Today saw very climactic negative readings on the Net Advances-Declines and Net Advancing Volume-Declining Volume. I like to evaluate these when they arrive as either an initiation or exhaustion. Carl and I discussed this in our recording of the DecisionPoint Show this afternoon (link to be sent to subscribers soon!) and came to an interesting conclusion.

Yesterday's PMO BUY signal on the NDX did not survive today's volatile decline. Despite that, the NDX remains well within a strongly rising trend channel. Strong support is certainly available at the February top.

** Announcement **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will likely be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car to make our way back to California with various sightseeing stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America. A heads up to Bundle subscribers, the LIVE Trading Room is on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

DP INDEX SCOREBOARDS:

TODAY'S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

SECTORS

SIGNALS:

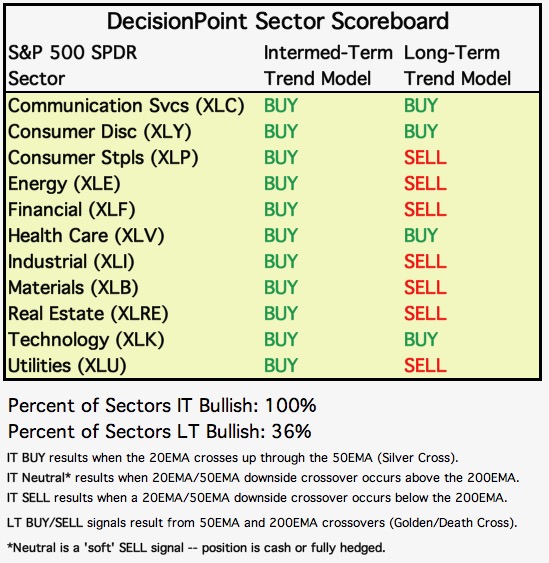

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: Let's start with the intraday chart. Price had been oscillating within a trading range for the past week. Today the decline that began at the end of trading yesterday continued with gusto on a gap down. Price did attempt to recover and brought the PMO back above its signal line. However, I don't like the reverse flag. I also wouldn't get too excited about the PMO BUY signal given the negative RSI alignment. Support is available at around 2970.

What I found particularly interesting on the one-year daily chart is that despite today's 2.5%+ decline, price is holding the rising trendline. Carl and I discussed the strength of support during the show. We have long-term support along the 2019 tops, intermediate-term support along the April/May double-top, shorter-term support at the 50-EMA and finally, 200-EMA support. If price breaks all of those support levels, I would expect plenty of pain to follow.

Climactic Market Indicators: Very high climactic negative readings on Net A-D and Net A-D Volume. This is accompanied by a VIX that is nearing the lower Bollinger Band on the inverted scale. A VIX staying below its average suggests internal weakness. So these climactic readings arrived on high volume while the VIX is nearing the bottom Bollinger Band. Strong support is near as I noted above. Carl and I are leaning to this being a selling exhaustion. That would mean we likely will remain in the rising trend. However, remember, these are generally very very short-term indicators, so a selling exhaustion could manifest with a rally pop in the morning followed by a fizzle in the afternoon. Mainly, it suggests to me that support should hold over the next day or two.

Short-Term Market Indicators: The short-term market trend is BEARISH and the condition is OVERSOLD. Based upon the STO ranges since the March price low, market bias is NEUTRAL. What stands out to me here are the oversold readings. I note that location and readings for all of these indicators are in near-term oversold lows. I think this supports the idea of a selling exhaustion.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (% of SPX stocks 50EMA > 200EMA) are falling. The SCI has now had a negative crossover. Historically, with only a few exceptions, this isn't good for the market. I also notice a BPI that has topped again below its signal line.

The intermediate-term market trend is UP and the condition is NEUTRAL. With most of the ITBM/ITVM readings since the end of April being above the zero lines, the market bias is BULLISH. The ITBM/ITVM are in declining trends and remain above zero. %PMO Xover BUY Signals has reached very oversold territory which could also support a selling exhaustion.

CONCLUSION: Climatic indicators and oversold indicators with a bullish bias suggests that we are seeing a selling exhaustion not initiation. Price managed to hold the rising trend and is coming upon multiple levels of support. I'm looking for a rally pop Thursday or Friday. Whether that "pop" will have staying power and mark a significant reversal isn't quite clear.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: The PMO BUY signal was reengaged after a whipsaw sell signal yesterday. Turns out yesterday's price bar was an island reversal. The 20-EMA has been a problem for price to overcome since it crossed below back in late May. Given the positive PMO and rising RSI and what could be a bullish double-bottom forming, I am looking for a test of overhead resistance at the September/October top.

GOLD

IT Trend Model: BUY as of 3/24/2020

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold pulled back today but I don't see any major price deterioration. The PMO is on a BUY signal and discounts remain on PHYS, I'm bullish on Gold.

GOLD MINERS Golden and Silver Cross Indexes: Miners pulled back today and could be forming a reverse island. Given the strength of the indicators I am expecting this group to resume the rally out of the bullish flag formation. Currently all of the GDX stocks have 20-EMAs above 50-EMAs. That's overbought but we know that overbought conditions can persist. I'll be keeping an eye on the RSI and 20/50-EMAs.

CRUDE OIL ($WTIC)

The oil market is under severe pressure due to a lack of demand, and we do not believe that USO is an appropriate investment vehicle at this time. Until further notice we will use $WTIC to track the oil market. Since this is a continuous contract dataset, it doesn't "play well" with our Trend Models, and we will not report Trend Model signals for oil.

$WTIC Daily Chart: Finally the decline that the PMO has been warning about has arrived. The 20-EMA held as support, but the RSI is dropping quickly alongside the PMO, I still expect a breakdown. Today's drop also could be forming a bearish double-top.

BONDS (TLT)

IT Trend Model: Neutral as of 6/5/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The PMO is telling me we should see an end to the current declining trend. In the thumbnail you can see that price action has formed a symmetrical triangle. It formed after the rally from the June low so the expectation should be an upside breakout.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount AND get the LIVE Trading Room for free! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)