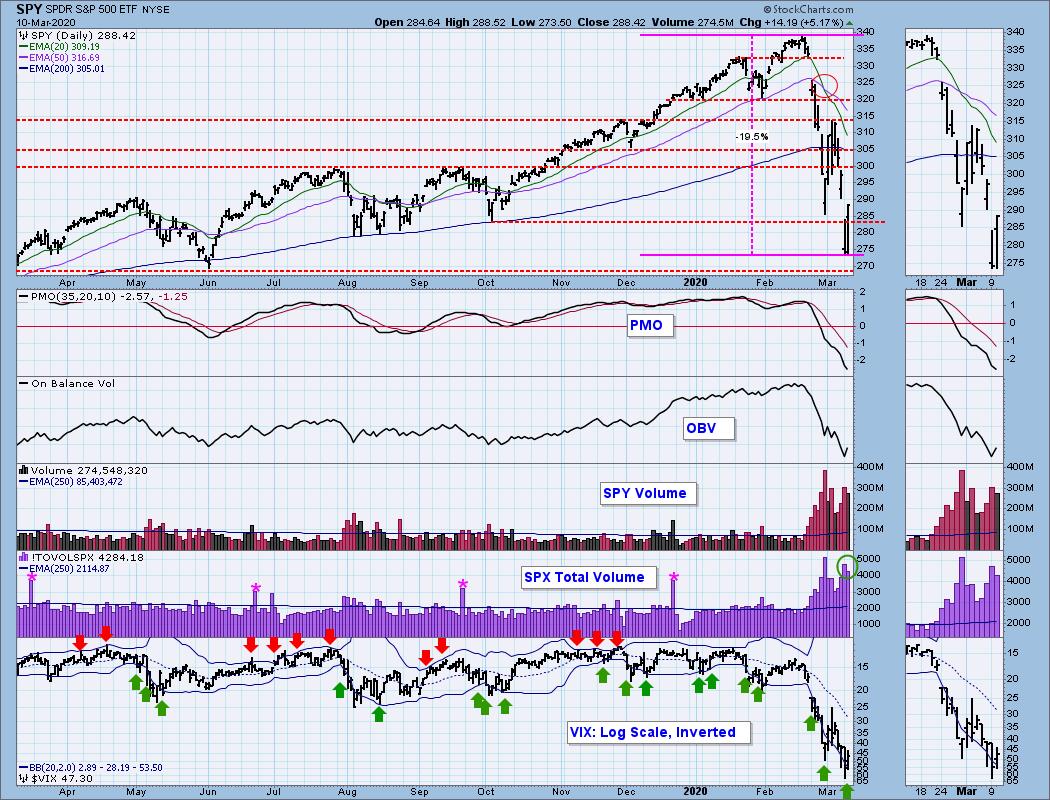

There was lots of activity in the capital today and it seemed to assuage fears about the effects of coronavirus on businesses, particularly cruise lines and airlines. A drop of the payroll tax until the end of the year was bandied about and you could almost see the saliva pooling in the business world. This likely was a catalyst to the rally; however, we were seeing extraordinarily high readings on the VIX and a snap back rally was technically warranted in the short term. I remember during past crises that 'feelings' start to become a big factor in the swing of the markets. The VIX is still reading a whopping 47.3! For candlestick fans, we do have a possible bullish hammer. I do like that we saw nice volume today, but you can see the OBV is still trending lower overall.

