I had quite a few email requests for symbols that readers are looking at as potential "Diamonds" - I looked at them all and picked my five favorites! What was truly impressive is that some of these requests came in a few days ago and, since then, the stocks have done exactly as expected! Good work, everyone! Feel free to start sending in your requests anytime for next Thursday's Diamonds Report.

I love to get your feedback on DP commentary and, on Thursdays, I look at reader-requested symbols, so shoot me an email at erinh@stockcharts.com. I read every email I receive and try to answer them all! Your insight helps me to tailor my commentary to what my readers and viewers want to hear about.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Current Market Outlook:

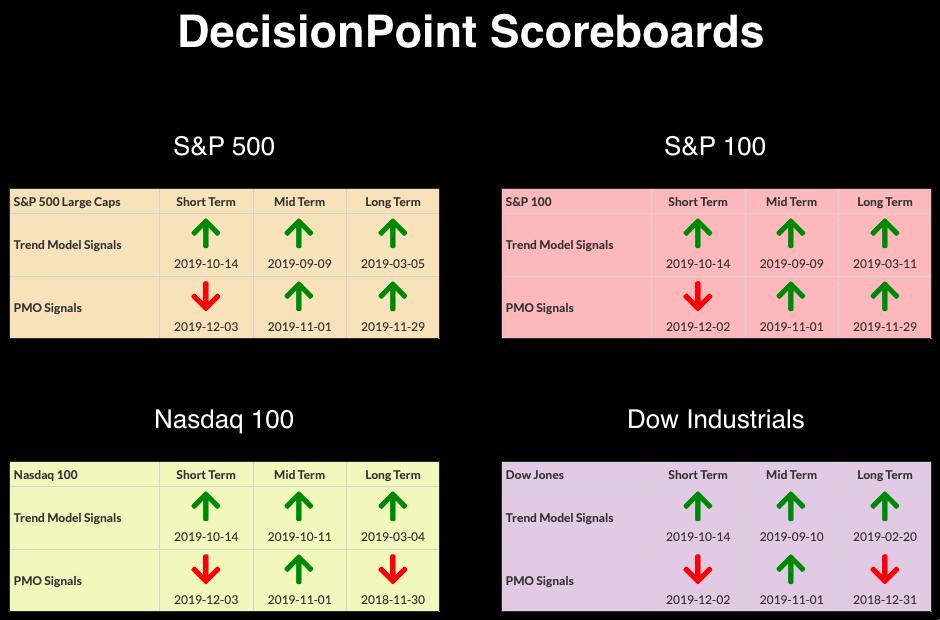

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and momentum is failing in the short term. Caution is warranted.

