I've decided that, on Thursdays, I will take a look at some reader-requested "diamonds." With that in mind, I'm challenging my readers to find their own "diamonds in the rough" and send the symbol to me. I will pick five winners to analyze using DecisionPoint analysis techniques. Today, I was able to gather all five diamonds from the Diamond PMO Scan. While they aren't perfect, I think there are some interesting possibilities here.

I love to get your feedback on DP commentary and on Thursdays I will look at reader requested symbols, so shoot me an email at erinh@stockcharts.com. I read every one of them and try to answer them all! Your insight helps me to tailor my commentary to what my readers and viewers want to hear about.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Current Market Outlook:

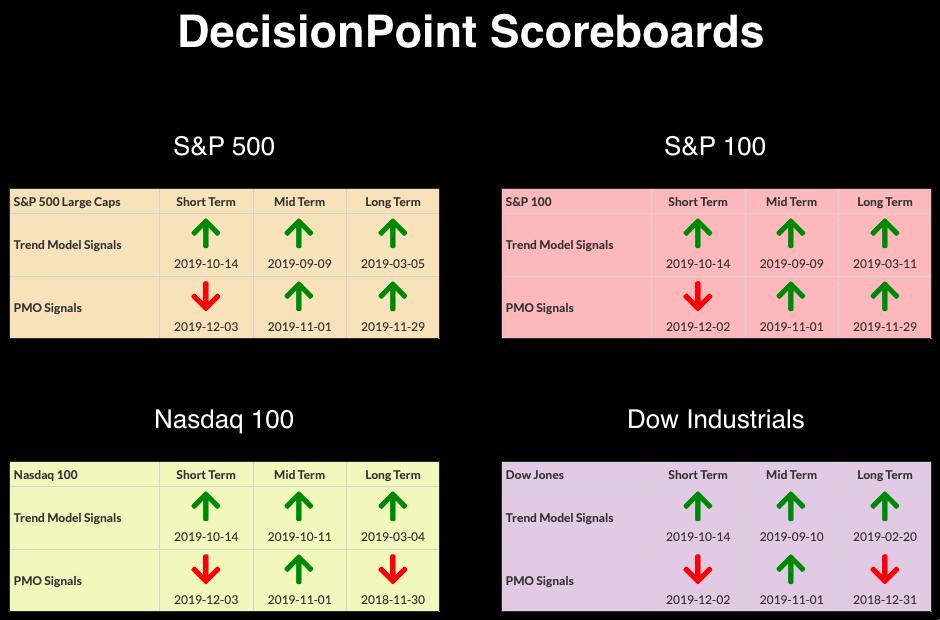

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and momentum is failing in the short term. Caution is warranted.