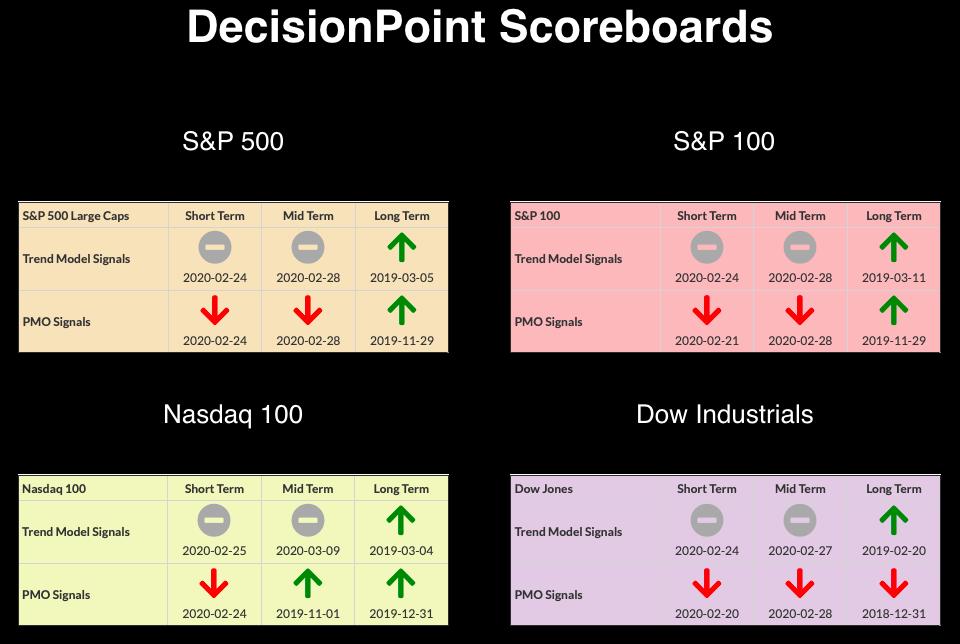

CURRENT BROAD MARKET DP Signals:

TODAY'S Broad Market Action:

