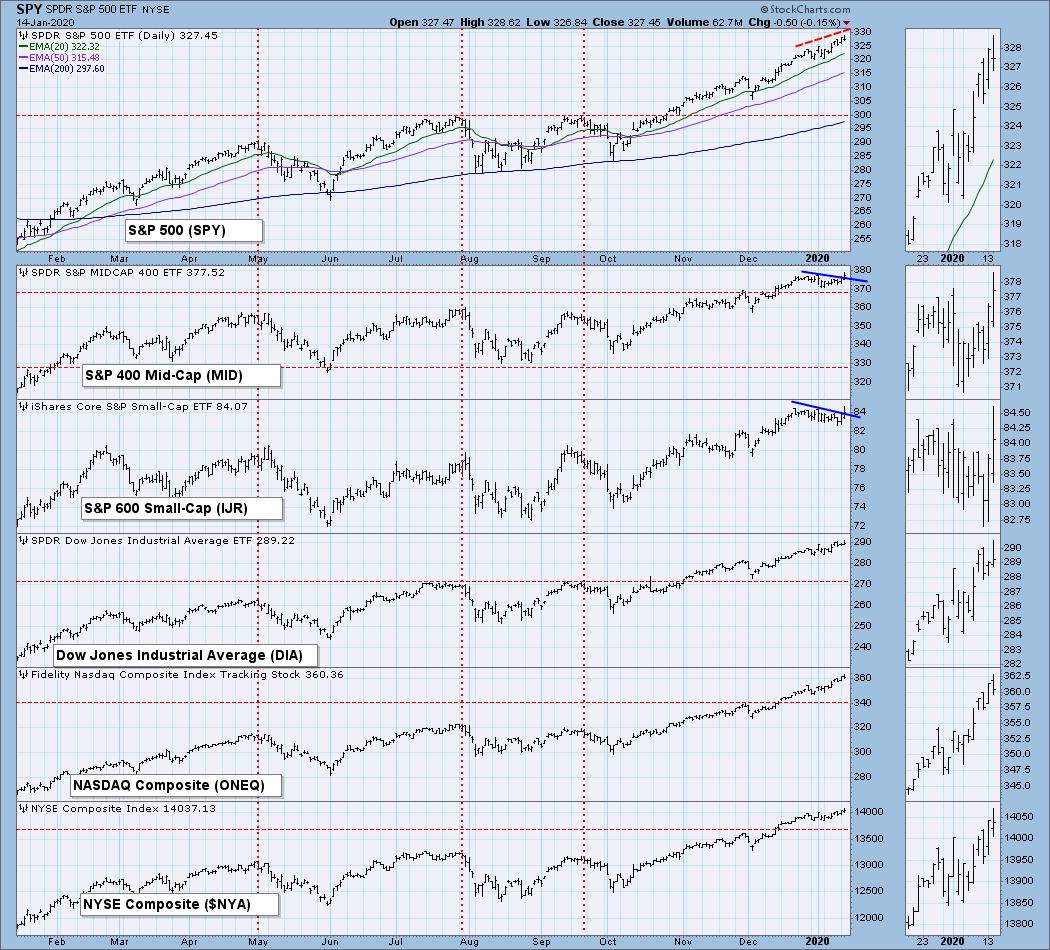

As I took a look at my chart books and the market summary report above, I noted that the SP600 has been outperforming of late. I know I've preached it over and over, but bull markets are sustained when the small and mid-cap stocks get on board a rally. Today we saw a breakout on both the SP400 (IJH) and SP600 (IJR). I'm trying decipher whether this is a case of 'too little too late' or 'better late than never'. While new intraday all-time highs were logged, I would really like to find price closing at all-time highs before I can dismiss the 'too little too late' response.

