On Thursday, while the business channels were showing crude trading below 18.00, the closing quote for WTIC (West Texas Intermediate Crude Oil - Continuous Contract) was up almost +30% at 25.53. Confusing, right? The reason is that the business channels were reporting the front contract, which is May, but $WTIC started tracking the June contract, which costs more than the May contract. Sometimes the change is less jarring, sometimes it's not. This is why I use USO to track oil -- it shows an actual portfolio of futures contracts with the contract rollover slippage built in.

Here is a snapshot of futures contracts from MarketWatch.com that I took this morning. Notice how the the price of a contract increases the farther out it is, basically a reflection of time value. I claim no expertise in futures, so my terminology may be wrong, but you get the idea. Continuous contract quotes can be choppy, and are best used for general orientation. For chart analysis for trading you would want to chart the actual contract or the ETF.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

GLOBAL MARKETS

BROAD MARKET INDEXES

SECTORS

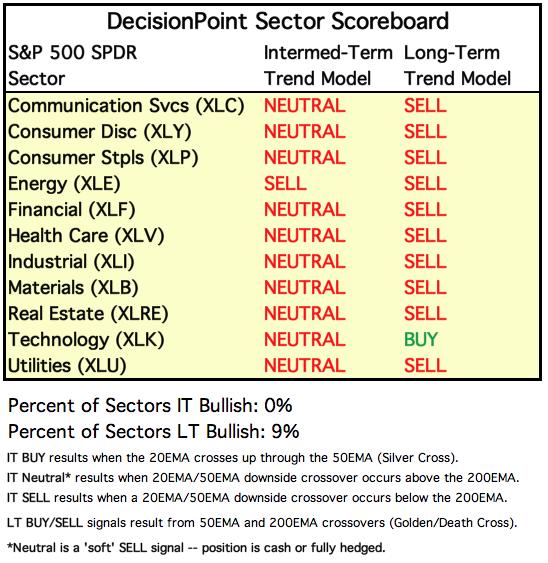

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

ETF TRACKER: This is a list of about 100 ETFs intended to track a wide range of U.S. market indexes, sectors, global indexes, interest rates, currencies, and commodities. StockCharts.com subscribers can acquire it in the DecisionPoint Trend and Condition ChartPack.

Top 10 . . .

. . . and bottom 10:

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: SELL as of 3/19/2020

SPY Daily Chart: This was an options expiration week, so today's SPX Total Volume could include some of that activity; however, it is not end-of-quarter, and any volume spike should be attributed mostly to normal trading. That said, volume did expand today, confirming the new rally high. The rising wedge remains intact, so a downside resolution should still be expected.

The one-year daily chart shows that price is deep into the resistance zone. In this scale we can see how steep the rally is. If the rising wedge resolves upward, that would be bullish. But then we'd have to acknowledge that the rally was becoming parabolic, and that would ultimately be bearish.

SPY Weekly Chart: In spite of the raucous rally, the weekly PMO has a rather flat bottom, and it is at the bottom of the bull market range for this indicator. At the 2009 market lows, the weekly PMO was around a -10, so we haven't seen anything near bear market readings here yet.

Climactic Market Indicators: There were a few climactic readings on Friday. Upside exhaustion?

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL to OVERBOUGHT, depending on which short-term indicators below we look at. The problem here is that, while price has been moving higher, two of the indicators have drifted lower, indicating that internal support of the price advance is being undermined. This is a strong indication that we're about to see a decline in this time frame.

Intermediate-Term Market Indicators: We can see recent Bullish Percent Index deterioration similar to what we saw on the short-term chart above. The Silver/Golden Cross Indexes have been beaten down so far they are slow to recover.

The intermediate-term market trend is UP and the condition is NEUTRAL in terms of indicators being near the zero line, but considering the distance they have traveled up from their recent lows, they could be considered overbought. The boxed area shows what a bull market initiation thrust looks like. Currently, those indicators have a good start on repeating such a pattern. We shall see.

CONCLUSION: Thursday was a down day, but after the close President Trump announced the plan to re-open the country, and the futures went ballistic. Still, it is inconceivable to me that the market will be able to continue to rally to all-time highs in the face of an economy that's been torn to shreds, and with there being no certainty regarding when/how we will get past COVID-19. Of course, the market has just demonstrated that there is a big difference between what I can conceive of, and what the market will actually do. The market frequently suffers from cognitive dissonance. But there is no way to ignore the fact that the fundamentals behind this market are a wreck.

The intermediate-term technicals are not that bad, but the short-term indicators are calling for a top and pullback. We've been watching a rising wedge formation. and they most often resolve downward, even in bull markets. Assuming we get that short-term decline, it could have a domino effect, getting intermediate-term indicators turning down, and so on. I expect next week to be a down week.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

DOLLAR (UUP)

IT Trend Model: BUY as of 3/13/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: The wide price swings in March reflect currency confusion as COVID-19 burst onto the scene.

UUP Weekly Chart: Price seems to have settled back into the two-year rising trend channel.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Dollar volatility bled into gold prices in March. The rising trend line from the March low is very steep, and it was broken today. I'll be looking for the pullback to continue in order to set a less accelerated rising trend.

GOLD Weekly Chart: It hasn't been an easy ascent, but gold has rallied +70% from the 2015 bear market low.

GOLD MINERS Golden and Silver Cross Indexes: Price is at overhead resistance, and the Bullish Percent Index is at the top of its range, so gold miners are vulnerable for a pullback.

CRUDE OIL (USO)

IT Trend Model: NEUTRAL as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Crude oil is still under pressure due to very low demand.

USO Weekly Chart: Current support for USO is about 4.00, which is the same as 19.20 for crude (WTIC).

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The daily PMO is close to topping below the signal line, which is bearish.

TLT Weekly Chart: The weekly PMO is very overbought, but it is still rising at a good clip, so internals are still strong in this time frame.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Carl

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)