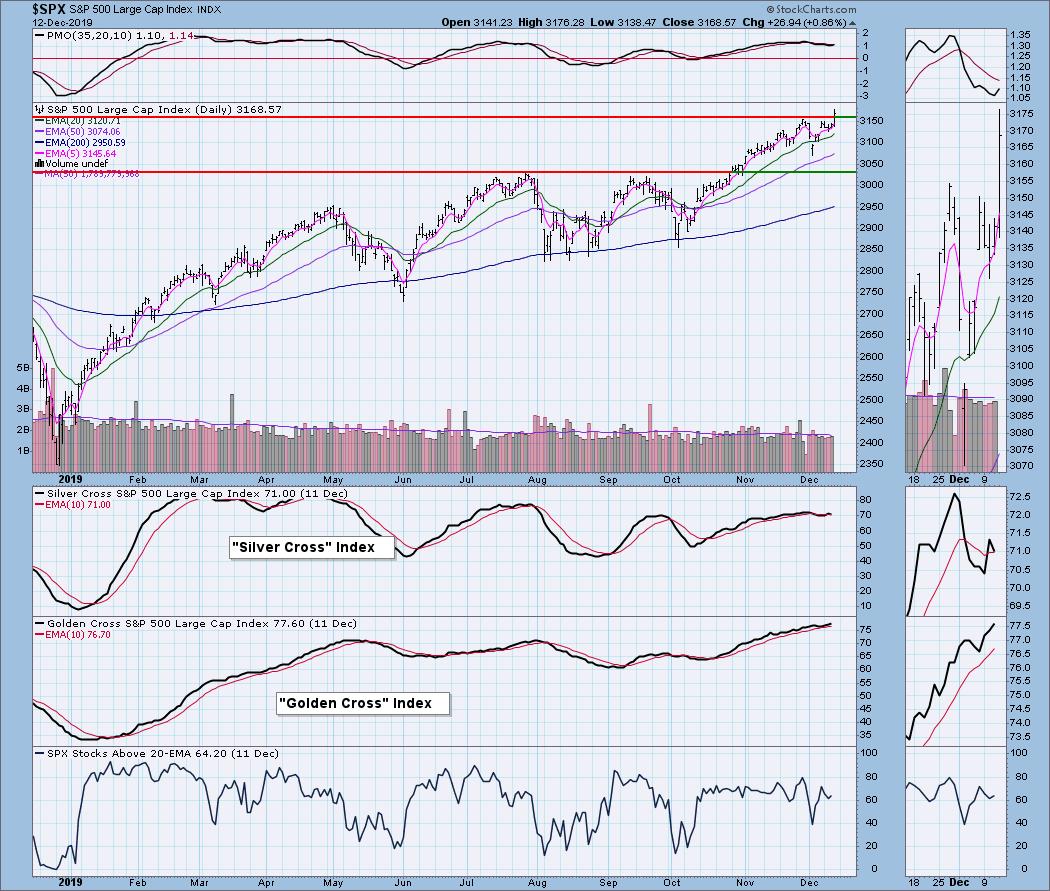

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 13

- Diamond Dog Scan Results: 8

- Diamond Bull/Bear Ratio: 1.63

Abbott Laboratories (ABT) - Earnings: 1/21 - 1/27/2020

We had a beautiful breakout from an ascending triangle pattern. It didn't quite close above that area, but, with a big rally today and a new PMO BUY signal, I would be looking for higher prices. Overhead resistance is at about $88.50. The OBV has been rising with price lows, which is positive. The SCTR is on the low side, but it is rising.

The breakout on the weekly chart is clearer, but the most important thing on the chart is a PMO that is beginning to scoop in preparation for a BUY signal.

Century Aluminum Co (CENX) - Earnings: 2/19 - 2/24/2020

This request came from a reader whose opinion I greatly respect and you can see why. The request came in 12/9; since then, it has run up quickly after forming a cup. It has hit overhead resistance, so I suspect it will drop or pause a bit to form a "handle." The PMO triggered a BUY signal today and while it looks overbought, we can see that the bottom of the range is at -10, so a reading around +3 shouldn't be a concern. The SCTR just entered the "hot zone" and the OBV is confirming the move higher.

We also have a cup forming on the weekly chart. That cup formed right on a strong support level and didn't actually have to drop down to the 2016 lows before moving higher. The PMO just entered positive territory.

