The Diamond Scan presented only six candidates for review, one of which I wrote about yesterday (COST). I opted to run one of my less restrictive scans to see if there were a few hiding out there that my Diamond Scan doesn't normally pick out. That gave me 16 results. Of these, the majority were REITs. This is a defensive sector of the market and seems to hold up fairly well when the broad markets are weak or teetering.

Welcome to "DecisionPoint Daily Diamonds", a newsletter in which we highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis and to see if these stocks pique your interest. There are no guaranteed winners here.

Current Market Outlook:

Market Trend: Currently have Short-Term Trend Model Neutral signals for the DP Scoreboard Indexes. The NDX triggered an IT Trend Model Neutral signal yesterday when the 20-EMA dropped below the 50-EMA. The SPX, OEX and Dow are all in line to do the same tomorrow.

Market Condition: Weak internals, with Price Momentum Oscillator SELL Signals on DP Scoreboard Indexes in all timeframes.

Market Environment: It is important to consider the "odds" for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross: 49.9% SPX ITTM Buy Signals (20-EMA > 50-EMA)

- Golden Cross: 64.4% SPX LTTM Buy Signals (50-EMA > 200-EMA)

Diamond Index:

- Diamond Scan Results: 6

- Diamond Dog Scan Results: 29

- Diamond Bull/Bear Ratio: .20

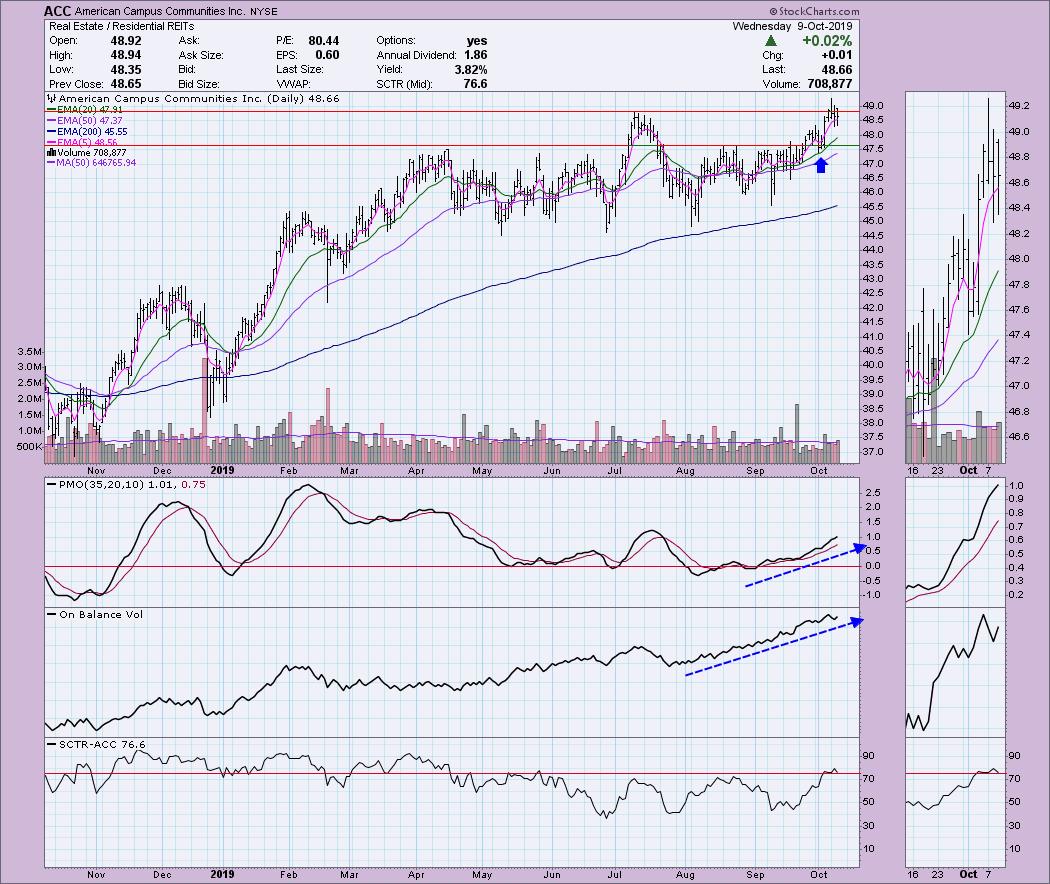

American Campus Communities Inc (ACC) - Earnings: 10/21/19

We saw a failed breakout Monday, but price is above the 20-EMA. It bounced off the 20-EMA and has now paused to digest the move. Indicators are all positive with the PMO not at all overbought. Volume is behind this rally higher. For a short-term investment, I'd probably set a stop around $47.25 to prevent being stopped out should it require a throwback to the original breakout point at $47.50 before rising higher.

