It isn't surprising to see Technology leading the market higher, but what was surprising was to see Materials up 2.81% and Technology up 1.91% today. I decided to look at the Materials sector chart (XLB) and was surprised to see the indicators showing excellent participation across the sector with nearly 93% of components with price above the 20-EMA and 89% with price above the 50-EMA. The PMO has turned up and the RSI remains positive and not overbought. If I had to complain, I would say that I'd like the OBV tops to not be in a negative divergence with price tops. Interestingly, the only two Industry Groups within XLB that were negative for the day were Gold and Gold Mining and I have to say I still like both of those industry groups.

Here is the link to register for next Monday's (9/7/2020) free DecisionPoint Trading Room!

Here is the link to the recording from Monday (8/31/2020) where Erin looked at Apple (AAPL) & Tesla (TSLA) and took symbol requests. She introduced how to use the 5-minute bar chart to time your entries! Password to view recording: V#^P89Yv

DP INDEX SCOREBOARDS:

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

SECTORS

SIGNALS:

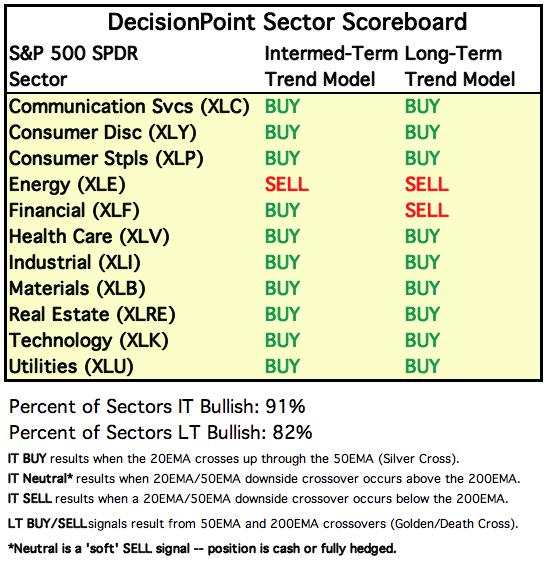

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: I decided to look at the 5-month candle chart rather than the one-year chart. Price has traveled past the top of the original rising wedge. The concern here to me would be the very overbought RSI. The PMO is flat and telling us very little except that it is overbought and that acceleration is flat. The VIX stayed below its moving average today and penetrated the bottom Bollinger Band again. A VIX like this is normally an indication that a rally pop is on the way. However, we already have a rally. It seems to me that market participants realize that the market can't keep moving higher. I don't see this as a rallying point, and yet...the market continues higher.

Climactic Market Indicators: We didn't see especially climactic numbers today, but at least they were on the positive side. New Highs expanded somewhat which is good.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL. Based upon the STO ranges, market bias is NEUTRAL. The STOs continued lower today. They have been fairly good and identifying market turning points so I'll continue to stay short-term bearish.

Intermediate-Term Market Indicators: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI shows the percentage of SPX stocks on Point & Figure BUY signals.

The SCI topped below its signal line. I find that especially bearish. The BPI also turned down. This all happened on a rally of nearly 1%. The negative divergence is telling us something.

The intermediate-term market trend is UP and the condition is NEUTRAL. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH.

The ITBM and ITVM are rising ever so slightly, but the PMO crossover BUY signals topped below the signal line.

CONCLUSION: Indicators are mostly bearish right now. We shouldn't be seeing PMO crossover BUY signals contracting and tops occurring on the SCI and BPI when the market rallies almost 1%. These negative divergences have me looking for a near-term decline.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Yesterday's comments still apply:

"Despite a recent PMO BUY signal and ascent, the Dollar has done nothing but edge lower. The RSI is negative (not oversold) and the PMO has topped. Next area of support is at the March intraday low. Until I see the declining trendline broken, I'll remain bearish on the Dollar (UUP)."

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Yesterday's comments still apply:

"Not much action on Gold. It looks like it is going to break to the upside out of the symmetrical triangle. That triangle is a continuation pattern, so the likely resolution is an upside breakout. The RSI has stayed in positive territory and the PMO has now decelerated its descent. I like Gold."

Full Disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: Miners are trying to breakout of their symmetrical triangle. The GDX PMO is beginning to rise. The RSI is positive. Unfortunately, we lost some participation today with %Stocks indicators tipping over. Good news is that the BPI had a positive crossover and the long-term indicators are still at 100% participation.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/13/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Yesterday's comments still apply:

"I've moved to a 4-month chart for USO because it is impossible to decipher price movement on the one-year daily (even on a log chart). At this point, price is in a bearish rising wedge. The good news is it is holding onto support at the 20/50-EMAs and we did get that IT Trend Model BUY signal this month."

BONDS (TLT)

IT Trend Model: Neutral as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: TLT made an attempt to recapture the rising bottoms trendline. It closed near its high so it could resume that rising trend soon. The PMO is turning up in oversold territory. The RSI is still negative but it is improving.

Full disclosure: I own TLT.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Get in on the new "DecisionPoint Diamond Mine" trading room as part of that subscription! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)