Three sectors saw new IT Trend Model BUY signals today. On all three charts we have moving average "braiding" and are now increasingly vulnerable to whipsaw signals. Consequently, next time we get the switch I won't necessarily be leading with it unless there's more to say about the chart. The IT Trend Model BUY signals are generated when the 20-EMA crosses above the 50-EMA. It does not matter where the 200-EMA is, a positive crossover is always a BUY signal on all of our Trend Models. I have the three sector charts below.

Financials are trying to wake back up. The RSI is nearly positive and we are seeing a rising PMO. The EMAs are the issue right now. There are three of them for which price needs to distance itself from. The SCI and BPI are both rising nicely and the %Stocks indicators are mid-range and could support some upside.

XLV looks healthier (no pun intended) as price has pushed past all three of its EMAs. The RSI is positive and the PMO is nearing a crossover BUY signal.

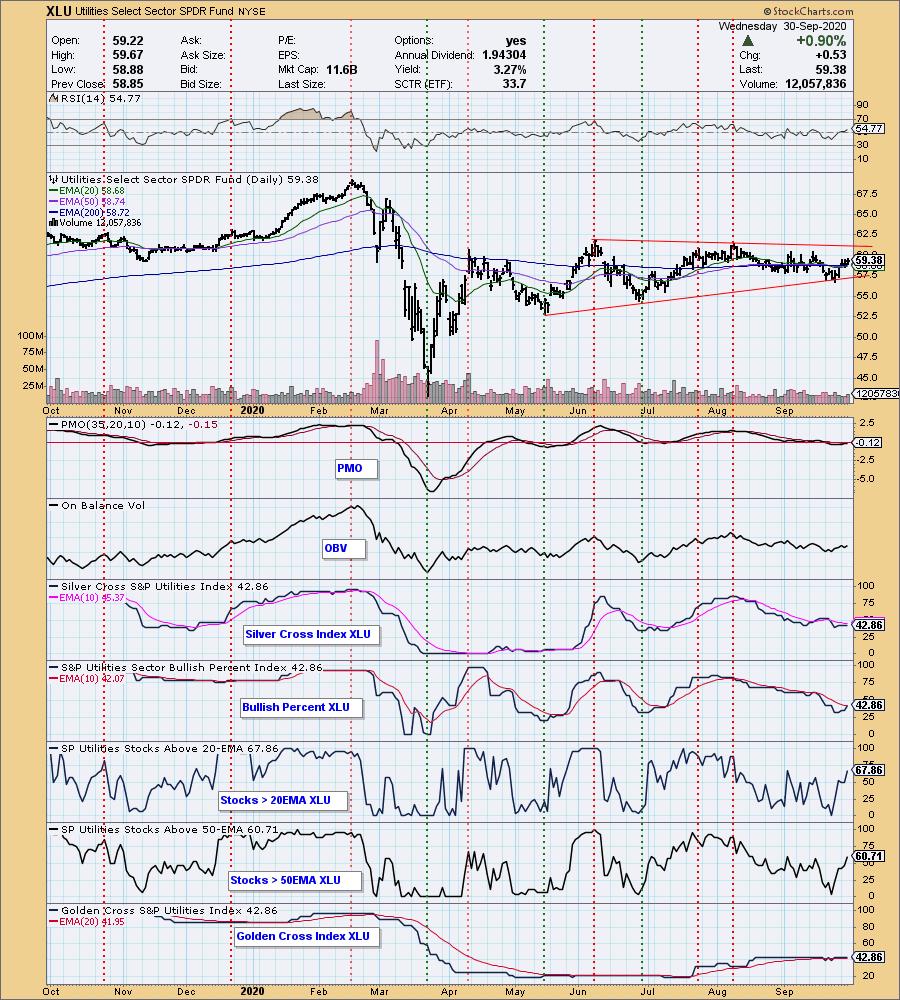

I wrote extensively about XLU yesterday so I'd direct you there. I was a day early as that IT Trend Model Neutral signal I was discussing disintegrated today on a big rally. The RSI is positive and the PMO is rising out of oversold territory.

Don't miss the October 5th free DP Trading Room! I will have guest Julius de Kempenaer from RRG Research. He will show us how he uses RRG to trade!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 9/28 trading room? Here is a link to the recording (password: FT&&l3#K). For best results, copy and paste the password to avoid typos.