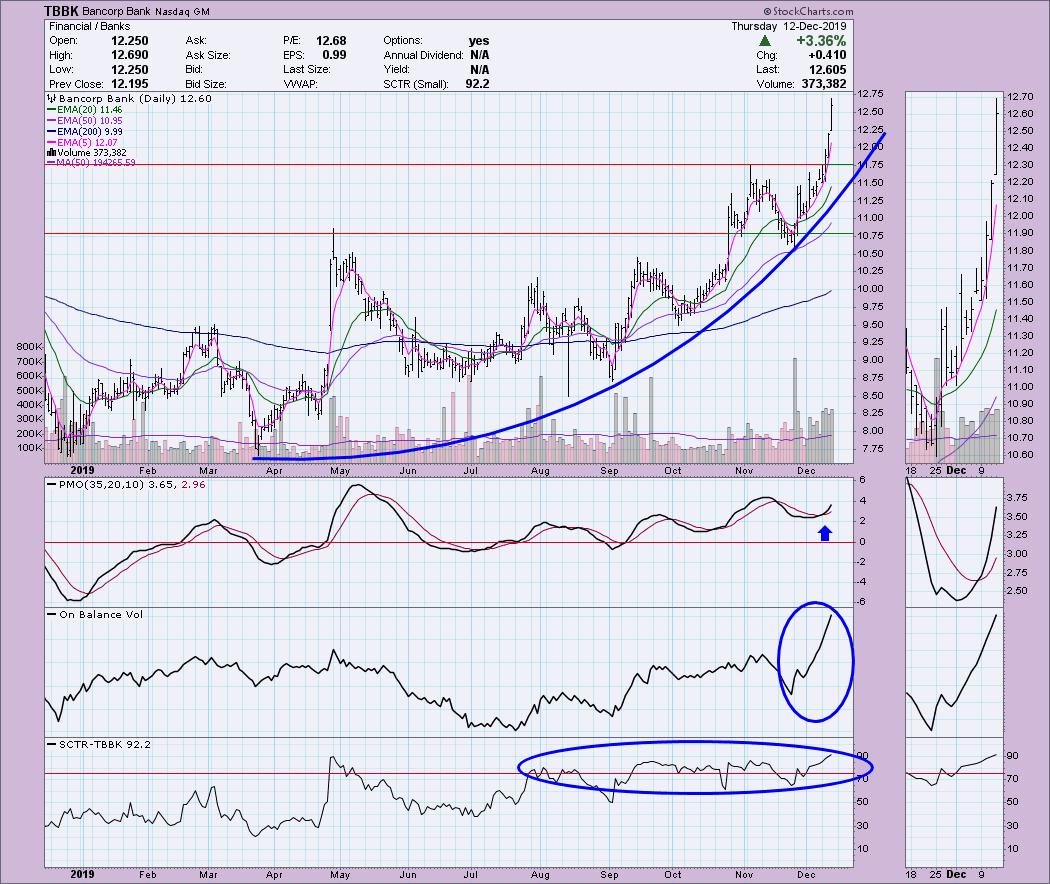

Bancorp Bank (TBBK) - Earnings: 1/22 - 1/27/2020

Nice job from my reader who submitted this one earlier this week at the breakout. The PMO is on a new BUY signal and certainly has headroom to move higher before reaching overbought territory. The OBV and SCTR are impressive. My only concern here is that it is in a parabolic move, which can end abruptly and cause many gains to be lost, so I would recommend using a trailing stop here.

The breakout on the weekly chart is also impressive. Overhead resistance doesn't arrive until at least $16.50, but major resistance doesn't hit until we reach the 2014 high.

Stratasys Inc (SSYS) - Earnings: 3/5 - 3/9/2020

Again, dear readers, this request came in before today's 3.5% rally, so your analysis processes are right on. The PMO gave us a BUY signal just before the breakout from the declining trend. Volume has been coming in consistently and is rising. The SCTR is rising from the ashes, which is encouraging as well.

I thought weekly chart on this was interesting. SSYS has been in a solid trading zone or basing pattern for years. Price is now bouncing off the bottom of that range and the weekly PMO has turned up. A ride to the top of that range would be quite lucrative.