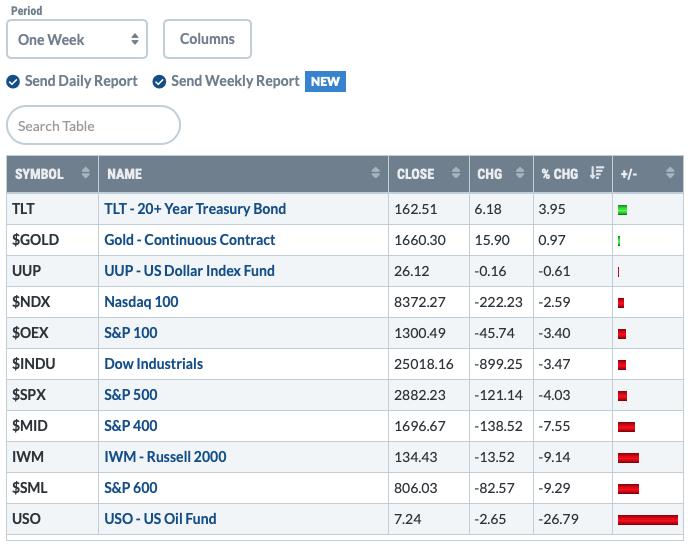

Past WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

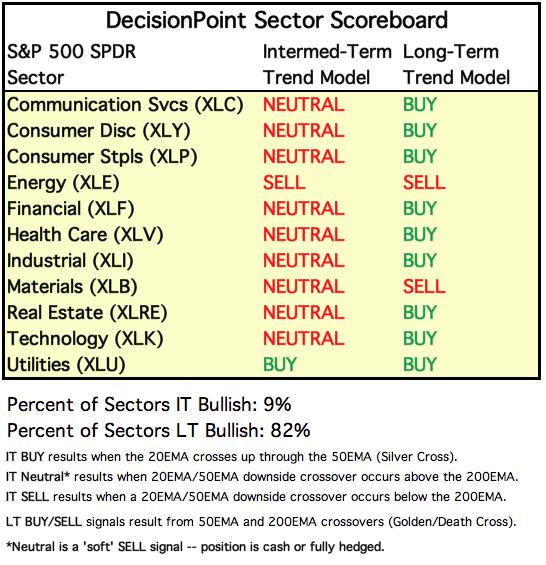

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

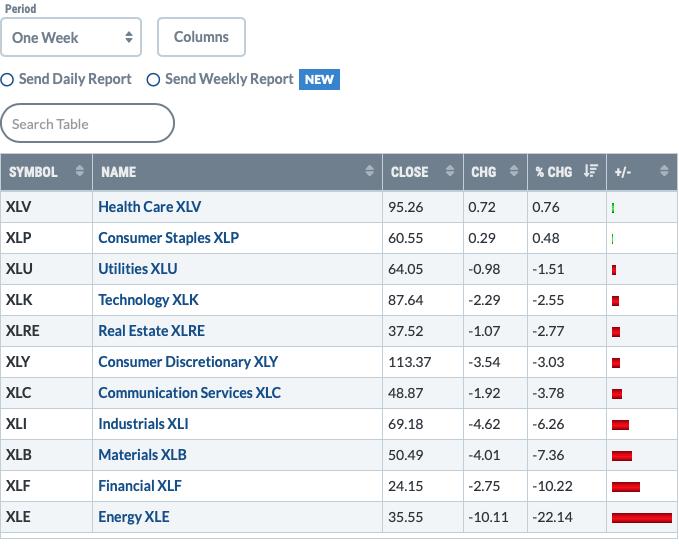

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: BUY as of 2/26/2019

SPY Daily Chart: It is fascinating that after writing yesterday about the near 20% drop that would tell us we are in a bear market "officially", today we saw a powerful rally. Total volume was satisfying, but it would be nice to see a black volume bar that is higher than the rest. I've been using August 2019 as a benchmark. Granted the correction was far deeper, but I would look for similar market action. We may've hit the low for now, but I would expect choppy and difficult trading ahead. Let's face it, trying to set a reasonable stop in this market environment is nearly impossible. I don't see that changing.

Climactic Market Indicators: Today we saw an upside climax. Today's candlestick is a bullish hammer which leads me to believe tomorrow will see a continuation of today's rally. Yet, so far we have seen wild swings to the opposite direction after these historic rallies. Let's just say that under 'normal' circumstances (less volatility), I would view it as an initiation, not an exhaustion.