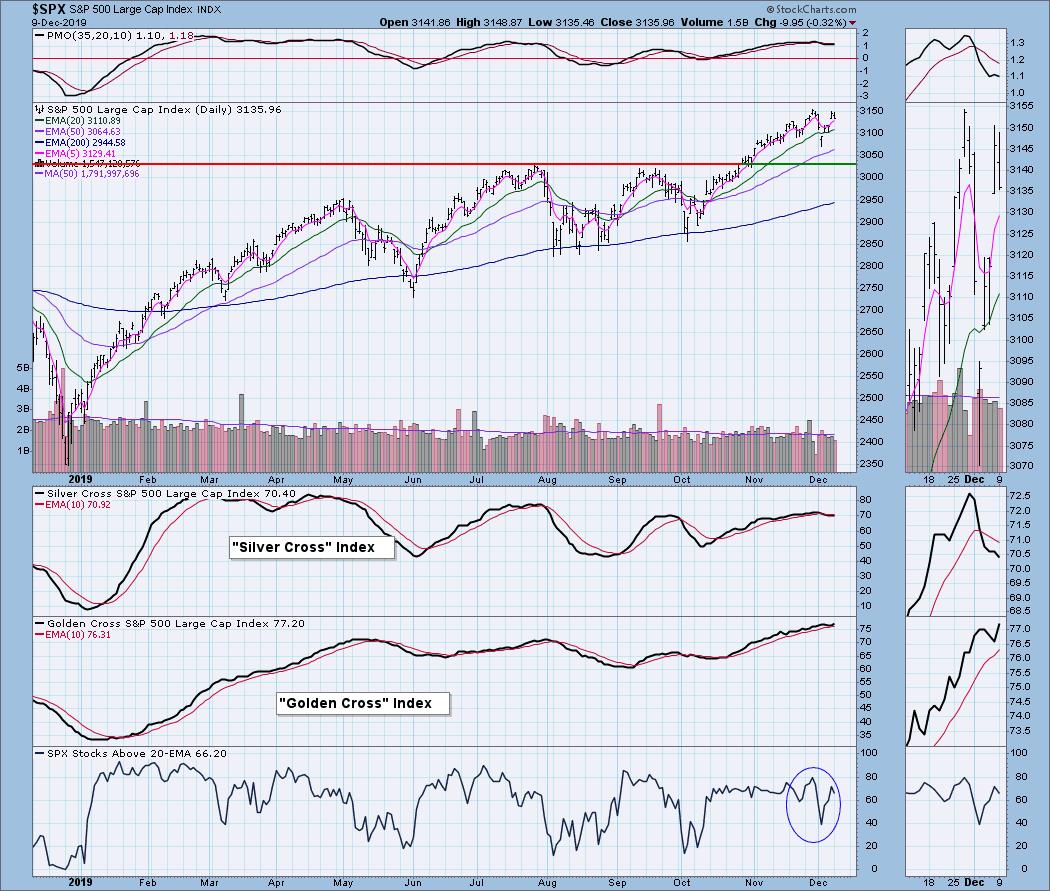

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 17

- Diamond Dog Scan Results: 13

- Diamond Bull/Bear Ratio: 1.31

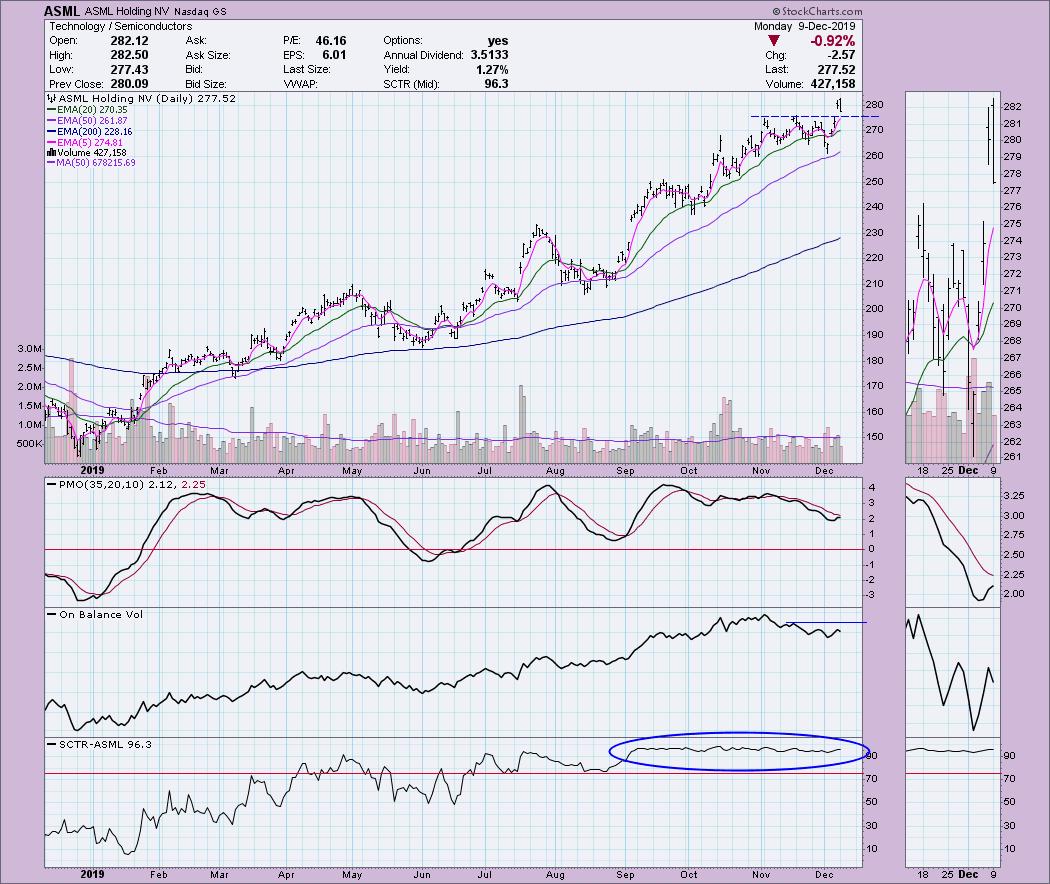

ASML Holding N.V. (ASML) - Earnings: N/A

ASML broke out last Friday, and today price was thrown back to the breakout area. It nearly closed the gap that formed on Friday. I like these types of breakouts and a follow on pull back. The PMO is rising and the SCTR has looked good for months. If I had to pick something I'm not thrilled with, it would be the OBV. I like to see an OBV break out when price breaks out. You'll note that it hasn't reached the volume levels it did on those previous two price tops that I've connected. On the bright side, today's pullback came on lower volume.