TODAY'S Action:

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. Monday through Thursday the DecisionPoint Alert daily report is abbreviated and covers changes for the day.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

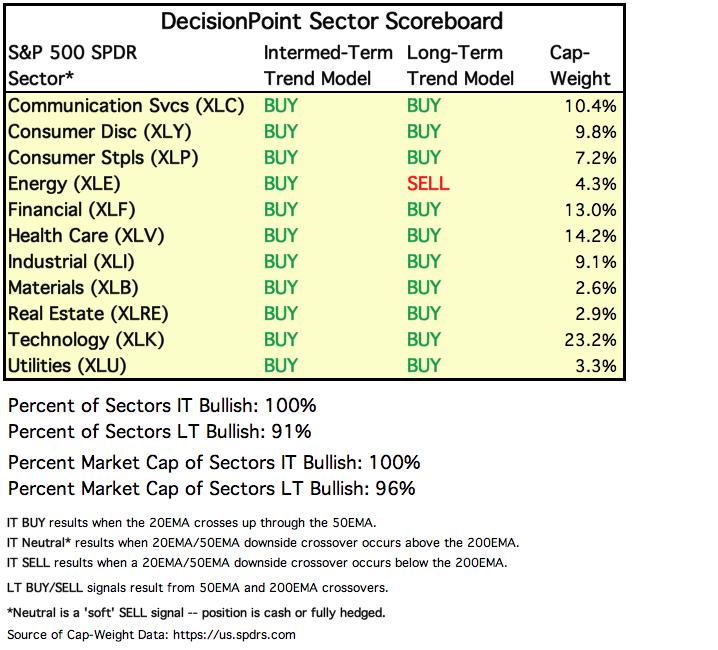

SECTORS

SIGNALS:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

TODAY'S RESULTS:

