An exceptional gain today for the markets which was mostly led by Energy today. It has been seriously lagging but a look at the USO chart (found in the section on Oil further down), it is clear that Oil was a likely driver. Of concern right now is the short-term rising wedge that has materialized on the SPY chart. These are bearish formations and suggest a breakdown from the rising trend, culminating in a move about the height of the back of the pattern. That would give us a minimum downside target around 326. We aren't talking a serious correction, mainly a pullback and some more volatility.

TODAY'S Broad Market Action:

Top 10 from ETF Tracker:

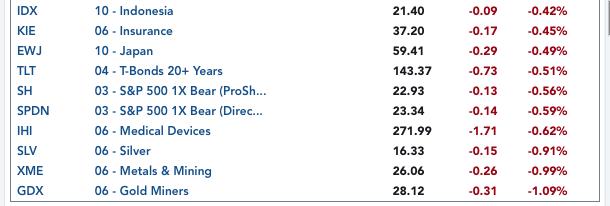

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

SECTORS

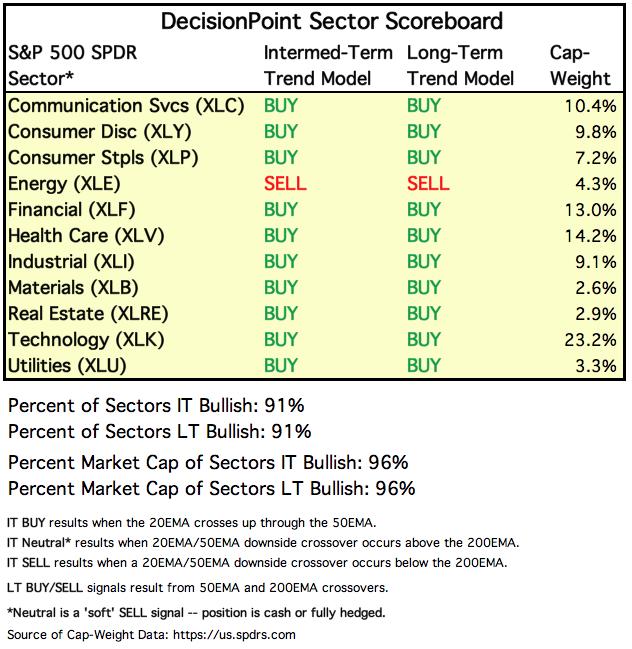

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

STOCKS

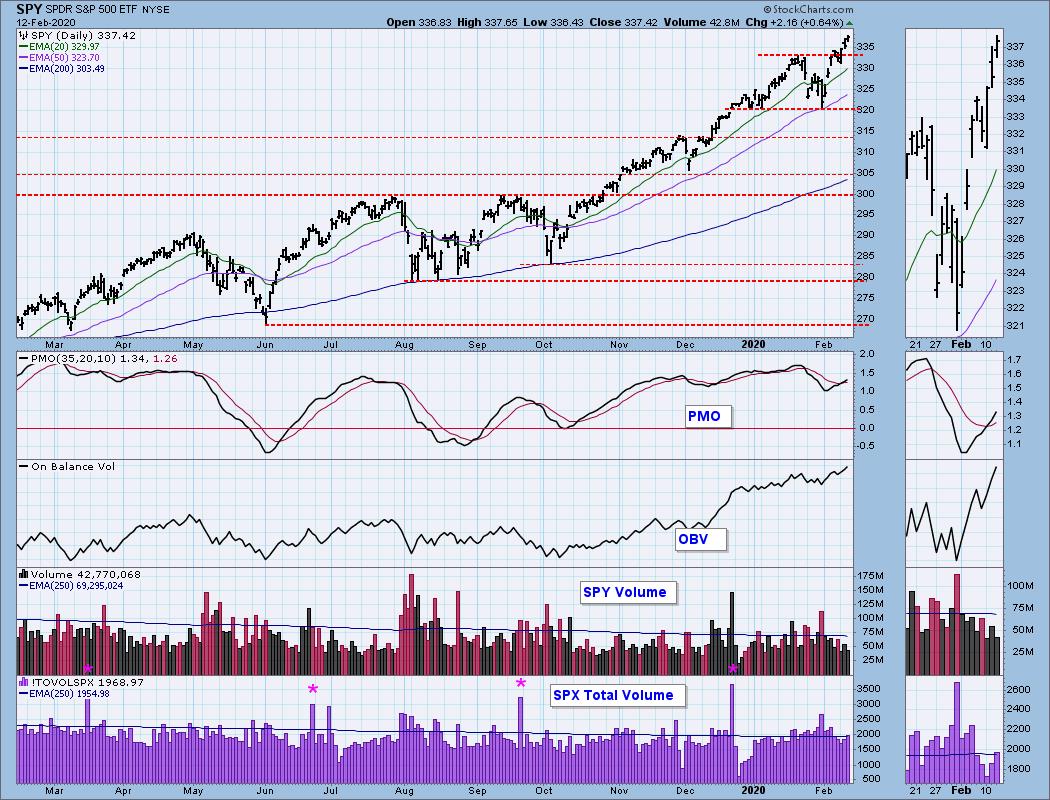

IT Trend Model: BUY as of 9/6/2019

LT Trend Model: BUY as of 2/26/2019

SPY Daily Chart: Total volume for the SPX was elevated above its annual average (250-EMA) on a sizable move to the upside. Unlike previous breaks to new all-time highs, I can report that the equal-weight version of the SPY was up 0.69% so we much better participation across the board. The PMO continues rising after a clean BUY signal. Other than the short-term rising wedge (annotated above in opening), the daily chart looks good.