The weekly chart shows a rising PMO, but it is getting on the overbought side. The angle of ascent is steeper, which leaves the intermediate-term picture a bit murky. This is probably a better short-term investment than longer-term. I would want to watch this one closely.

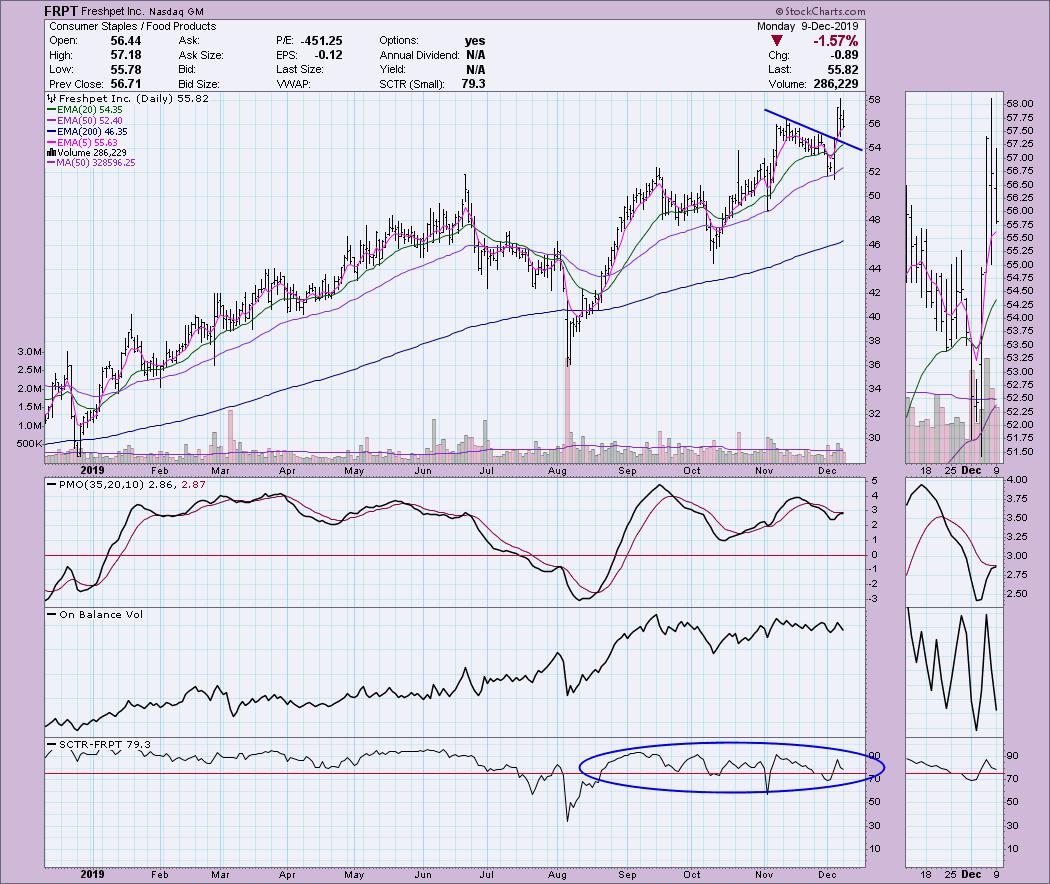

Freshpet Inc (FRPT) - Earnings: 11/4/2019

Here, we have another breakout and pullback. The PMO is about to trigger a crossover BUY signal. OBV is rather flat; it did confirm the decline. We are seeing rising tops in the thumbnail. SCTR has been lingering in and out of the hot zone above 75 for months.

I really like the PMO on the weekly chart. It is rising following a crossover BUY signal and is not overbought. Price has increased its ascent, which does make it somewhat vulnerable in the intermediate term.

LATAM Airlines Group S.A. (LTM) - Earnings: N/A

LTM broke out last week and is continuing to rise nicely. I note that it just received a Short-Term Trend Model BUY signal as the 5-EMA just crossed above the 20-EMA. Note the curve in the PMO as it gears up for a nice clean crossover with very little twitch. The OBV shows rising bottoms and is making its way back up the the October high. The SCTR just hit the hot zone above 75. Upside target is $12.10.

Two bullish formations on the weekly chart. In the shorter term, we have a bull flag; in the longer-term, a double-bottom. The PMO had been decelerating, but it is rising again. If the double-top executes with a move above our target on the daily chart, the minimum upside target would put it at that 2018 top.

