It was interesting to look at the results of the Diamond and Diamond Dog Scans today, where we had 16 bullish results and only 32 bearish results. If you recall, for the past few weeks, I've been seeing far more bearish results. I'm starting to track these numbers and I'll report back when I have more data. Today's "Diamond Ratio" is 0.5. I used Carl's Scan today, which looks for particularly "beat down" stocks that are starting to see a shift in momentum.

Welcome to "DecisionPoint Daily Diamonds", a newsletter in which we highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis and to see if these stocks pique your interest. There are no guaranteed winners here.

Current Market Outlook:

Market Trend: Currently have Short-Term Trend Model Neutral signals for the DP Scoreboard Indexes.

Market Condition: Weak internals with Price Momentum Oscillator SELL Signals on DP Scoreboard Indexes.

Market Environment: It is important to consider the "odds" for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross: 55.2% SPX ITTM Buy Signals (20-EMA > 50-EMA)

- Golden Cross: 65.4% SPX LTTM Buy Signals (50-EMA > 200-EMA)

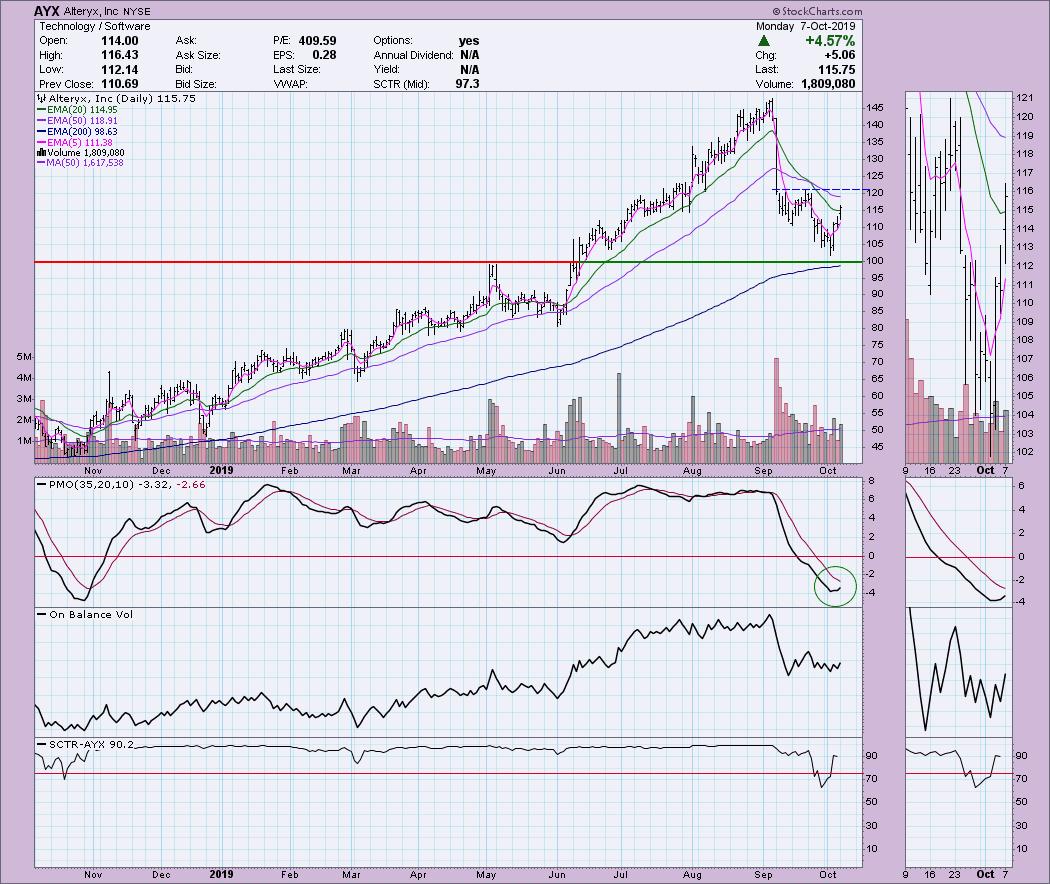

Alteryx Inc (AYX) - Earnings: N/A

Full disclosure - I do own this stock. I'm still tentative about the market overall and the technology sector is questionable right now, but I did see a few software stocks land in the scan results today. This one may need a small pullback to the 20-EMA after a 4.5% upswing, but I believe it has the legs to break above overhead resistance at around $120. The PMO has shifted higher and is rising for the first time since the price shock at the beginning of September. The SCTR is still very healthy, so relative strength is there.

Brookdale Senior Living Inc (BKD) - Earnings: 11/4 - 11/8/2019

This one has been in a solid rising trend since the September low. I like that it didn't need to go all the way down to test support at the March/May tops and August low. It broke above the 20-EMA but did pull back somewhat today. I would look for a move to $8.60 if it can get a 20/50-EMA positive crossover. Volume is starting to come in and the SCTR is in the "hot zone" above 75.

First Trust NASDAQ Cybersecurity ETF (CIBR) - Earnings: N/A

This one broke out above the 20-EMA last Friday; today saw a continuation of the move. The PMO is about to trigger a crossover BUY signal and the OBV looks like it will break out of the declining trend. The SCTR recently shot higher as well. There is still downward pressure on this one, as the declining tops trend line hasn't been tested yet.

MarketAxess Holdings (MKTX) - Earnings: 10/23/2019

This one needs to break above short-term overhead resistance. It made the attempt today. The good news is that it has closed well above the 20-EMA today and Friday. We have a very oversold PMO that is rising. I'd like to see a bit more positive volume on this one as the OBV needs to do more work to break out of its declining trend.

Trade Desk Inc (TTD) - Earnings: 11/7/2019

Another software company found its way onto the Diamonds report. Notice the rounded bottom or cup forming along with the PMO. It may not be that visible, but, if you look in the thumbnail, you can see that the OBV is starting to rise and should break out of its declining trend soon. There are plenty of areas of overhead resistance, with the next big one being the 200-EMA at about $200. If it breaks above that, I would look for a move to challenge the May top.

Full Disclosure: I own AYX, as I noted above. I am not planning on purchasing these or any additional stocks at this time. I'm currently about 60% in cash, but watching my stops closely.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**