It was a spooky Halloween WealthWise Women show today and, as part of the program, we played "Trick or Treat?" with securities. One of the agreed upon "treats" was Merck (MRK), which came up in my scan today as well as hitting Mary Ellen McGonagle's radar. I like the others as well. It was a "dead" day with a lack of scan results on the Diamond scan, so I pulled these from my Bullish EMA - Mid-Range SCTR scan. I remain cautious on the broad markets. It must be said that, if the overall market is precarious or possibly ready to chop around rather than trend higher, finding diamonds that will follow through is challenging. We'll see if these "diamonds in the rough" are up to the challenge.

I love to get your feedback on DP commentary, so shoot me an email at erinh@stockcharts.com. I read every one of them!

Welcome to "DecisionPoint Daily Diamonds," a newsletter in which I highlight five "diamonds in the rough" taken from the results of one of my DecisionPoint scans. Remember, these are not recommendations to buy or sell, but simply stocks that I found interesting. The objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Current Market Outlook:

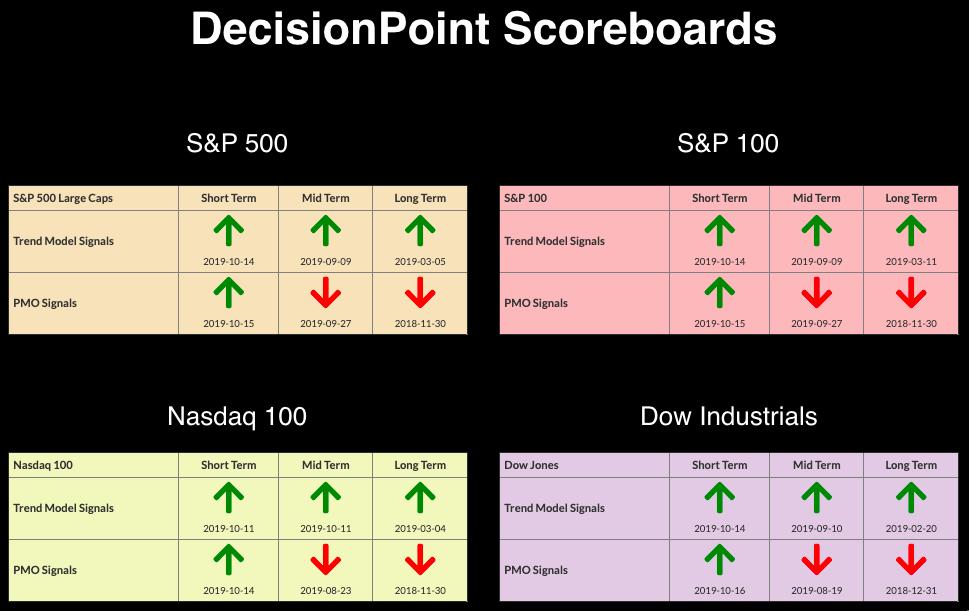

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

Market Condition: The market is overbought and we have Price Momentum Oscillator (PMO) BUY signals on the DP Scoreboards. Caution is still warranted as volume, breadth and DP indicators are not confirming these new all-time highs (see today's DP Mid-Week Alert).

Market Environment: It is important to consider the odds for success. Here are the current percentages on the Silver and Golden Cross Indexes:

- Silver Cross Index: 66.0% SPX IT Trend Model Buy Signals (20-EMA > 50-EMA)

- Golden Cross Index: 70.0% SPX LT Trend Model Buy Signals (50-EMA > 200-EMA)

Diamond Index:

- Diamond Scan Results: 5

- Diamond Dog Scan Results: 43

- Diamond Bull/Bear Ratio: 0.12

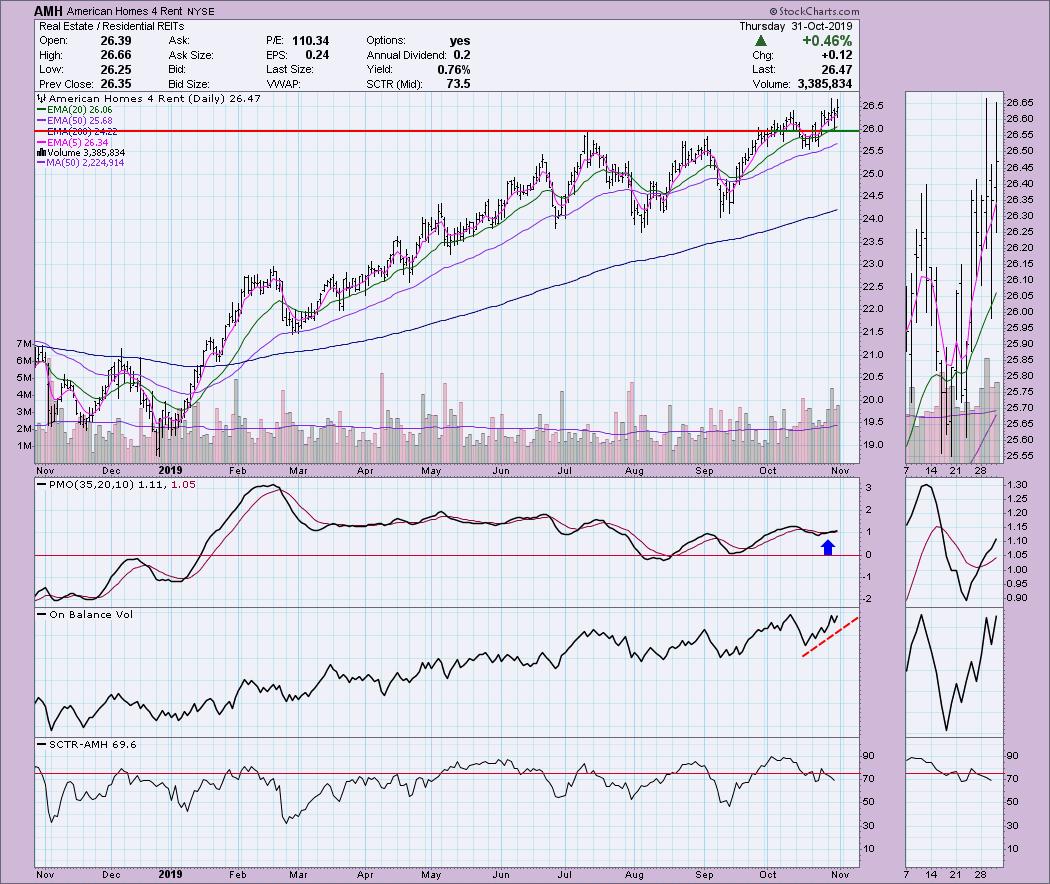

American Homes 4 Rent (AMH) - Earnings: 11/7/2019

AMH had a false breakout in early October, but it found support along the 50-EMA and bounced. The PMO has now given us a crossover BUY signal and the OBV is confirming this rally. REITs have been one of the strongest sectors in 2019 and I suspect that will continue. Yes, the SCTR is declining, but it is still in respectable territory.

This week's breakout is looking good as it remains above support at the July top. The weekly PMO just had a crossover BUY signal.

BWX Technologies Inc (BWXT) - Earnings: 11/14/2019

BWXT managed to avoid a negative 20/50-EMA crossover and is now comfortably above both as it continues to move higher from the October low. Positive volume is coming in now and its SCTR is in the "hot zone" above 75. Upside potential is a tasty treat for this Halloween. The PMO is now above zero after generating a crossover BUY signal.

The weekly PMO was in decline, but it has quickly recovered and is bottoming above the signal line. It is far from being overbought. Upside potential on the weekly chart is $70.