M/I Homes Inc (MHO) - Earnings: 2/3 - 2/7/2020

On Friday, MHO broke out of a symmetrical triangle. This is what we expected, as it is a continuation pattern, meaning price should continue in the same direction it was going before the pattern formed. The PMO has turned up and is making its way toward a crossover. Rising bottoms on the OBV confirm the move higher. Again, we have an OBV reverse divergence, as the October top is higher than the current OBV top, yet this price top is above the previous October high. I will forgive that given the strong SCTR and price breakout.

The weekly PMO is overbought, but we have seen it rise much higher in 2013. This is a somewhat parabolic price move, which always worries me. It will likely continue higher, but a trailing stop may be in order to protect you from the expected parabolic breakdown that usually occurs with these patterns. Those breakdowns are fast and furious, so protect yourself.

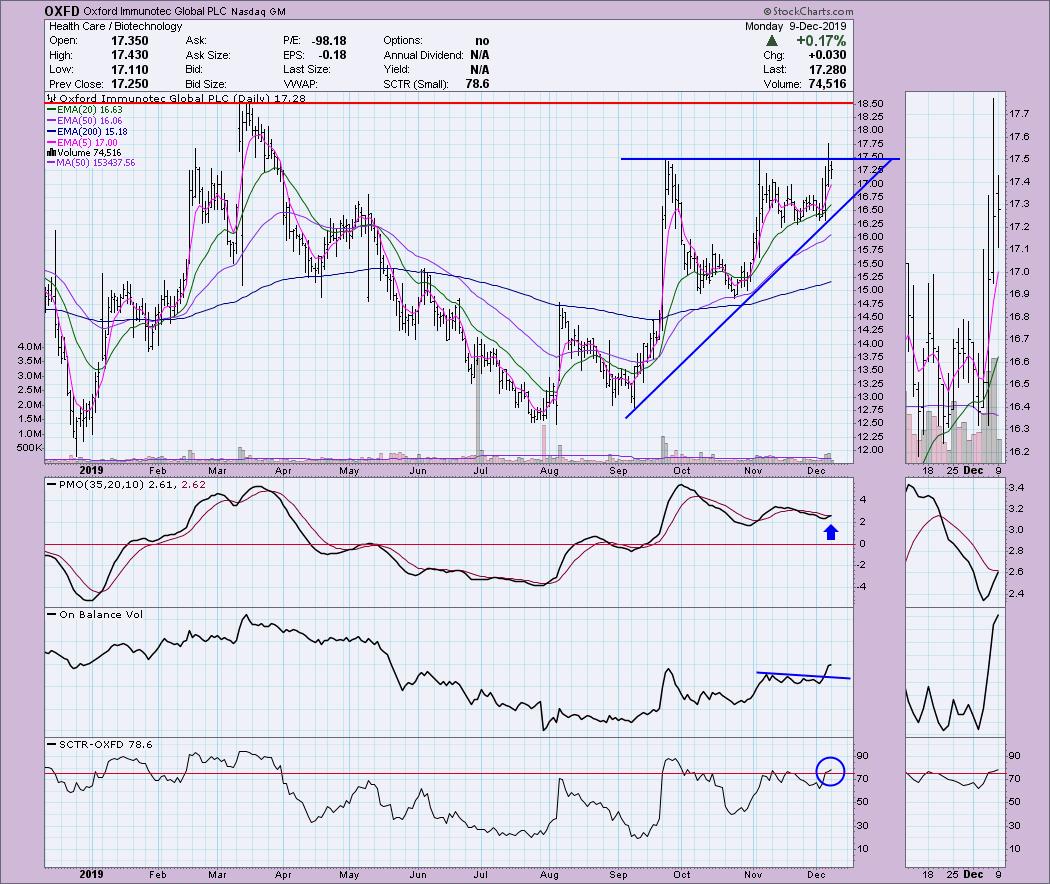

Oxford Immunotec Global PLC (OXFD) - Earnings: 11/5/2019

The ascending triangle pattern took some time to execute, but it did on Friday. Price dropped back below today. The PMO looks healthy and the OBV breakout is excellent. The SCTR has just reached the hot zone above 75.

A very long-term ascending triangle is on the weekly chart, which is exciting to me. However, we could still see a failed test at overhead resistance. Based on the daily chart, a short-term investment should bring you up to that level. The PMO is very healthy and not overbought.

Full Disclosure: I do not own any of the stocks presented. I remain in 80% cash.

Market Vision 2020 - Sign Up for Details

I will be presenting at the "Market Vision 2020" online conference on January 4th! It is sponsored by EarningsBeats.com and promises to be "THE" event to start the new year. We will have many of the commentators that you love presenting their "market view" for 2020, with John Murphy as the keynote speaker! For information on the event, sign up for the free emails, which will give you all the details as we get closer!

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**d