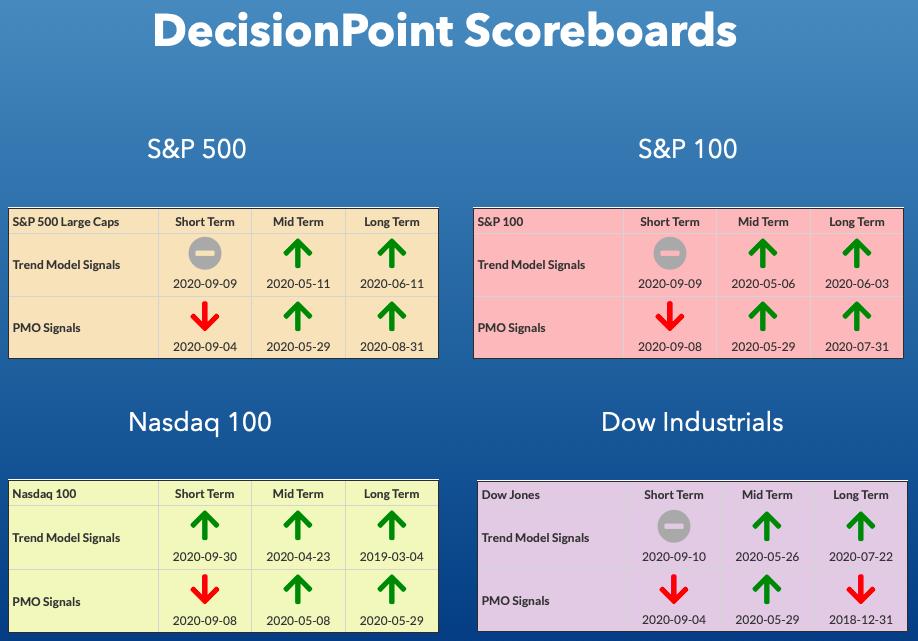

DP INDEX SCOREBOARDS:

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: Finally an actual breakout! The gap up now looks more like a breakaway gap instead of the doom and gloom of a reverse island (although technically that is still possible). The PMO is rising nicely and narrowly avoided negative territory. Volume was slightly lower, but certainly more confirming than anything we've seen so far.

Climactic Market Indicators: We didn't see climactic readings but do beware of the declining trend they have over the past week. The VIX remains above its EMA and that implies internal strength typically.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is OVERBOUGHT. Based upon the STO ranges, market bias is BULLISH.

Readings are looking overbought, but certainly not at extremes for these indicators. I do have to complain about the lack of movement on the %Stocks indicators. I do know it was a rocky trading day over all and that could be part of the problem there.

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

The BPI continues higher after its positive crossover yesterday. The SCI and GCI both turned up.

The intermediate-term market trend is DOWN and the condition is NEUTRAL. The market bias is NEUTRAL.

ITBM/ITVM still haven't reached positive territory, but they are on their way. We got the positive crossover on the %Stocks with crossover BUY signals indicator.

CONCLUSION: It was a rocky trading day but given the breakout above the February top and positively rising indicators, I'm looking for higher prices in the short term, but am staying alert given the overbought STOs.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Yesterday's comments still apply:

"The gap was covered last week and now we see a pullback. This sure looks like a bullish cup and handle. The PMO is rising and the RSI is positive and not overbought. We could see another day of lower prices, but the cup and handle along with the PMO and RSI tell me to expect higher prices soon."

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Nice rally in Gold today. It didn't quite put it above overhead resistance at the 2011 top and 20/50-EMAs. The RSI is rising and the PMO is turning back up so it may be time for a breakout. Discounts are increasing on PHYS and that generally is positive for Gold.

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: Miners are now back above short-term overhead resistance. They nearly triggered an IT Trend Model Neutral signal today. It will trigger tomorrow unless price can get above the 50-EMA. I like that price is now back in the previous trading range. We saw vast improvement on the %Stocks indicators and the PMO is turning up in oversold territory. It may be time for Gold and Miners to sparkle again.

CRUDE OIL (USO)

IT Trend Model: SELL as of 9/8/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Big decline for USO and Oil today. The RSI is falling in negative territory and the PMO has topped below its signal line which is especially bearish. Volume increased on the decline. I suspect we will need to test the $26 level. News suggests lower prices as oil production is increasing globally.

BONDS (TLT)

IT Trend Model: Neutral as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: We could be looking at an island here, but I wouldn't get too optimistic. The RSI is negative and the PMO has sharply turned down below the zero line which is especially bearish.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room that is part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)