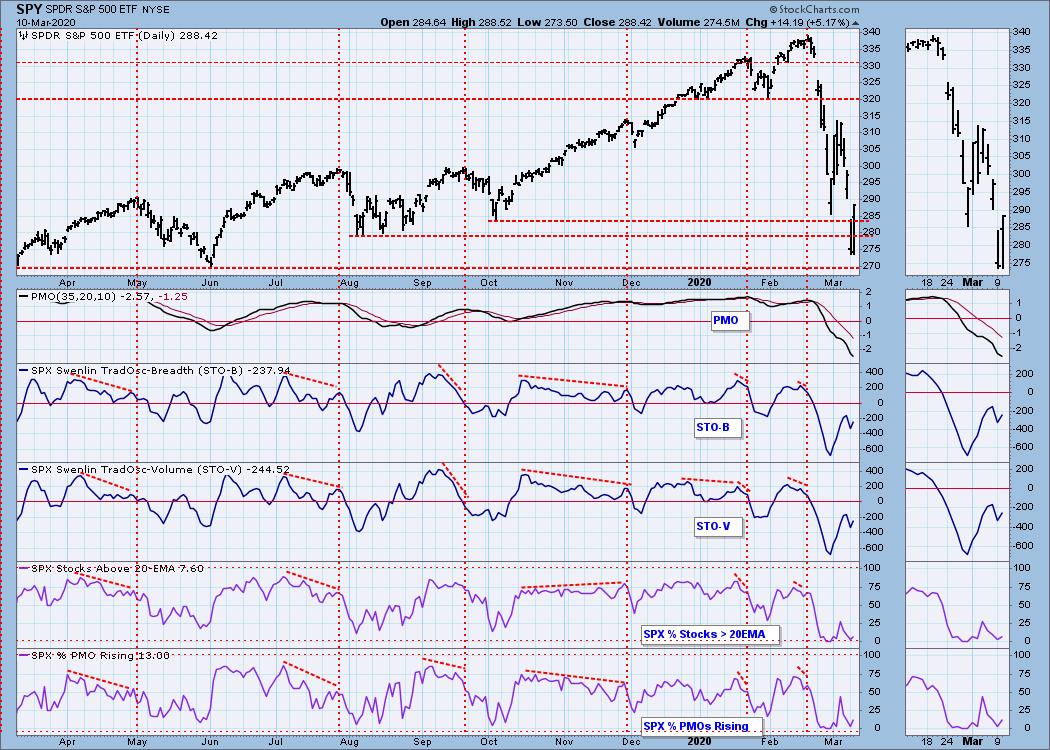

Short-Term Market Indicators: The ST trend is DOWN and the market condition is NEUTRAL based upon the Swenlin Trading Oscillator (STO) readings. The STOs are both rising and are very near neutral territory. I do think it is positive that they both turned immediately up after yesterday's historic loss.

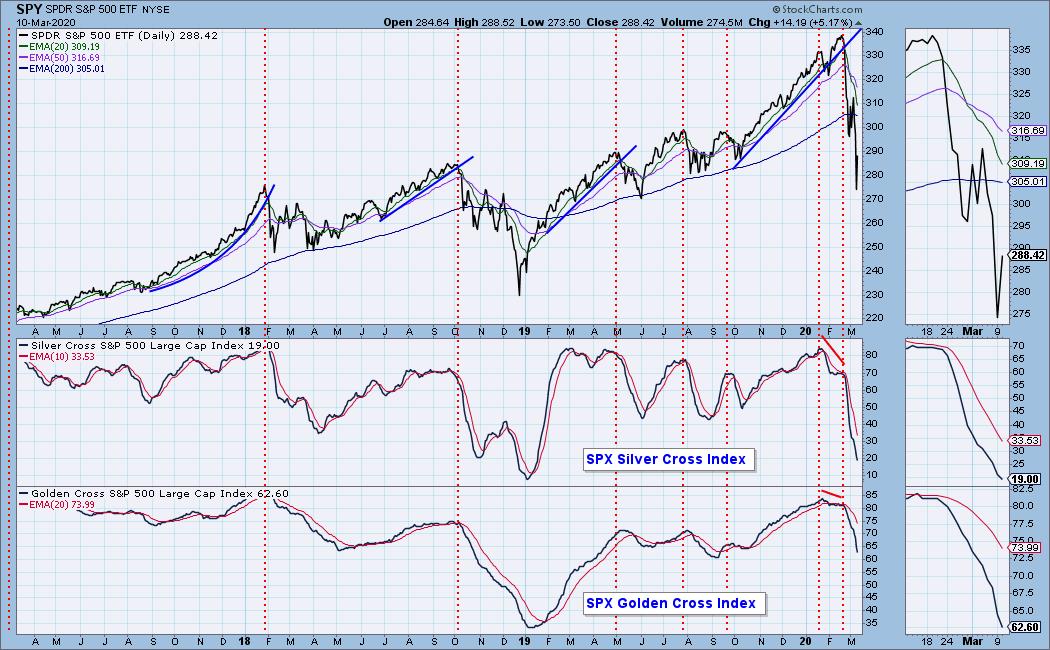

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are declining. Yesterday's comments still apply : "The SCI is now very oversold but has not hit its lows. The GCI is now hitting oversold territory, but it has more room to fall. With a very strong bull market rally, many stocks, like the market, have 50-EMAs well-above their 200-EMAs so it will take a bit longer to see the GCI hit the oversold levels we want."

