The PMO crossed above its signal line on both the SPY and SPX. The SPX chart is below. At this point I'm going with a bullish ascending triangle pattern. The bulls are working hard to push price above gap resistance with no luck so far. However, based on what I'm seeing on the indicators, I think an upside breakout is possible.

DP INDEX SCOREBOARDS:

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

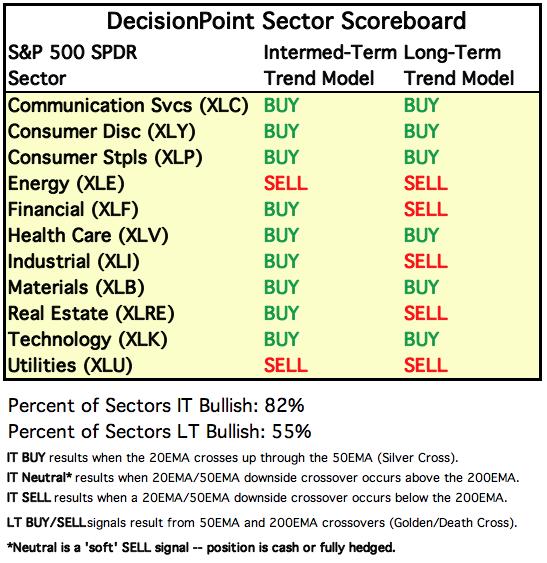

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: The rising wedge is outlined. I am prepared to see an upside breakout. The Nasdaq has already blown away its previous all-time high from February. Volume did come in today on this near 1% gain. The OBV logged that gain and basically killed the negative divergence that had set up between declining OBV tops and rising price tops.

Climactic Market Indicators: More climactic positive readings appeared today. It be a buying exhaustion or a continuation of the buying initiation from yesterday. With the new PMO BUY signal and VIX rising but not overbought on the inverted scale, I suspect it is not an exhaustion.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL. Based upon the STO ranges, market bias is BULLISH. The STOs moved higher again today and are not overbought. The negative divergence never really played out so I do think we are still somewhat vulnerable. The vast improvement on the %Stocks indicators supports higher prices.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and Golden Cross Index (% of SPX stocks 50EMA > 200EMA) continue higher which is bullish. The BPI rose significantly after a positive crossover yesterday. That's bullish for the IT.

The intermediate-term market trend is UP and the condition is SOMEWHAT OVERBOUGHT. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH. PMO Crossover BUY signals are continuing to rise and improve and that is now joined by rising ITBM/ITVM. Everything looks good on these indicators, although they are beginning to get overbought.

CONCLUSION: More bullish action from our indicators in all time frames has me bullish going into tomorrow and the end of the week. I suspect price will make a push into the gap resistance area soon. Whether it can completely overcome that resistance, I think the jury is still out.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Price broke below the $26 support level that I've been watching closely. Today low was beneath the June low. The PMO turned over well below the zero line and it triggered a SELL signal today as it finally crossed below its signal line. The RSI is negative and not oversold yet. I am looking for the Dollar to continue lower.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold is maintaining its rising trend. The PMO has flattened but not turned lower. The RSI is in positive territory and we are still seeing some discounts. I believe Gold will go higher.

GOLD MINERS Golden and Silver Cross Indexes: Miners didn't quite get above the rising trendline. It is however maintaining easily above the 20-EMA. I believe you could make a case for a bullish flag that has been put on top of the previous flag (red). Overall the indicators remain healthy which tells us that the majority of Gold Miners in GDX are configured very bullishly. I'm holding NEM.

CRUDE OIL ($WTIC)

The oil market is under severe pressure due to a lack of demand, and we do not believe that USO is an appropriate investment vehicle at this time. Until further notice we will use $WTIC to track the oil market. Since this is a continuous contract dataset, it doesn't "play well" with our Trend Models, and we will not report Trend Model signals for oil.

$WTIC Daily Chart: Yesterday's comments still apply:

"Price has been unable to break above $42. The 200-EMA is posing stout resistance. The RSI is trending lower now and the PMO has yet to turn up so I'm not expecting a breakout yet."

BONDS (TLT)

IT Trend Model: BUY as of 6/26/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Yesterday's comments still apply:

"Bonds are remaining in a rising trend and the RSI is quite healthy. I would look for a challenge of overhead resistance around $170."

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount AND get the LIVE Trading Room for free! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin's Travel Log (Monday - Tuesday):

A friend of mine told me to not be sad the trip is over, be glad that you went! I agree wholeheartedly! When last I left you on Sunday, we had just arrived at the Grand Canyon and had experienced our first sunset. For Monday night, we scheduled a sunset jeep tour. We very much enjoyed seeing three other viewpoints of the canyon that we hadn't experienced yet. The sunset was beautiful off the mesa. The sun slowly dipped below the horizon and the canyon turned even more beautiful. There were a few viewpoints that had me nervous at their distance to the edge, but I managed and am here to talk about it. While on our jeep tour we saw wild horses, elks, squirrels and ravens.

When we got ready to get in the car to leave, there were two elk munching in the vacant lot next to our parking spot. They were right there...so close. We also saw a young buck munching grass on the side of the busy road. We found that all of the wild life there were very tame and used to people being around.

The next morning we took a plane ride above the Canyon. It really put into perspective the size and scope of it. We also were able to view the rivers in between. From most of the vista points, you couldn't see the rivers. After finishing the plane flight we got back on the road to return to California. The desert was a hot moon scape. I believe it was 117 degrees at the rest area we stopped at before we reached Needles. To each his own, I missed the lush green of Alabama. Of course, sitting on our patio in Redlands, CA last night, we marveled at the cool air and zero humidity and realized why many want to retire right where we are. We have now set our sights on Lake Martin or other nearby lakes in Alabama as our retirement area. We could have a lake house, boat house and boat for cheaper than our house here in Southern Cal. Plus it would have acreage and more square feet than we have now. Not sure when we will retire there yet, but it is comforting to know it is waiting for us when we are. We are healthy and at home self-quarantining for a week or so to make sure we don't have symptoms for COVID. We were vigilant in our safety despite so many others who were not. We kept our distance from those who weren't protecting themselves. I was heartened to see nearly everyone walking around the canyon wearing masks along with sanitizing stations if needed. I do have to call out New Mexico, Louisiana, Texas and Florida where the masking was very lax. In some cases it was truly shocking how strangers were getting so close to each other with zero protection. Neither John nor I have fevers or symptoms so we are feeling confident. Here are some photos from our jeep tour and plane flight. I have so many more photos, but I won't bore you all!

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)