Coming to you from the southern rim of the Grand Canyon! The price action from June until now has been choppy and sideways. I suspect we will experience more of the same as overhead resistance at the gap from February has been holding strongly. The PMO has now turned down below its signal line and we have a negative divergence between the OBV and price. Given we are likely at the top of this trading channel (a cardinal high has not yet been established, I'm going by today's intraday high), I would look for another trip down to the bottom of the channel.

** Announcement **

I am traveling July 1 - July 15. I am writing on the road, but broadcasting will likely be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car to make our way back to California with various sightseeing stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America. A heads up to Bundle subscribers, the LIVE Trading Room is on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

DP INDEX SCOREBOARDS:

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

SECTORS

SIGNALS:

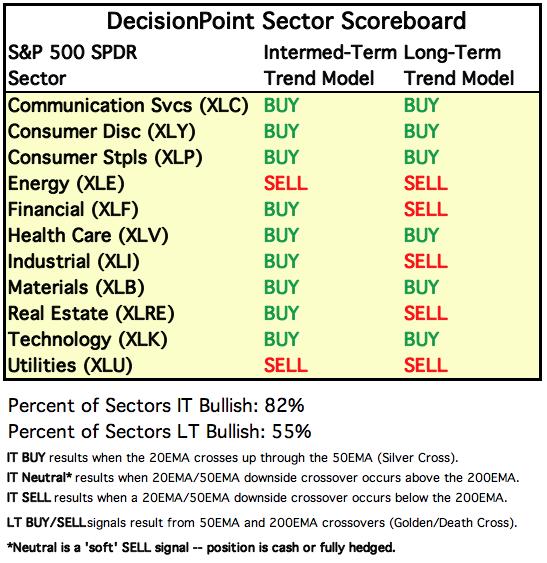

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: Gap resistance is very clear on this daily chart. For bulls out there, we could be forming a flag with this trading range. However it could take some time for it to develop as we travel in the trading channel.

Climactic Market Indicators: No climactic readings today, but I do note that the VIX has moved below its average on the inverted scale and that is short-term bearish.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL. Based upon the STO ranges, market bias is BULLISH. Yesterday's comments still apply:

With today's market action, we can now see negative divergences appearing.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) is decelerating but still traveling lower, and the Golden Cross Index (% of SPX stocks 50EMA > 200EMA) has topped. The BPI interestingly just had an upside crossover which could be considered bullish.

The intermediate-term market trend is UP and the condition is NEUTRAL. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH. PMO Crossover BUY signals are continuing to rise and improve, but both the ITBM and ITVM are in decline.

CONCLUSION: It appears that we have a new trading range developing. Indicators are neutral to bearish so I am looking for price to start making its way to the bottom of the range. Overhead resistance at the February gap is strong and I don't see the indicators being bullish enough to call for a breakout yet. In fact, we are starting to see short-term negative divergences popping up.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Friday the Dollar triggered a LT Trend Model SELL signal as the 50-EMA crossed below the 200-EMA. The PMO is still avoiding a crossover SELL signal, but it seems likely it won't be able to avoid it. The double-top isn't textbook as they are reversal patterns, but it looks pretty bearish to me. I've been waiting for a breakdown below support at $26 and I still think I'll get it.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold continues its rising trend. We were seeing premiums rising, but today we are back to having a discount so I'm not worried about sentiment right now. However, that decelerating PMO is a bit worrisome. For now the rising trend is intact and the PMO is rising so I suspect we could see higher prices. Although looking at the Gold Miners chart below the Gold chart, it's hard to get too bullish on Gold right now.

GOLD MINERS Golden and Silver Cross Indexes: Today's deep decline broke the short-term rising trend. The other indicators are beginning to deteriorate so I'll likely be selling my NEM stock.

CRUDE OIL ($WTIC)

The oil market is under severe pressure due to a lack of demand, and we do not believe that USO is an appropriate investment vehicle at this time. Until further notice we will use $WTIC to track the oil market. Since this is a continuous contract dataset, it doesn't "play well" with our Trend Models, and we will not report Trend Model signals for oil.

$WTIC Daily Chart: Price has been unable to break above $42. The 200-EMA is posing stout resistance. The RSI is trending lower now and the PMO has yet to turn up so I'm not expecting a breakout yet.

BONDS (TLT)

IT Trend Model: BUY as of 6/26/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds are remaining in a rising trend and the RSI is quite healthy. I would look for a challenge of overhead resistance around $170.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount AND get the LIVE Trading Room for free! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin's Travel Log (Friday - Sunday):

When last I left you we had just landed in Texas. We had an extensive travel day into Roswell NM. No offense to those from New Mexico, but it was definitely our least favorite spot. So hot, no trees to be found, poor cattle out on ranges with no shade...it was a bit depressing to be honest. Carlsbad Caverns was in the morning and we were glad we got there early enough to get in. They are restricted the amount of people who can go through. A benefit was that with fewer visitors, we had the Caverns almost to ourselves. We entered some of the rooms with no one near us. You could hear the water dripping from the ceilings into ponds and crevices. The pictures do not do it justice. We got into Roswell afterward and were pleasantly surprised at how cute it was. I managed to find a winery as I generally can sniff them out quickly. Pecos Flavor Winery in Roswell is a definite "must" for wine drinkers. I was pleasantly surprised at how good their wines were! Unfortunately the museums were closed so I'm going to come up again later with my daughter who is a follower of ancient alien myths. The people were very friendly and welcoming. I loved how they embraced their alien heritage with various alien touches on Main St. At breakfast before leaving Roswell, the owner bought us our breakfast because he overhead that my husband is a 22-year veteran from the Navy. What a surprise and so heartwarming.

We left Roswell and headed to Meteor Crater. I remember it as a kid and it was every bit as impressive as it was then. Unfortunately it was really buggy so we didn't spend much time there at all. We had a long trip to get to Grand Canyon Village anyway. The difference between New Mexico and Arizona was stark. The mesas became more plentiful and then we started to see all of the pines. We arrived at the adorable Bright Angel Lodge on the southern rim. We are sad we couldn't get a rim view cabin, but we are steps away from the view. We ate dinner overlooking the Canyon and then went out to take sunset pictures. Again, pictures do not do justice to how spectacular and magnificent the Grand Canyon is. Simply stunning and literally breathtaking. Tonight we have a sunset jeep tour to find the most picturesque spots at sunset. Tomorrow we take a 40-minute plane ride across the canyon before we head out on the long drive back home to Southern California. This trip has been an adventure of a lifetime and it is so crazy that this is all in OUR country! If you haven't done southern tour like this, I highly recommend it. It's not that expensive and it is like traveling to different countries as you move across the states. We are already planning our next trip Northward to see Zion, Bryce Canyon and Arches National Parks. Now I need to finish writing so I don't miss my sunset Jeep tour! Enjoy the photos:

Pecos Flavor Winery:

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)