Climactic Market Indicators: New Highs pulled back slightly, but I would say we are looking at somewhat climactic readings on breadth overall. I believe this spells out a buying exhaustion on the way. The VIX is rising nicely and is now above the 20-EMA on the inverted scale. We could eke out some more upside before a pullback. I generally look for those when the VIX reaches the upper Bollinger Band. So while breadth could be suggesting a nearing pullback, the VIX is telling us that we likely will see some more upside movement.

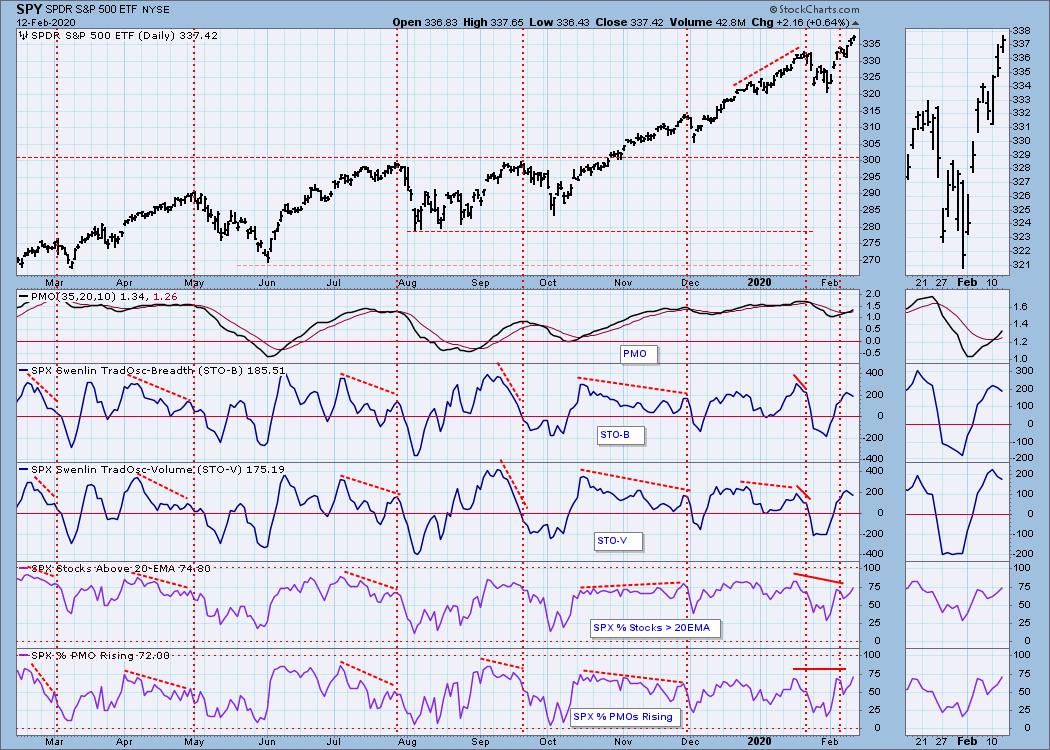

Short-Term Market Indicators: The ST trend is UP and the market condition is MODERATELLY OVERBOUGHT. (Carl and I are adding this statement to the Short-Term and Intermediate-Term Indicator sections in addition to the Conclusion.) I continue to be bothered by the declining trend of the STOs as the market makes new all-time highs. Not the last time these indicators began topping, price eventually corrected. At least the %SA20/50-EMAs are rising and not really overbought.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) We are now seeing some improvement on the SCI and GCI. I would think this is due to better market participation today. Maybe it can keep rising and lose all the "twitch".

The IT trend is UP and the market condition is NEUTRAL based upon the ITBM and ITVM readings, and SOMEWHAT OVERBOUGHT based upon the PMO and Silver Cross/Golden Cross Index readings. I like the looks of the intermediate-term indicators on this chart. We have positive crossovers on the ITBM/ITVM and as I noted above the SCI is rising again.

CONCLUSION: The ST and IT trend are UP. Market condition based on ST and IT indicators is NEUTRAL to MODERATELY OVERBOUGHT. I am bothered by the short-term indicators that are declining as price makes new all-time highs and the rising wedge. I'm looking for a short-term pullback that would execute the bearish wedge. After that, our IT indicators are bullish and suggest more all-time highs.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: UUP popped today. Support is being held easily. Biggest problem is the overbought PMO, although it isn't decelerating at all right now.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold is pretty much ignoring the Dollar and in fact, is traveling more in concert with it than the typical reverse correlation. I like this symmetrical triangle and expect it to resolve to the upside.

GOLD MINERS Golden and Silver Cross Indexes: Yesterday's comments still are accurate: "The handle on this pattern is now a symmetrical triangle and means we should see an upside breakout. The Silver Cross Index isn't on board with that scenario just yet and I'd like to see price stay above the 20-EMA."

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: BUY as of 12/16/2019

USO Daily Chart: Excellent breakout on Oil today. It has nearly executed a short-term bullish double-bottom formation. The PMO is turning up. This is looking better as a bottom fishing opportunity, especially now that a stop level around $10.30 is easy to set based on support.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: A double-top is forming on TLT and suggests a price will break down further. The moment of truth will arrive when it tests the 20-EMA and of course the confirmation line at the February low.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)