There is a basic concept about price movement that most novice investors do not understand. If the price falls 35%, that does NOT mean it only needs to rise 35% to get you back to where you were. Your cost-basis is different at the low. It will take you a 55% gain to get back up there. Greg Schnell talked about this is in his last article. I posted my chart below to Twitter, Facebook and LinkedIn. Teach this! Inform anyone who asks you about investing in this market. In today's DecisionPoint Show Carl and I both agreed that is difficult to envision a 55% rally right now. In fact, we will likely have to suck up more decline and thus need an even larger percentage gain to reach all-time highs.

SPECIAL ANNOUNCEMENT: Erin Swenlin will be joining Mary Ellen McGonagle in a LIVE trading room event this week or next. Details are being ironed out. We will notify all of our subscribers for this FREE event!

CURRENT BROAD MARKET DP Signals:

Below are the Scoreboard index charts. I've also included IJH, the S&P400 ETF which also received a PMO BUY signal.

TODAY'S Broad Market Action:

Past WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

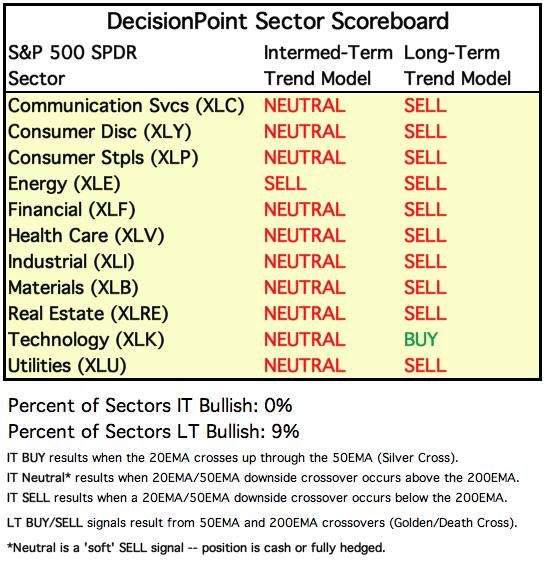

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: SELL as of 3/19/2020

SPY Daily Chart: We are at a very important resistance area right now. On the shorter-term chart below, we see that the descending wedge resolved as expected to the up side. The amount of that gain has now fulfilled the pattern's upside target (typically the target is calculated with the length of the back of the pattern). This gives us yet another resistance issue. The 20-EMA has been reached and not surpassed..more resistance. We are also now up against the declining tops trendline which is also resistance. Are we through?

No. There is a strong zone of resistance AND price is up against Fibonacci retracement resistance as well. Another issue would be the volume contraction on this rally.

Climactic Market Indicators: Readings are somewhat climactic, but not anything I can read. The VIX closed above its 20-EMA on the inverted scale which would normally be a short-term bullish flag. Even if the VIX got to the upper Bollinger Band, that would still give us a VIX > 30 which is still very high.

Short-Term Market Indicators: The ST trend is UP and the market condition is OVERBOUGHT based upon the Swenlin Trading Oscillator (STO) readings. Overbought conditions in a bear market tell us to expect a decline. The STOs are overbought, and %PMO Rising is EXTREMELY overbought. This isn't good for the short term.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) are declining. No change in the SCI as it approaches zero. The GCI is very oversold. It does appear to be decelerating which is good for the longer term.

The IT trend is DOWN and the market condition is EXTREMELY OVERSOLD based upon all of the readings on the indicators below. I like the positive crossovers on the ITBM and ITVM. We want to watch for the SCI to get on board. It lags behind slightly. Additionally, we should look for a powerful upward thrust like we saw out of the 2018 low if we have truly put in a bear market low.

CONCLUSION: The ST is UP and IT trend is DOWN. Market condition based on ST indicators is OVERBOUGHT and based on IT indicators is OVERSOLD. Overhead resistance right now is intense. With volume contracting on this rally, I am not confident that we will see a breakout here. ST indicators suggest a decline soon. My sense is that this rally is out of steam.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 3/9/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Price is holding support at the 2019 high but given the configuration of the PMO, I don't expect it to hold up.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: We have a textbook bull flag on Gold. Full disclosure, I own GLD. The PMO BUY signal looks good and we can see premiums on PHYS continue which tells us there is bullish sentiment. I was asked recently about bullish sentiment on Gold and why it isn't contrarian. It is contrarian, but only when it moves to extremes. For now it shows us investors in PHYS don't mind paying a small premium to own it and that is bullish.

GOLD MINERS Golden and Silver Cross Indexes: The Silver Cross Index is at oversold lows, the Golden Cross Index is only in neutral territory. At this point $23 is holding. With Gold looking bullish, Miners may get a bit of a tailwind. Unfortunately they will be subject to the headwind of the rest of the market.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Support was broken. The symmetrical triangle resolved to the downside as expected. Notice on USO that volume has been increasing on the decline. That doesn't bode well.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The "V" bottom on TLT has retraced more than 50%, that suggests to me that we could see a move to test the top of the parabolic. The PMO is overbought, but I suspect it will be able to stretch higher.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

If there is a Money Show in May, I will be there! Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)