You may have noticed that the Dow and S&P 500 couldn't get in sync this week. That is because of the 4:1 split of AAPL stock, that was effective on Monday, resulted in AAPL's weighting in the Dow 30 being cut by three-quarters, whereas AAPL's cap-weighting in the S&P 500 remained undiminished. As a result, there were times on Friday when the S&P 500 was down about -2.5%, while the Dow was only down -1%. AAPL's influence was especially evident because, from Wednesday's high to Friday's low, AAPL declined -20%. While this went a long way to correct AAPL's vertical move in August, AAPL is still very overvalued, and it is still parabolic. Regardless of which way it goes from here, keep in mind that it is going significantly interfere with the Dow and SPX being in sync and day that AAPL makes a big move in either direction.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

GLOBAL MARKETS

BROAD MARKET INDEXES

SECTORS

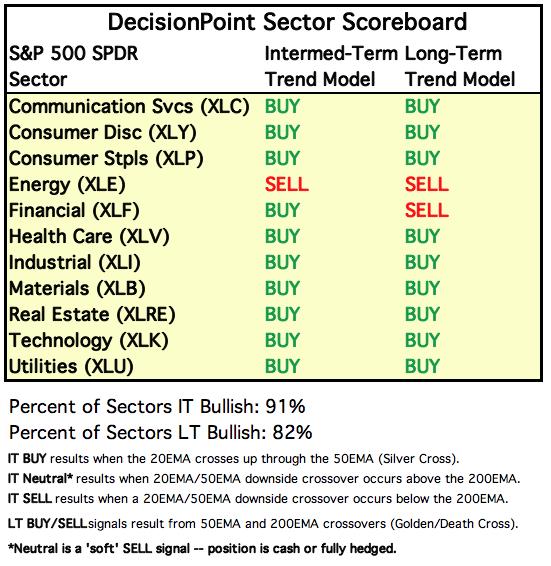

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

ETF TRACKER: This is a list of about 100 ETFs intended to track a wide range of U.S. market indexes, sectors, global indexes, interest rates, currencies, and commodities. StockCharts.com subscribers can acquire it in the DecisionPoint Trend and Condition ChartPack.

Top 10 . . .

. . . and bottom 10:

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: In the week of August 17th, the market began a steady advance that was a bit too steep, getting price too far above the rising trend line. This week the market corrected that excess with a sharp correction that pierced the rising trend line intraday, taking price back to the horizontal support line drawn across the February top. Not to worry, by Friday's close, the rising trend line had been recaptured.

The line drawn across the February top has provided support for the time being.

SPY Weekly Chart: The rally from the march low is extremely steep, and this week the rising trend line was penetrated briefly. The weekly PMO is very overbought and is looking toppy.

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The Silver Cross and Bullish Percent Indexes show solid negative divergences between this week's top and the June top. The Golden Cross Index (GCI) is -25% lower than it was in February, which is a profound contraction of participation. While I wouldn't normally reach back so far between tops, the GCI is a long-term measure, and the comparison is appropriate.

Climax Indicators: After almost two weeks of steady, small advances, the market gapped up on Wednesday with climactic (greatly expanded) readings on New Highs, Net A-D, Net A-D Volume, and SPX Total Volume readings. Many interpreted this as the beginning of a more accelerated up leg; however, we reported it as an upside exhaustion climax, because the climax activity occurred at the end of an up trend. The next day was another climax day, only this time it was to the downside, and possibly the beginning of a new down trend, so we identified it as a downside initiation climax.

As you can see on the chart, this has been a year with many of climax days, and except for the February/March decline, the downside climaxes didn't result in extended declines. Friday was another climax day, but most of the evidence is buried in the intraday action. The only evidence left at the close was SPX Total Volume and total volume for the SPY ETF (see one of the SPY daily charts above). So, what kind of climax was it? I'm pretty certain that it was a downside exhaustion climax. There was a successful test of long-term support, and the rising trend line was recaptured.

Short-Term Market Indicators: The short-term market trend as measured from the mid-August low is UP and the condition is NEUTRAL. The short-term market bias is NEUTRAL.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL. The market bias slightly BULLISH.

CONCLUSION: This week we had three climax days in a row -- upside exhaustion on Wednesday, downside initiation on Thursday, and downside exhaustion on Friday. We can't be certain that Friday finished off the decline, but important support held admirably, and it isn't the first time this year that we've seen a quick and dirty correction that is over before the bears can get more than a bare whiff of success. Downside exhaustion doesn't necessarily preclude a continuation of the decline -- we can't rule out that the market could churn for a few days before continuing downward. And there are still plenty of negative divergences begging for such an outcome. Nevertheless, Friday's price action should give more encouragement to the bulls than the bears.

Note: On Monday the U.S. markets will be closed for Labor Day.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The dollar has been somewhat erratic for a month, but the down trend continues. The daily PMO is rising, but that just reflects the deceleration of the decline, not a positive change in trend.

UUP Weekly Chart: I see plenty of potential levels of support, but nothing I want to hang my hat on.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: To me it is important that gold stay above the long-term support line, but I don't think a breakdown will break the bull market.

GOLD Weekly Chart: From the 2018 low, we can see successive trend lines bending ever higher. I would like to see more sideways movement to decelerate the advance. The weekly PMO has topped, so I may get my wish.

GOLD MINERS Golden and Silver Cross Indexes: GDX has formed a bearish descending triangle, but the miners are in a bull market, and a major selloff seems unlikely.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/13/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: USO has been turned back from overhead resistance, so I have tentatively identified the July low as potential support. Next stop would be 24.00. Note that the 20EMA is about to cross down through the 50EMA, both of which are below the 200EMA, and that will generate a IT Trend Model SELL signal.

USO/$WTIC Weekly Chart: We currently see a potential trading range for USO of between 16.50 and 30.25 -- the bottom of that range is equal to about WTIC 10.00. Considering the panic that was present when that low was hit, I don't think it will be retested. Rather, I think that WTIC 20.00 or 30.00 are the more likely support levels. Granted, that's not very specific, but my purpose is to minimize 10.00 as a potential target.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Some tome ago I took a guess and drew a support line across the bottom of the May/June congestion (about 160.25). So far that looks like a pretty good guess. As long as the Fed leave interest rates alone, we should look for continued sideways movement for bonds, with a potential low for the range of 152.50.

TLT Weekly Chart: The rising trend line seems to be becoming irrelevant.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Carl

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)