China has been in the news often as many of the Chinese companies are experiencing a crack down by the government on the "private" sector. We, of course know that there really isn't a "private" sector in China as the government controls all. This has been a wake-up call for many investors who were holding many of these China-based companies.

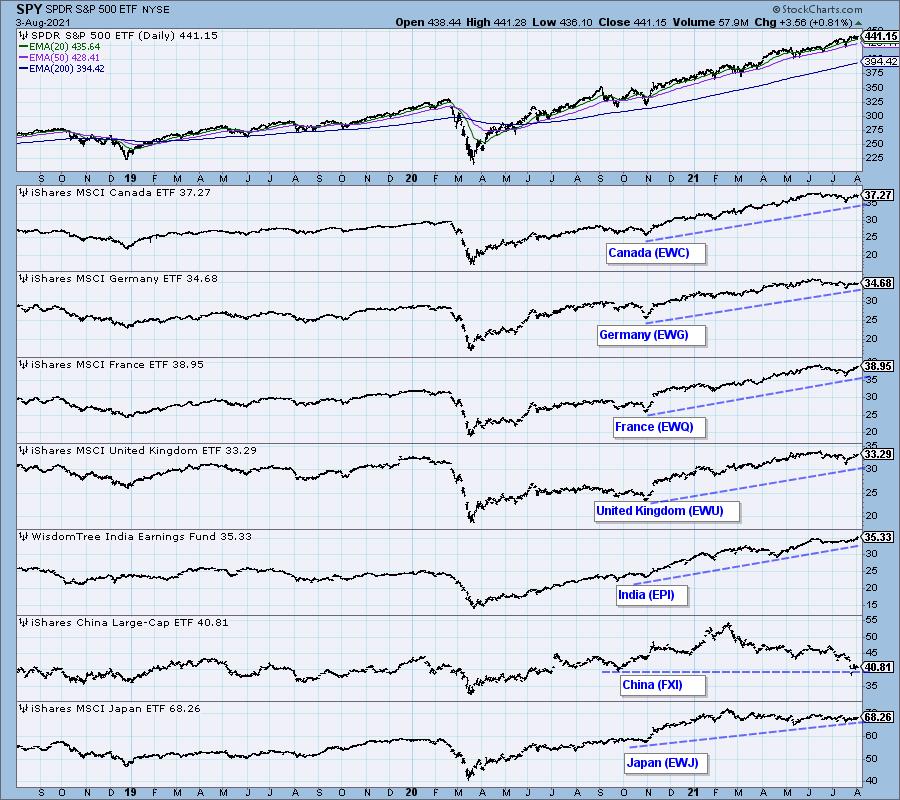

How damaging has the government been to the Chinese market? The global markets chart below (available to subscribers) shows the continued long-term rising trends on all markets with the exception of China (FXI).

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available!

If we look at the weekly chart for FXI, we can see a large head and shoulders pattern that formed this year. It resolved to the downside as expected back in May. The minimum downside target of the pattern would put FXI at support around $35.00, but I doubt it will stop there. In fact, FXI is only 22% away from its bear market low! The weekly RSI is attempting to turn back up in oversold territory, but the weekly PMO has plunged into negative territory. Many might consider this a possible reversal point, but the weekly PMO suggests otherwise. I wouldn't go bottom fishing here, the risk is still far too high to catch a tasty bottom fish here.

Technical Analysis is a windsock, not a crystal ball.

--Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.