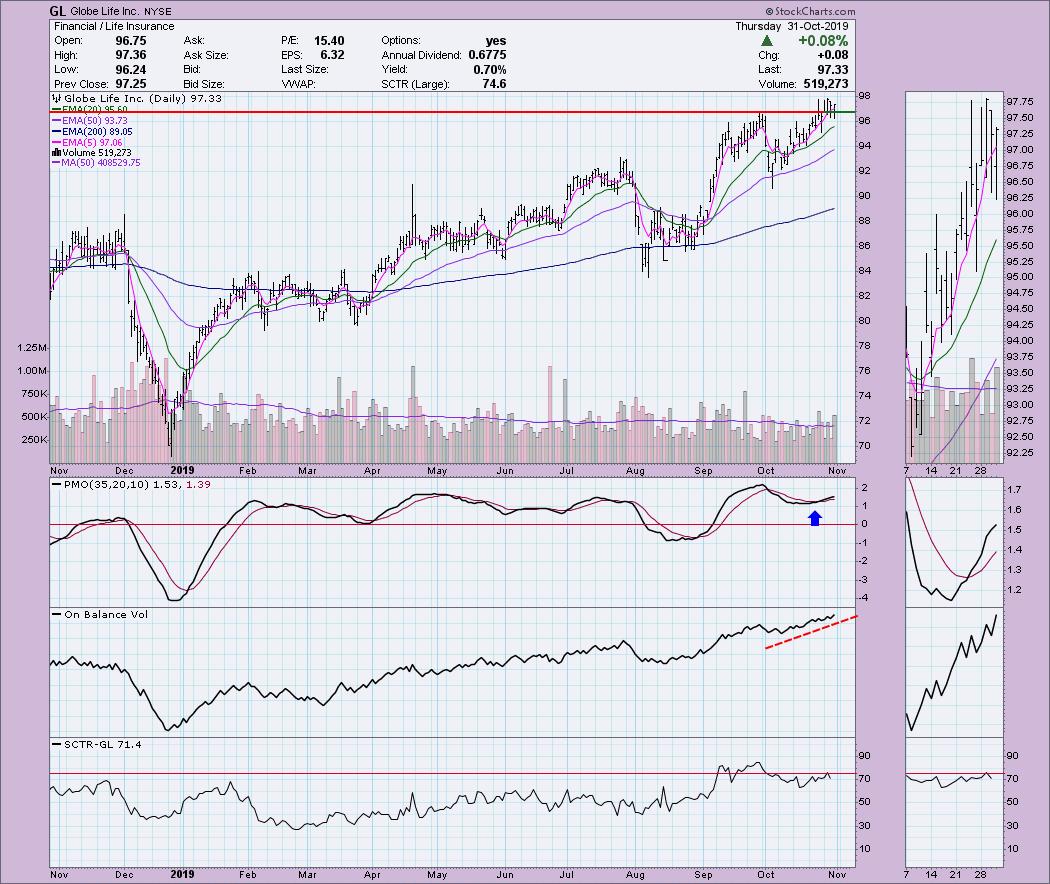

Globe Life Inc (GL) - Earnings: 10/23/2019

Today, Globe Life held on after dropping below support earlier today. It closed near its highs, so this might be the end of the pullback from the earlier breakout last week. The PMO is somewhat overbought, but it is on a BUY signal. OBV looks great as it continues to move higher.

I like the weekly PMO here. It is rising strongly and is not overbought, so it can support higher highs without getting overbought too soon.

Merck & Co Inc (MRK) - Earnings: 10/29/2019

This was the chart we looked at on WealthWise Women today. The breakout isn't complete yet, but the PMO BUY signal is encouraging on good volume. The OBV has turned up on the rally. I'd like to see it move higher than the September top as it breaks out. Since it hasn't completely broken out yet, this is what to watch for to confirm the breakout. The SCTR is shooting higher, which is bullish.

The weekly PMO could look better, but it did turn up today. This one may need to simmer a bit longer (reminder for me to go stir the chili that is simmering on the stove right now!)

T-Mobile US, Inc. (TMUS) - Earnings: 10/28/2019

I like to present large cap stocks when I can. MSFT showed up on one of my scans today, but I wrote about that one yesterday. Price pulled back toward the breakout point at $81 and it is now moving back up. Overhead resistance currently lies at $85. The PMO is rising nicely and is not overbought. The OBV is rising with price and that is always bullish.

When this chart goes final tomorrow, I suspect that weekly PMO will have triggered the BUY signal that we see right now on the chart. Look at the steady rally it has been in all year long.

Full Disclosure: I don't own any of the stocks I've presented today and I don't plan on adding any to my portfolio at this time. I have to trust that the market is in a solid uptrend before I add positions and I'm just not certain (enough) to invest in the markets further. I'm currently about 60% in cash.

SAVE THE DATE!!

Erin Swenlin will be presenting at the TradersExpo in New York City on March 15-17, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**