The Price Momentum Oscillator (PMO) crossed above its signal line on both the SPY and Dow Industrials (INDU). The PMO on the Dow is not yet overbought, but there is a longer-term bearish rising wedge that is problematic. In the 4-month candle chart of the SPY below, you'll note we had higher volume than yesterday, but not above average. The other news for the day is that we did see some climactic readings on our very short-term indicators that could mean a short-term exhaustion ahead.

TODAY'S Broad Market Action:

Top 10 from ETF Tracker:

Bottom 10 from ETF Tracker:

On Friday, the DecisionPoint Alert Weekly Wrap presents an assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

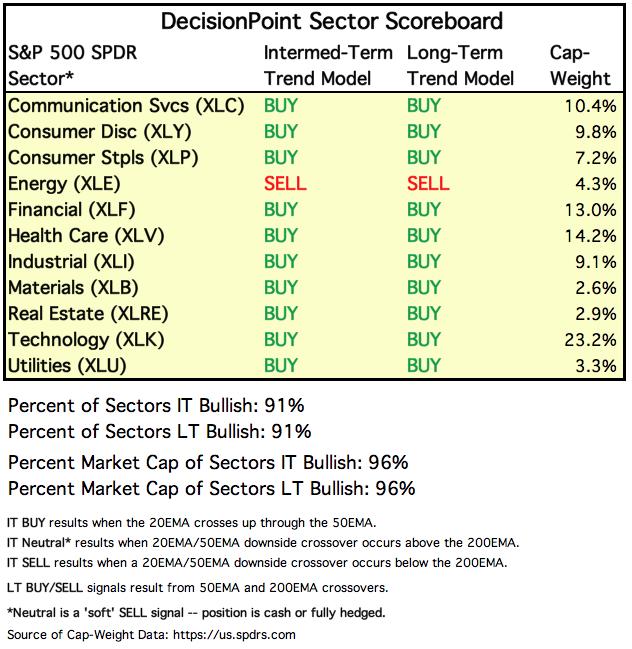

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

STOCKS

IT Trend Model: BUY as of 9/6/2019

LT Trend Model: BUY as of 2/26/2019

SPY Daily Chart: Another breakout day and new all-time highs for the market. The PMO triggered the BUY signal suggesting we should see the rising trend continue.

Climactic Market Indicators: While not super climactic and "spiky" , we did see an expansion of New Highs to a climactic level and Net A-D was elevated. The VIX is still sitting in the middle of the Bollinger Bands in Neutral territory. I see the possibility of a buying exhaustion. I'm not looking for a big decline, just a few days moving into the end of the week.

Short-Term Market Indicators: The ST trend is UP and the market condition is MODERATELLY OVERBOUGHT. (Carl and I are adding this statement to the Short-Term and Intermediate-Term Indicator sections in addition to the Conclusion.) I was really disappointed when I saw this chart. I liked that we were seeing a continuation rally, but then to see the STOs turning down...no! The negative divergence with %Stock > 20/50-EMAs still are sporting negative divergences with price tops.

Intermediate-Term Market Indicators: The Silver Cross Index (% of SPX stocks 20EMA > 50EMA) and the Golden Cross Index (percent of SPX stocks 50EMA > 200EMA) were also disappointing today. The SCI fell and the GCI was flat.

The IT trend is UP and the market condition is NEUTRAL based upon the ITBM and ITVM readings, and SOMEWHAT OVERBOUGHT based upon the PMO and Silver Cross/Golden Cross Indexes. I like the ITBM and ITVM right now. They are rising and have had positive crossovers their signal lines today in concert with the PMO. The intermediate term looks rosier than short term.

CONCLUSION: The ST and IT trend are UP. Market condition based on ST and IT indicators is NEUTRAL to MODERATELY OVERBOUGHT. In the very short term, going into Thursday or Friday, I'm looking for a decline--not a deep decline based on ST indicators turning down and a few climactic positive readings that could mean an exhaustion on the way.

(Not a Diamonds subscriber? Add it to your DP Alert subscription and get a discount! Contact support@decisionpoint.com for your limited time coupon code!)

DOLLAR (UUP)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Despite declining, UUP is holding onto support at previous overhead resistance. The PMO is getting overbought though. Best case I would look at sideways consolidation along this new support area. Worst case a corrective move back toward the 20-EMA. Set a stop if you own it and want to preserve profit.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: I noticed a symmetrical triangle on Gold. This is a continuation pattern and suggests an upside breakout. Gold sentiment is very bullish and that could be a problem, but if the Dollar pulls back or corrects, Gold will benefit.

GOLD MINERS Golden and Silver Cross Indexes: The handle on this pattern is now a symmetrical triangle and means we should see an upside breakout. The Silver Cross Index isn't on board with that scenario just yet and I'd like to see price stay above the 20-EMA.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 1/27/2020

LT Trend Model: BUY as of 12/16/2019

USO Daily Chart: Will it hold here or not? It very well could as this is a strong support level. However, I wouldn't take the chance until at least the PMO turns up. I still see $9.25 as a viable downside target and will need convincing price action and momentum before I would bottom fish here.

BONDS (TLT)

IT Trend Model: BUY as of 1/22/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: TLT failed to reach its previous top and now could be forming a bearish double-top. There is also a reverse island pattern forming off Friday's gap up. The PMO isn't overbought but it is struggling to find a direction. Might be time for a pullback to the 20-EMA.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

d