STOCKS

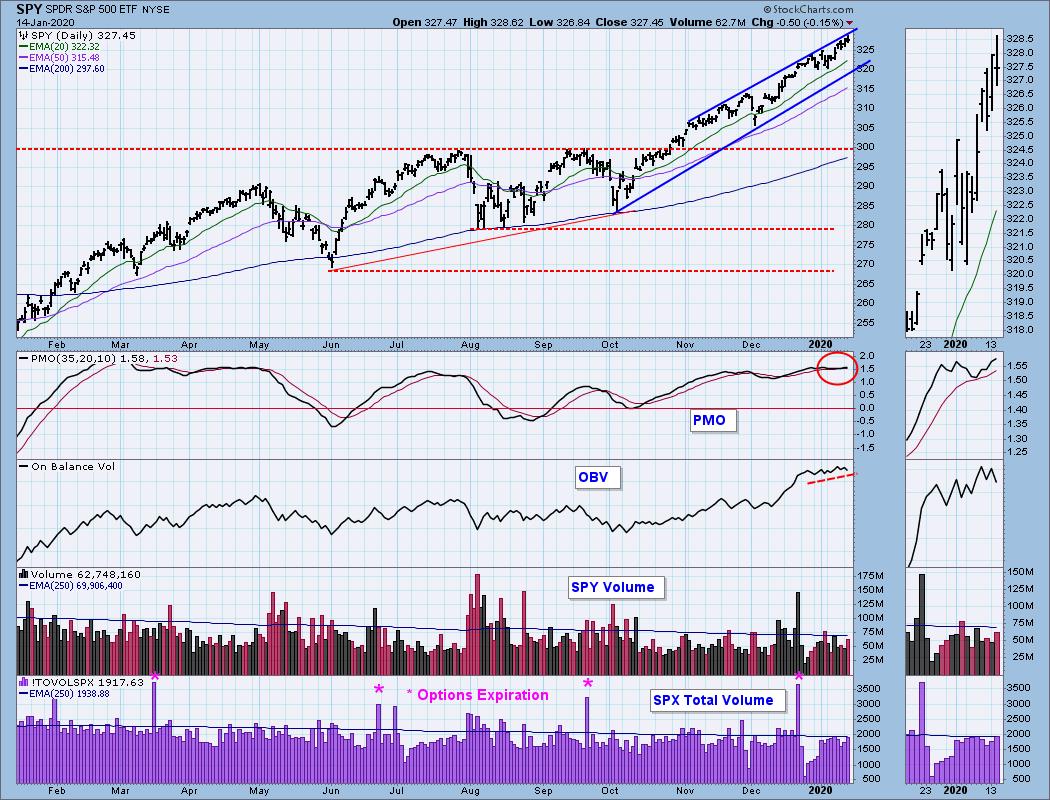

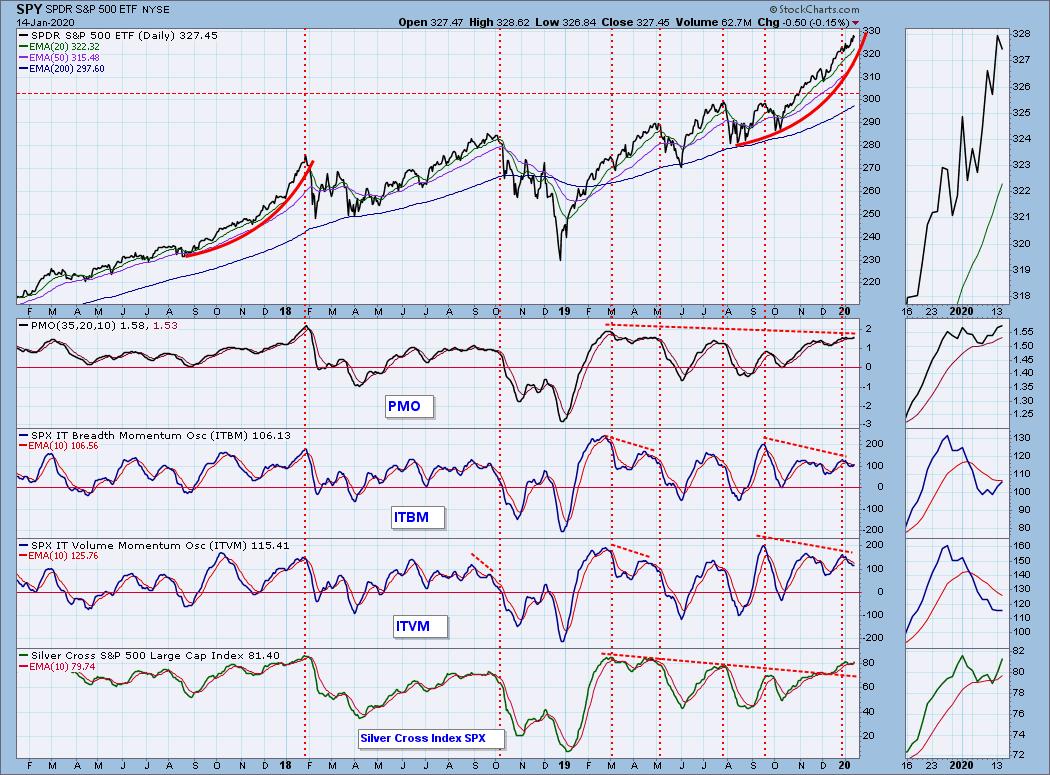

IT Trend Model: BUY as of 9/6/2019

LT Trend Model: BUY as of 2/26/2019

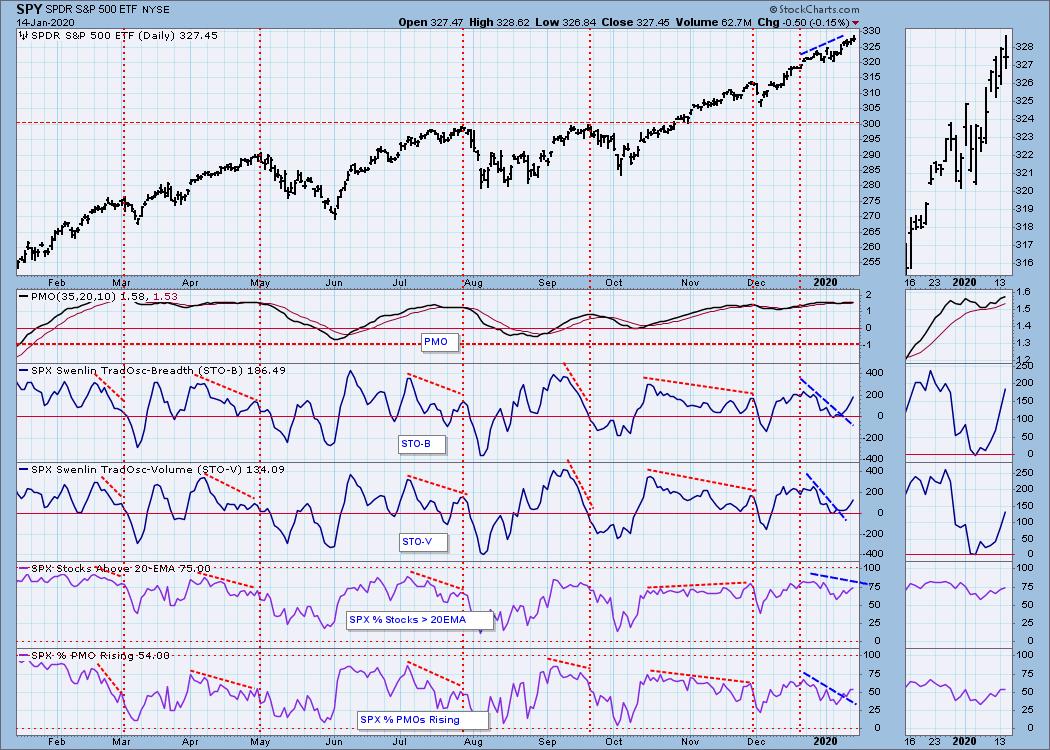

SPY Daily Chart: The PMO narrowly avoided a SELL signal and is hesitating on its rise, but it is rising and has surpassed the previous top. The OBV is a mixed message to me. On the one hand we do see rising bottoms, but on the other hand in the very short term, the last two tops define a declining tops trendline while price tops have continued to move higher. The rising wedge is still in play, but with price staying well above the 20-EMA and new intraday highs being revealed each day, I'm not looking for it to break down just yet.

Climactic Market Indicators: Volume was respectable today, but on a decline, probably would want to see less. New Highs are staying around 60 which suggests strength short-term. Other than that no climactic readings. I continue to be concerned about the VIX squeeze. I've highlighted what I think is a similar situation to what we have now and it is concerning.

