I had an email this week asking me why I hadn't updated the Long-Term PMO signals to SELLs. The monthly charts have had the negative crossover nearly all month. However, our signals don't go "final" until the finish of the last trading day of the month. Well, here we are. All three have joined the Dow with LT PMO SELL signals. I have included the monthly charts beneath the Scoreboard. You'll note that I have annotated cardinal tops. The LT PMO is very helpful in notifying us of long-term tops. Last year, I had expected the SELL signals to precede a bear market. It did precede the December dives, but it almost immediately switched directions and gave us BUY signals again. I don't see that happening this time around. These signals don't happen often, but when they do, they generally precede bear markets.

SPECIAL ANNOUNCEMENT: Erin Swenlin will be joining Mary Ellen McGonagle in a LIVE trading room event Thursday 9:00a EST. Details are being ironed out. I will send all of our subscribers the link Wednesday night or sooner. The first few events will be free as we work through the initial setup and after that we will offer it as a discounted 'add-on' service to our subscribers.

TODAY'S Broad Market Action:

Past WEEK Results:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

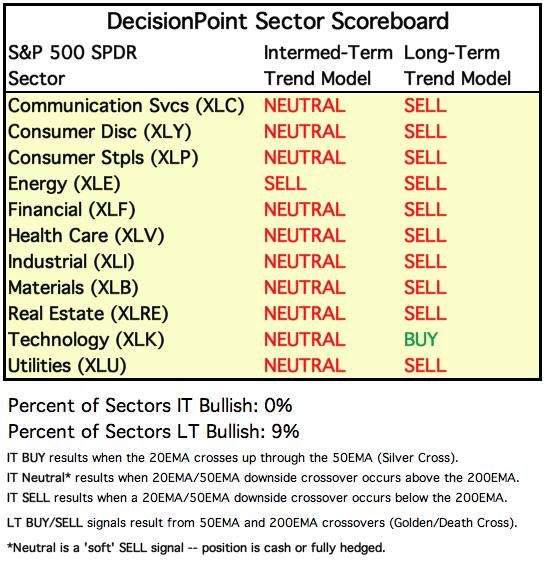

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

One WEEK Results:

STOCKS

IT Trend Model: NEUTRAL as of 2/28/2020

LT Trend Model: SELL as of 3/19/2020

SPY Daily Chart: The SPY struggled with overhead resistance as I suspected. This area of resistance matches up with the June low, last week's high, 20-EMA and a Fibonacci retracement level (not annotated for the sake of simplicity). We did get a PMO BUY signal yesterday, but the OBV is rather lackluster. I also note that we did see an increase in total volume...on a decline.

Climactic Market Indicators: Readings on Advances-Declines are somewhat climactic. The interesting notes on this chart would be a VIX contracting, now above its 20-EMA on the inverse scale. However, I also see that A-D positive breadth is on the decline. In a rally, I pay attention to declining tops. In a decline, I pay attention to rising bottoms. That is where the action is. Right now seeing that decline, it tells me we are still in trouble in the shorter-term.

Short-Term Market Indicators: The ST trend is UP and the market condition is OVERBOUGHT based upon the Swenlin Trading Oscillator (STO) readings. We see a tick lower on all of these indicators. They are overbought and I don't like seeing a top of any kind right now. The %PMOs rising is still very overbought.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) is steady and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) is still declining. I believe it is a good sign to see deceleration on the GCI, but I am not getting overly excited until I see it actually bottom in oversold territory.

The IT trend is DOWN and the market condition is EXTREMELY OVERSOLD based upon all of the readings on the indicators below. I like the positive crossovers on the ITBM and ITVM. We are seeing a nice thrust upward similar to the move out of the 2018 low. It certainly could suggest a market bottom here, but I need to see more of the same from these indicators over the next week. I am currently not of the opinion that we have hit the market bottom.

CONCLUSION: The ST is UP and IT trend is DOWN. Market condition based on ST indicators is OVERBOUGHT and based on IT indicators is OVERSOLD. Many have talked about the "pent up" consumerism that we will experience as soon as the virus lets up and the world begins to open again. While I believe there will be pent up demand, I have a problem with the unemployment situation. The Fed suggested we could see 30% unemployment. That's about one-third of the country. Carl and I talked about his parents behavior after the depression. Up until they passed (God bless them), they were unbelievable savers of EVERYTHING, not just money. Even if we see employment pick back up, the scars that will have been left by this disaster will be indelible most people's psyches. They won't be as loose with their spending, vacations, businesses, etc. I've even seen posts from my friends about how they have retrained their minds to save moving forward...not just money, but toilet paper squares, water, clothes, shoes, food... We have more challenges ahead.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 3/9/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: There was a new PMO SELL signal triggered today on UUP. So far support at the October top is holding up, but the PMO suggests a breakdown.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Well, the flag didn't execute and the symmetrical triangle or pennant resolved to the downside. Price dipped below the 20-EMA. We saw very high discounts on PHYS. This is can be bearish for Gold. I am still looking at as an example of demand for Gold, but it appears we may have to retest the September top first. Full disclosure: I own GLD.

GOLD MINERS Golden and Silver Cross Indexes: The Silver Cross Index is at oversold lows, the Golden Cross Index is only in neutral territory. $23 support barely held today. The close at $23.04 was the low for the day. This could be a good entry point, but I don't like the way the Golden Cross Index is falling away.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Oil continues to struggle with selling really not letting up. I don't see a reversal, I suspect more chop and possibly even lower prices based on volume and the PMO direction. When demand does pick up, many of us will be racing to get in. I personally can't wait ;-)

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Yesterday's comments still apply. "The "V" bottom on TLT has retraced more than 50%, that suggests to me that we could see a move to test the top of the parabolic. The PMO is overbought, but I suspect it will be able to stretch higher."

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

The May Money Show has been tentatively moved to August. We don't have the dates yet. Erin Swenlin will still be presenting at the The MoneyShow Las Vegas August 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be an online conference in May, stay tuned for details.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)