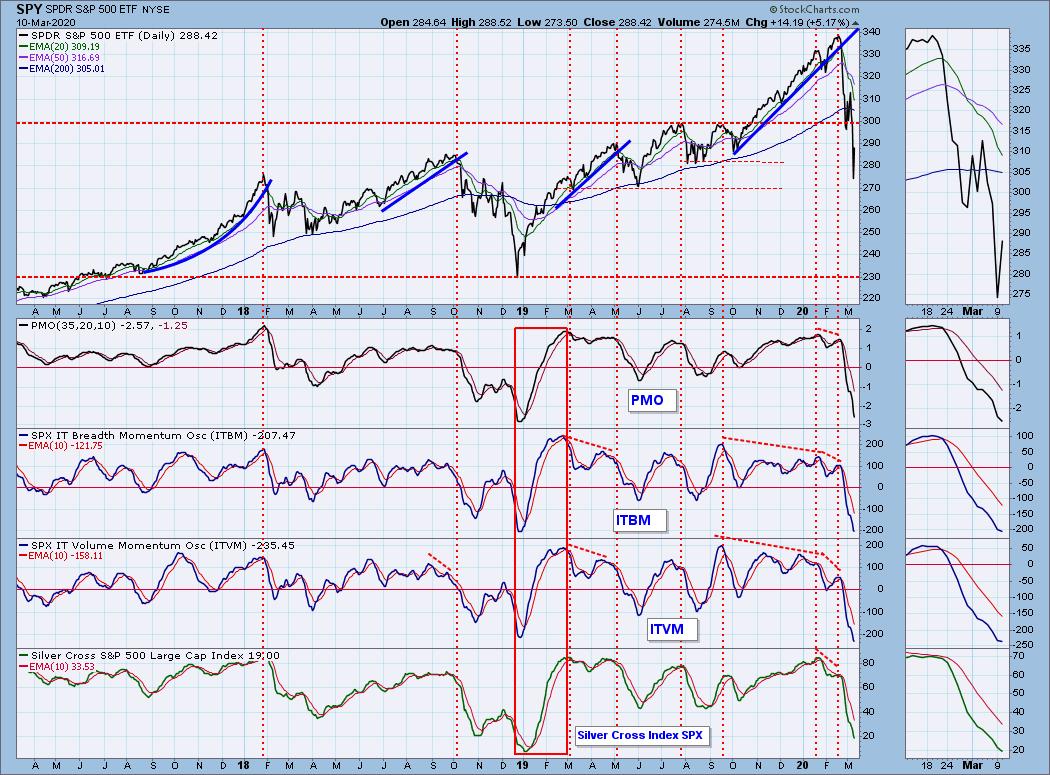

The IT trend is DOWN and the market condition is VERY OVERSOLD based upon all of the readings on the indicators below. Extremely oversold indicators are here and we are finally seeing the readings we did back at the end of 2018. They are beginning to decelerate but I'm way more interested in where they bottom.

CONCLUSION: The ST and IT trends are DOWN. Market condition based on ST and IT indicators is VERY OVERSOLD. The 20% magic number to reach to call it a 'bear market' was narrowly avoided today. Carl and I have not changed our mind about this being a bear market. I am planning on 'selling into strength' when the opportunities present themselves. I won't be adding to my positions. Remember Carl's advice: "While bear market rallies present great profit opportunities, long positions should be managed in the short-term."

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 3/9/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Nice rebound on the Dollar today. UUP closed above its 200-EMA and is back above support at $25.90. The new IT Trend Model Neutral signal from yesterday, along with a falling but not quite oversold PMO, I'm not looking for much of a rally continuation.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Not surprising given the rising Dollar that Gold lost ground today. I'm worried about a possible double-top pattern possibly forming. In the meantime, I'll trust the PMO and look for a breakout.

GOLD MINERS Golden and Silver Cross Indexes: Miners benefited from the market rally and were up .66%. The SCI and GCI are both stable for the moment.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Huge rebound in Oil. Apparently global political pressure is helping. We could start to see follow through here with price being so overbought and participants possibly working together.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: An over 5% move downward didn't break down the parabolic. I would stay away until that pattern resolves or set a trailing stop.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)