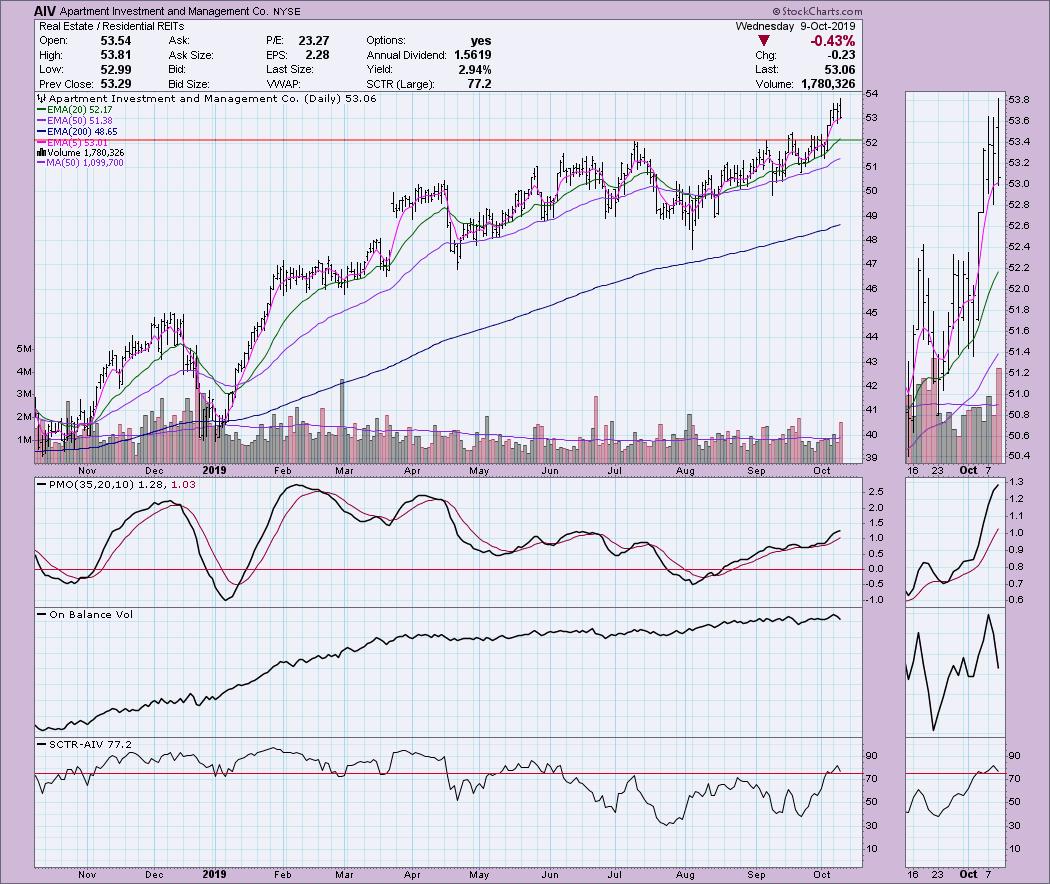

Apartment Investment and Management Co (AIV) - Earnings: 10/31/2019

In this case, we have a successful breakout and now a consolidation this week. My one concern here is the large amount of volume coming in on today's move lower. Other than that, the PMO is rising nicely and is not overbought. The OBV is still healthy despite two days of high selling volume. SCTR remains above 70, which suggests internal and relative strength.