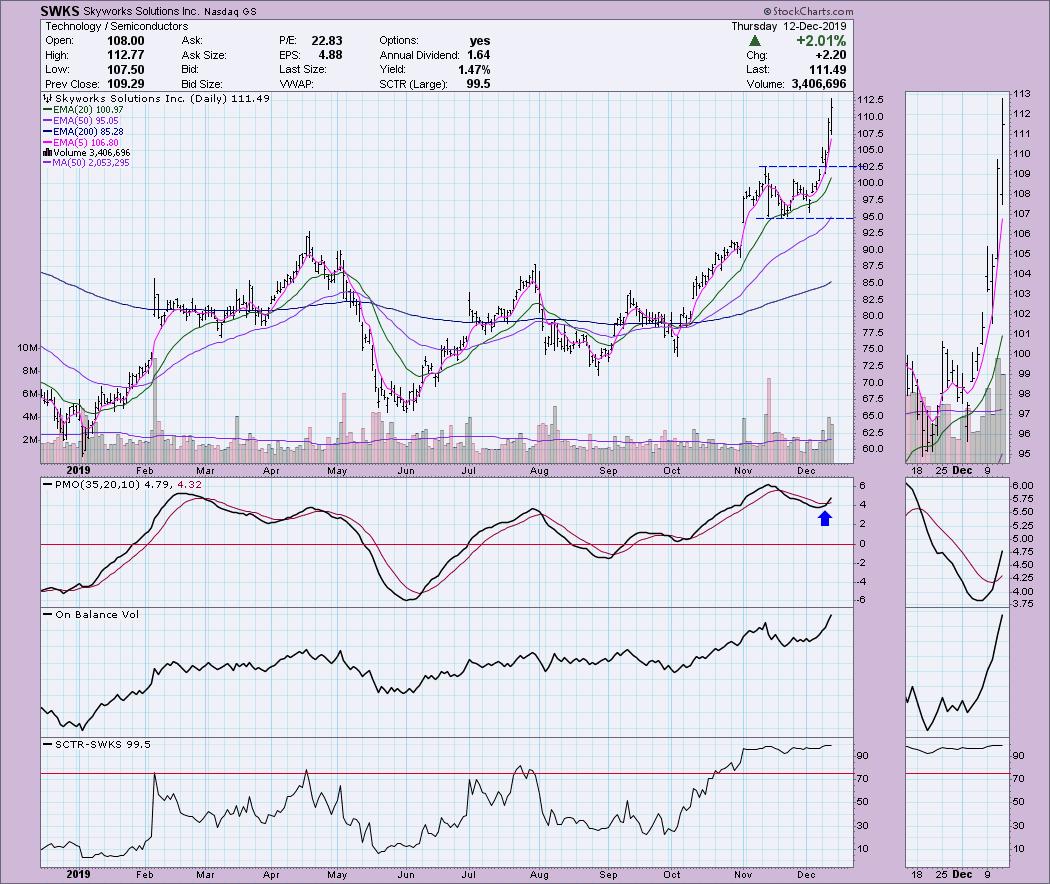

Skyworks Solutions Inc. (SWKS) - Earnings: 2/3 - 2/7/2020

This is a big name and it is ruling the large-cap universe with a 99.5 SCTR. This request came in last night, so the 2% gain is a sweet reward. The PMO is on a new BUY signal. It is a bit on the overbought side, but we have seen it stretch above +5. I would prefer to enter something like this on a pullback, but, seeing the increasing positive volume each day, I don't know that we will see a pullback.

The weekly PMO suggests that we could see continued higher prices. Price is right on overhead resistance at all-time highs, so it is on the overbought side as far as price. If we see a breakout to new all-time highs, this one could certainly run higher and set a new area of support.

Thank you again, readers, for all of your great suggestions, it was very hard to decide which to spotlight. I will keep the ones that I didn't go over on the list for next Thursday and let them compete against the new requests that arrive this week. Again, great job, everyone!

Full Disclosure: I do not own any of the stocks presented, but I have to say that many of these are on my watchlist for adding. It is going to be time for me to re-enter cautiously next week. I am 80% cash.

Market Vision 2020 - Sign Up for Details

I am so excited to participate in "Market Vision 2020", an online financial conference on Saturday, January 4, 2020 to kick off the new year. Make sure you're subscribed to the Market Vision 2020 newsletter in order to receive the latest updates on the event (and save a lot of money if you decide to attend!). *Click Here* to subscribe to the free newsletter. There will be lots of giveaways and free educational events for everyone who follows along – don't be left out!

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**