Yesterday I talked about the climactic positive readings on breadth and how they were flashing "buying exhaustion". Well today, we have extremely climactic negative readings on breadth and the VIX. How do we read this? Another exhaustion? We'll talk about that more later. The sector that really took it on the chin today was Technology. Below is the chart of the NDX. Price broke through two shorter-term rising trends; however, the longer-term rising bottoms trendline out of the July low is still intact. More importantly the 20-EMA held up. The PMO topped in overbought territory which is not surprising given the voracity of the decline today. Now the question is whether this pullback is enough to spur buying again. Given what our indicators are saying, I'm not optimistic. Best case is likely consolidation before another downturn.

Here is the link to register for Monday 9/14/2020 free DecisionPoint Live Trading Room!

Here is the link to the recording from Monday (8/31/2020) where Erin looked at Apple (AAPL) & Tesla (TSLA) and took symbol requests. She introduced how to use the 5-minute bar chart to time your entries! Password to view recording: V#^P89Yv

DP INDEX SCOREBOARDS:

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

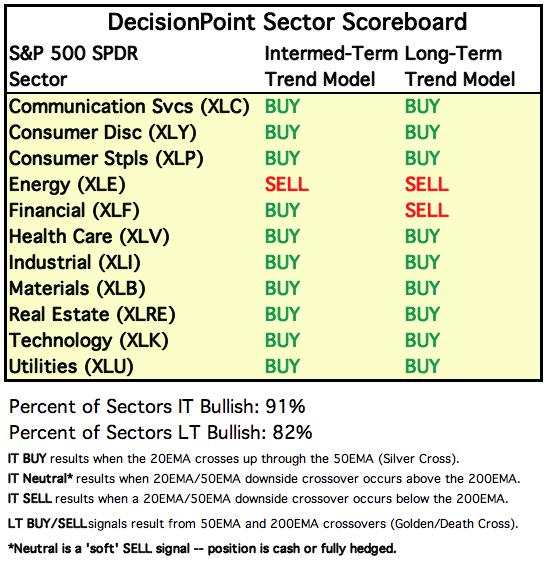

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: The SPY did not escape the deep decline today, but like the NDX, support at the 20-EMA held and the rising trend is still intact. Of course that rising bottoms trendline makes up the bottom of a bearish rising wedge. Some good news would be the RSI is no longer overbought. The PMO topped, but overall it is still flat and less than helpful. Notice the peak in volume today! Huge distribution day.

Climactic Market Indicators: Check out these climactic readings today to the downside! The VIX has now effectively opened up its Bollinger Bands from the tight squeeze and will become more helpful. The last time we saw a similar move was back in June. We had a couple of difficult weeks, but as soon as the VIX hopped back above its moving average on the inverted scale, the market formed a cardinal low. With today's readings coming in off a record rally, I have to look at this as a selling initiation climax...meaning we should see another decline tomorrow or the next day. Carl and I agree that if the decline doesn't continue tomorrow, we could see some short-term churn, followed by more decline. The 50-EMA is the 'line in the sand' as my friend Mary Ellen says. I believe that may be tested again just as it was back in June.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT. Based upon the STO ranges, market bias is NEUTRAL. The pullback on the %Stocks indicators are confirming this decline. We can see that back in June, these indicators were far lower and I believe we need to gird ourselves for a similar decline.

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

Negative divergences are likely beginning to play out here which is why Carl and I aren't convinced that the market will quickly resume a rally to the upside. Churn, pause, consolidation...whatever you wish to call it, I think that is the best case scenario as it would give us all a chance to beef up stops or determine your own 'lines in the sand'.

The intermediate-term market trend is UP and the condition is NEUTRAL. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH.

All of these indicators tipped back over. I was surprised to see that %PMO Crossover BUY Signals only fell slightly today. I do think you need more than 41% of stocks on PMO BUY signals to fuel a move to all-time highs.

CONCLUSION: Yesterday one might've thought that with such positive indicators and breadth that the market was ready hum along higher, but we have to evaluate when these numbers came in. Did they come in off a big decline or a rally? It was a rally so we read it as a buying exhaustion. Had we seen that after a decline, that would be an initiation. So now we had big negative readings. I can't read it as a selling exhaustion as we've really not much selling until today. I would look at the overall indicator readings as a mark of a selling initiation...sadly more downside ahead.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Yesterday's comments still apply:

"The Dollar rallied today, but as I have been saying all week, I won't pay much attention until we see a break out of the declining trend. The PMO has turned up which is positive, but I don't like the negative RSI and possible shooting star/island reversal candle on today's trading."

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: The 2011 top is still holding as support and so is the 50-EMA. The RSI is mostly neutral. The PMO has really pulled back during this pause in the rally which I find constructive. I'm not going to get overly concerned about Gold unless it breaks significantly below the 50-EMA. Discounts remain on PHYS, but not enough to really read anything into that sentiment measure.

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: GDX remains within its symmetrical triangle, holding above the 50-EMA. In the short term, we have Stocks above their 20-EMA falling rather quickly, but the amount losing support at the 50-EMA isn't too bad. The long-term picture looks pretty good given the 100% readings on those long-term indicators. I still have my position in a Gold Miner but I am watching the 50-EMA and $37.50 price point like a hawk.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/13/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Price executed the bearish rising wedge today with its breakdown. It isn't a decisive breakdown (3%+) yet, but the PMO did just recently trigger a SELL signal and the RSI is in negative territory (chart#2). This breakdown today did take out both the 20/50-EMAs as support. There is strong support at $28.

BONDS (TLT)

IT Trend Model: Neutral as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds were one of the few winners today. TLT has now recaptured its rising trend and the RSI has turned positive. We had already begun to see the PMO rise and we see very heavy volume on the rally off support at $160. If I had to point out a negative, it would be the long wick on today's candle which is generally a bearish sign.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room as part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)