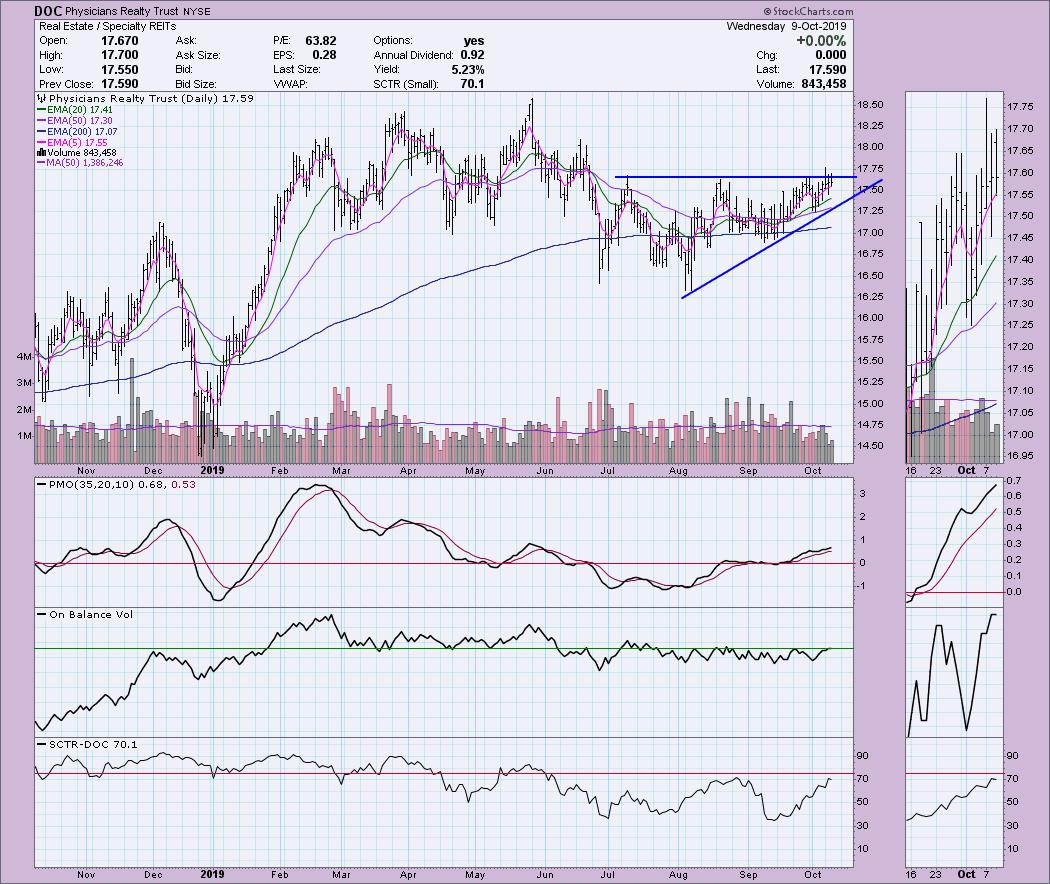

Physicians Realty Trust (DOC) - Earnings: 11/6/2019

I'm looking at this as the near-execution of an ascending triangle pattern. It needs to close above $17.75 before I'll call it "executed." The 20-EMA has held up as support and the 5-EMA is (currently) holding strongly. The PMO is rising nicely and isn't overbought. I like the volume that has been coming in this month. The OBV is steady and appears ready to break above previous tops. Excellent yield of 5.23%!

Equity Commonwealth REIT (EQC) - Earnings: 10/29/2019

Here we have another breakout above overhead resistance and a nice pullback toward the breakout point. The PMO is rising steadily and volume is certainly behind this breakout move. On a short-term investment, I'd probably put my stop just below the 20-EMA.

Stag Industrial Inc (STAG) - Earnings: 10/30/2019

STAG is ready to break out, but it hasn't managed to close above that September top. The PMO suggests we will see that breakout. The OBV has just about made up the distance that it fell on that late September price shock. Upside potential is pretty good on this lower-priced stock. It has a respectable yield of 4.73%, for those of you who hold their stocks in the intermediate term.

Full Disclosure: I do not own any of the stocks above and I am not planning on purchasing these or any additional stocks at this time. I'm currently about 60% in cash and watching my stops closely.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**