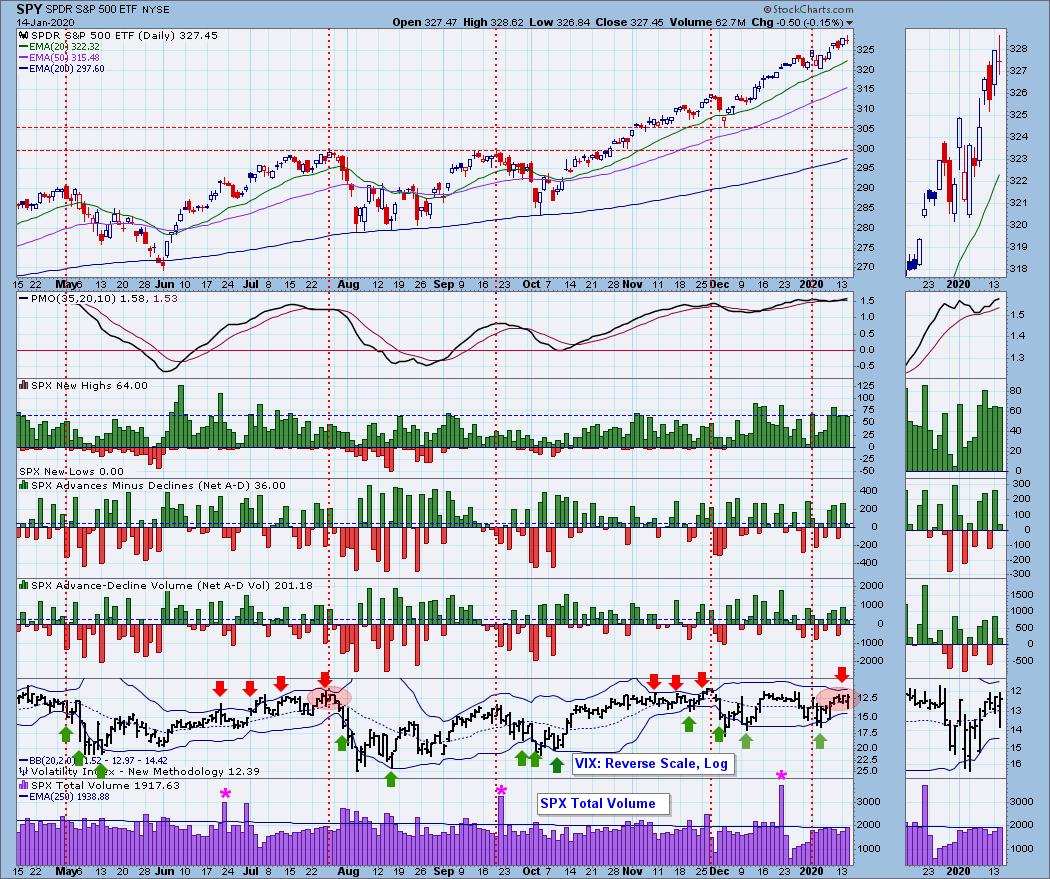

Short-Term Market Indicators: I like what I'm seeing on the STOs. They are continuing to rise since breaking their declining trend. This is good news for the short term. %PMO rising is improving and has broken its declining trend, but Stocks Above 20-EMA is still showing a negative divergence.

Intermediate-Term Market Indicators: SCI and GCI continue to rise. This tells us that participation is expanding.

The ITVM could look better but it has stopped its descent. I hope to see positive crossovers on these indicators this week. For now, they are showing improvement.

CONCLUSION: It's hard to argue with rising short-term indicators, improving intermediate-term indicators and the rally in small-caps. These are all bullish signs and certainly suggest rising prices or a consolidation instead of correction. The intermediate-term indicators still have room to improve and I'd like to see the %stocks above their 20-EMA get out of the current negative divergence before getting overly bullish.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 12/11/2019

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: The bullish falling wedge is still in play. Price is consolidating sideways, but the PMO continues to rise strongly. This could be the time for the pattern to execute with a breakout. I'm watching the 20/50-EMAs for a new IT Trend Model BUY signal.

GOLD

IT Trend Model: BUY as of 12/26/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold is pulling back more and I suspect it will go down and test 1525. The PMO has turned lower, but on a pullback this is of course natural. The 20-EMA and 1525 area will be telling. I would still give Gold the benefit of the doubt that it could hold the 50-EMA. The rally from the November lows was parabolic and a quick and deep correction was warranted. Now we watch to see when it will be ripe to rally again. Discounts are low and that isn't particular bullish for Gold.

GOLD MINERS Golden and Silver Cross Indexes: I was looking at the price pattern here and you could make a case for a cup and handle on GDX, although that is some 'handle' on that decline. Given the deep decline, it actually is somewhat encouraging to see 84 and 88 readings for the SCI and GCI respectively. The look of those indicators doesn't inspire confidence that GDX is ready to turn it around. They are affected by what is happening in Gold and may have to wait until Gold is finished pulling back before a good rally can begin.

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/6/2019

LT Trend Model: BUY as of 12/16/2019

USO Daily Chart: I had expected the rising trend on USO to fail today, but it managed to stay just above to keep it intact. Given the PMO, I still don't expect it to hold.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 12/12/2019

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: The falling wedge on TLT remains in play. I am expecting a breakout here given the PMO and the fact that the previous lows didn't have to test the bottom of the pattern. The 20/50-EMA positive crossover has yet to occur and take us out of Neutral on the IT Trend Model. Price will have to breakout and maintain above the 20/50-EMAs.

**Don't miss any of the DecisionPoint commentaries! Go to the "Notify Me" box toward the end of this blog page to be notified as soon as they are published.**

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links (Can Be Found on DecisionPoint.com Links Page):

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)