some premiums on PHYS. Gold is looking very bullish with the rising PMO.

GOLD MINERS Golden and Silver Cross Indexes: As noted above, I like Gold, but am not as comfortable with Gold Miners. While I believe they will definitely benefit if Gold rises, they are companies and they are subject to market forces that Gold itself may not be. I don't want to be in right now, so that does sway my opinion. So far they have avoided a death cross. If they close above the 50/200-EMAs tomorrow, it will be avoided altogether.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: The PMO hasn't turned up just yet. Prices do seem to have found support. I'd like to see the OBV bottoms begin to rise and the PMO to rise as well. That would get me bullish on Oil.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: We did see that PMO BUY signal yesterday, but yields are trending higher and that will put pressure on Bond prices.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

If there is a Money Show in May, I will be there! Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)